Q2 2025 - A Market Review

Market volatility spiked and stocks plunged in early April following sweeping tariffs but those initial losses were then more than recouped and we saw new record highs by the end of the quarter.

Q2 began with a thud on April 2nd, Trump announced sweeping and substantial tariffs on virtually all US trading partners on what he called “Liberation Day”. The tariff amounts were significantly larger than markets expected and their announcement sparked fears of a trade-war-driven economic slowdown, which hit stocks hard as the S&P 500 dropped more than 10% in the following days. However, April 8th turned out to be the low for the quarter as the rest of April saw the administration take numerous steps to walk back the impact of those announced tariffs.

Within a week, the administration had declared a 90-day delay where tariff rates on most trading partners would be just 10%, far below the announced rates. That delay was then followed by even more steps to reduce the burden of the levies, including exemptions for key imports such as smartphones, semiconductors, pharmaceuticals and computers.

The delay and exemptions gave investors some confidence that a trade war would not necessarily lead to a recession and that optimism combined with a solid first quarter earnings season to help the S&P 500 rally throughout the remainder of the month and close with just a slight loss, down 0.7%.

The market rebound accelerated in early May as Treasury Secretary Bessent announced he would be meeting with Chinese trade officials in Geneva. That boosted investor expectations for more tariff relief and those hopes were fulfilled as the meeting resulted in a dramatic reduction in tariffs on Chinese imports. That reduction, combined with still-solid economic growth, further eroded investors’ recession concerns and the S&P 500 jumped higher.

Earnings also contributed to the rally thanks to strong results from tech bellwether Nvidia, which reminded investors of the growth potential of AI. Finally, in late May, the Court of International Trade ruled the administration’s tariffs were illegal under the law used to justify the duties. The case was appealed immediately and a decision should come in Q3, but the initial ruling raised the prospect that tariffs could be eliminated almost entirely by the courts in the coming months. The S&P 500 turned positive year to date and finished May with very strong gains, up 6.29%.

The move higher continued in June although trade headlines, which had driven market moves for the first two months of the quarter, took a back seat to geopolitical concerns after Israel launched a massive attack on Iran. The hostilities between the two rivals caused oil prices to temporarily spike and that halted the rally in mid-to-late June, as investors again had to consider the prospect of rising oil prices hurting economic growth and boosting inflation.

However, that volatility was limited, as following US strikes on Iranian nuclear facilities, a ceasefire was agreed to between Iran and Israel and oil prices dropped sharply, turning negative for the quarter. That decline, combined with rising expectations for rate cuts in the second half of the year, pushed the S&P 500 to new all-time highs in the final days of June.

In sum, the stock market completed an impressive rebound from the steep declines of early April, as persistent tariff climb-downs by the administration led to the “TACO” narrative and boosted investor confidence while corporate earnings remained strong and economic growth proved resilient, yet again, even in the face of geopolitical uncertainty and elevated policy volatility.

Q2 Performance Review

The gains in the S&P 500 in the second quarter were particularly impressive considering the intense selling witnessed in early April, as the market rebound was broad and the majority of indices, sectors and factors logged a positive return for the quarter.

By market capitalization, Large Caps outperformed Small Caps in Q2, as they did in Q1. A lack of Fed rate cuts, generally elevated interest rates and some soft economic data late in the second quarter particularly weighed on smaller companies, although they still finished the quarter with a positive gain.

From an investment style standpoint, Growth massively outperformed Value in Q2, as tech-heavy growth funds attracted dip-buying investors following the steep April declines. Tariff reductions and exemptions also boosted the outlook for major tech firms while solid earnings from AI firms Nvidia and Oracle helped renewed AI enthusiasm amongst investors. Value funds, meanwhile, were weighed down by weakness in energy shares but still managed a slightly positive return for the quarter.

On a sector level, seven of the eleven S&P 500 sectors finished the quarter with positive returns. The best-performing sectors were the AI-linked Technology and Communications Services sectors as well as the Industrials sector. All three benefited from tariff reductions and exemptions as many companies in these sectors have substantial international businesses.

Turning to the sector laggards, Energy and Healthcare posted solidly negative returns, as both were pressured by negative industry-specific news. For Energy, volatility in oil prices (and a lack of a sustainable rally despite the Israel-Iran conflict) weighed on energy producers, as did general fears of an economic slowdown. For Healthcare, uncertainty over pharmaceutical tariffs as well as head-scratching policy actions and proposals from Health Secretary Kennedy damaged the performance of healthcare stocks.

US Equity Indexes

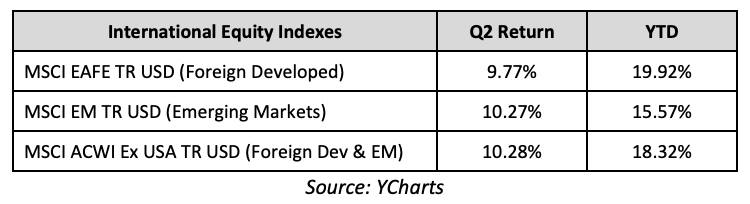

Internationally, foreign markets outperformed the S&P 500 for most of the quarter, although the late June surge in the S&P 500 saw that index pass both Emerging and Foreign Developed indices from a performance standpoint. Emerging Markets outperformed Foreign Developed markets due to substantial de-escalation in the US/China trade war as well as some encouraging Chinese economic data. Nevertheless, Foreign Developed markets still posted strong returns for the quarter thanks to falling interest rates and generally resilient economic growth.

International Equity Indexes

Commodities saw slight declines in the second quarter due to weakness in oil prices, although a continued rally in gold kept losses for most commodity indices limited. Gold added to the already-impressive YTD returns, aided by the falling dