Q1 2023 market color courtesy of finviz.com:

The S&P 500 ended the first quarter of 2023 with a solid gain as hopes for an economic “soft landing” and the Federal Reserve finally signaling the end of its historic rate hike campaign helped offset two more rate increases and the biggest bank failures since the financial crisis.

Markets started the year with strong gains in January, which were primarily driven by a continued decline in widely-followed inflation indicators. That decline in price pressures was coupled with surprisingly resilient economic data, especially in the labor market. Those forces combined to raise investors’ hopes that the Fed might in fact deliver the elusive economic soft landing, whereby the economy slows but avoids a painful recession while inflation moves back closer to the Fed’s target of 2%.

Additionally, corporate earnings for Q4 2022, that started being reported in mid-January, were better than had been feared and this resilient nature of corporate America contributed to the growing hope that both an economic and earnings recession could be avoided. The S&P 500 posted strong gains in the month of January, rising by more than 6%.

In February, however, the optimism for an economic soft landing was delivered a blow as economic data showed more and more jobs being filled while the decline in inflation seemed to be stalling. The January Jobs Report, released in early February, showed a massive half-a-million person gain in employment, implying that the labor market remains extremely tight (something the Fed believes is a major contribution to the inflation problem).

Later in the month, closely-followed inflation metrics such as the Consumer Price Index (CPI) measure of retail inflation and the Core Personal Consumption Expenditures (PCE) Price Index showed minimal further price declines, implying that the drop in inflation that had recently powered gains in stocks was no longer in place.

The strong economic data and the leveling off of inflation metrics led investors to start fearing even greater interest hikes for longer than originally anticipated in the coming months and that weighed heavily on both stocks and bonds in February. The S&P 500 finished the month in the red, falling over 2%.

March began with investors still focused on inflation and potential interest rate hikes, but the sudden failure of Silicon Valley Bank, at the time the sixteenth largest bank in the United States, shifted investor focus to a potentially dangerous contagious banking crisis.

Signature Bank of New York failed just days later and concerns grew about a regional banking emergency. In response, the Federal Reserve and the Treasury Department swiftly created new lending programs aimed at shoring up regional banks and preventing bank runs, but concerns about the health of the financial system persisted and those fears weighed on markets through the middle of the month.

However, while the Federal Reserve did hike interest rates again by a quarter of a point at the early March meeting, policy makers signaled that they are very close to ending their rate hike campaign. That admission, combined with no news of any additional bank failures, eased concerns about mushrooming banking problems and the S&P 500 was able to rally quite hard during the final two weeks of the quarter to end March with a small gain.

In summary, markets were impressively resilient in the first quarter as a looming end to rate hikes, further declines in inflation and quick and effective actions by government officials in response to the bank failures helped shore up confidence in the banking system. Stocks and bonds both logged modest gains in Q1, despite still-elevated market volatility.

Q1 2023 Performance Review

The first quarter of 2023 saw sharp reversals in index and sector performance compared to 2022.

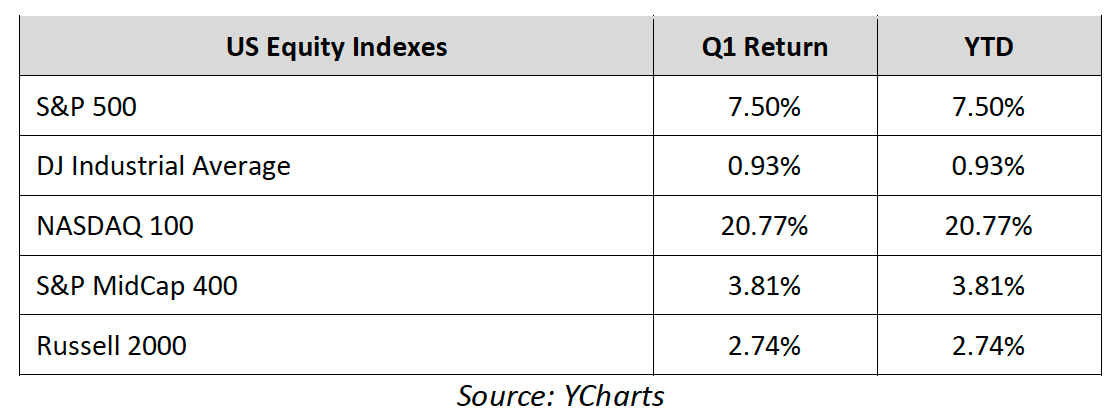

The NASDAQ-100 badly underperformed in 2022 but handily outperformed in the first quarter of 2023 and finished with very impressive returns. That outperformance was driven by a decline in bond yields (which makes growth-oriented tech and consumer discretionary companies more attractive to investors) and as mega-cap tech companies such as Apple, Alphabet/Google, Amazon and others were viewed as safe havens amidst the late-quarter banking stress.

The S&P 500, heavily weighted to the mega-techs, finished the quarter with a solidly positive return while the Russell 2000 small-cap index logged more modest, but still positive, returns through the first three months of the year.

By market capitalization, large cap stocks outperformed small caps as they did throughout 2022. Concerns about funding sources, should the banking crisis worsen, and higher interest rates weighed on small cap stocks as these smaller companies are more dependent on financing to maintain operations and achieve growth.

From an investment style standpoint, growth stocks handily outperformed value stocks which was a sharp reversal from 2022. Tech-heavy growth funds benefited from the afore-mentioned decline in bond yields and a late-quarter investor flight away from financials, which are primarily value stocks.

On a sector level, seven of the eleven S&P 500 sectors notched first quarter positive returns. It was very notable that the three worst performing sectors in 2022 were the three top performers in Q1 2023.

Communication Services was one of the best performing sectors in the first quarter thanks to strong gains from internet-focused tech stocks, as lower rates and the rotation to mega-cap tech companies pushed the sector higher. The Technology sector also clearly benefitted from those two trends, as it rose slightly more than the communications sector in Q1.

Finally, Consumer Discretionary, which has larger weightings towards tech-based consumer companies such as Amazon, Tesla and others, also logged a meaningfully positive gain thanks to the same general tech outperformance and as the labor market remained more resilient than expected and retail sales numbers held up, improving the prospects for consumer spending in the months ahead.

Turning to the laggards, the Financial sector was the worst performer in the first quarter as the regional banking crisis weighed on bank stocks and financials more broadly. Energy also logged solid declines through the first quarter as growing concerns about global economic growth and subsequent weakness in consumer demand weighed on the oil price and thereby on energy stocks.

More broadly, the remaining S&P 500 sectors saw small quarterly gains or losses, as there remains a lot of uncertainty about future economic growth and earnings and the banking stresses that emerged in March will only add an additional headwind.

Internationally, foreign markets largely traded in line with the S&P 500 in the first quarter and realized positive returns. Foreign developed markets actually outperformed the S&P 500 through the first three months of the year as economic data in Europe was better than expected and European banks were viewed as mostly insulated from the US regional bank crisis, with Credit Suisse the notable exception. Emerging markets logged slightly positive returns through March but underperformed the S&P 500 thanks to still-elevated geopolitical stress, including when US-China tensions briefly flared following the silly Chinese spy balloon affair.

Commodities saw sharp declines in the first quarter, thanks mostly to the notable weakness in oil prices, which hit fresh one-year lows - below where they were the day before Russia invaded Ukraine. Oil fell during the first quarter on rising global recession worries and subsequent reductions in demand expectations, while geopolitical risks didn’t rise enough to offset those demand concerns. Gold, however, posted a positive return as investors seemed to perceive it as a “store of value” in response to the regional banking anxiety.

Switching to fixed income markets, the leading benchmark for bonds (the Bloomberg Barclays US Aggregate Bond Index) realized a positive return for the first quarter of 2023. The Fed signaling an imminent end to rate hikes combined with concerns that the regional banking crisis would raise the odds of a recession, fueled a broad bond market rally in the first quarter.

Looking deeper into the fixed income markets, longer-duration bonds outperformed those with shorter durations in the first quarter, as bond investors welcomed further declines in inflation and risked reaching for long-term yield amidst an uncertain outlook for future economic growth and the resulting prospect of interest rate cuts in the case of a recession.

Higher-quality investment grade corporate bonds and higher-yielding, “junk” rated corporate debt registered similarly positive returns in the first quarter. Investors moved to both types of corporate debt following declines in inflation and as corporate earnings results were largely better than feared.

Market Outlook

Markets begin Q2 facing multiple sources of uncertainty including the path of inflation, future economic growth and recession risk, the number of remaining Fed rate hikes, and whether the regional banking difficulties have been truly contained. Yet despite all this, markets have proven to be surprisingly resilient since reaching their lows of last October. So, while headwinds remain in place and markets will likely stay volatile for a good while yet, there remains a path for imminent future positive returns.

Starting with the regional banking crisis, despite consistent comparisons on nonsense financial platforms on TikTok and Instagram as well as even on relatively mainstream financial media between what happened in March 2023 and during the 2007-2008 financial crisis, there are important differences between the two periods and regulators have already demonstrated their commitment to ensuring we do not experience a repeat of those turbulent times.

As we begin the new quarter, there is reason for hope that this financial sector disturbance has been contained. But regardless of whether or not that turns out to be true, regulators and government officials have already shown that they are ready to use current tools (or to even create new ones) to prevent a broader spread of the regional banking plight. That’s a very important positive difference from 2008.

Another huge difference is that the securities involved in 2007-2008 were private sector and mortgage-related which became worthless as many homeowners sank irrevocably under water with their loans. Here we are talking about US government Treasury Bonds held by banks that carry zero counterparty credit risk.

Looking past the regional bank issue, inflation remains a major longer-term influence on the markets and the economy, and whether inflation resumes its decline this quarter will be very important for investors and the markets. More specifically, the decline in inflation somewhat stalled in February and March - but if the decline resumes that could provide a powerful boost for both stocks and bonds.

Regarding economic growth, markets rallied on the hope of an economic soft landing earlier in Q1 and while what’s going on in regional bank-world complicates that optimistic outlook, it’s still a possibility.

To that point, employment, consumer spending and economic growth more broadly have remained impressively resilient, so while we should all expect some slowing in the economy this quarter, a recession is by no means inevitable. If the economy achieves a soft landing that could be an immense boost for all risk assets.

After one of the most intensive interest rate hike campaigns in history, the Fed has at long last signaled that it is close to being done with rate increases which, if true, will eventually remove one of the largest roadblocks to an end to the bear market.

To be sure, these are still rowdy times in financial markets. Investors are facing the highest interest rates in decades, the worst geopolitical tensions in years, and an uncertain economic outlook that may now be complicated by bank failures.

But while concerning, it’s important to remind ourselves of the quite amazing resilience of underlying US economic fundamentals and US corporate earnings throughout Q1 2023. And these two factors are the real long-term drivers of market performance, much more so than the latest disconcerting geopolitical or financial headline du jour. We do, however, still need to be prepared for continued volatility in the short/medium term.

As the founder and principal of Anglia Advisors with decades of experience in financial markets, I understand that a well-planned, long-term-focused and diversified financial plan built on a solid foundation of appropriate asset allocations for different time horizons can withstand virtually any market surprise and related bout of volatility, including the challenges of bank failures, multi-decade highs in inflation, rising interest rates, geopolitical tensions and growing recession risks.

I remain vigilant on behalf of Anglia Advisors’ clients regarding both portfolio risk and the economy and will continue to keep you informed of my views with my weekly market review each Sunday.

If you are already a client, I want to thank you for your ongoing confidence and trust. Please do not hesitate to contact me with any questions, comments or to schedule a portfolio review. If you aren’t a client yet, please reach out and I’d be delighted to discuss bringing you into the Anglia Advisors family.

Simon Brady CFP®. Founder, principal Anglia Advisors.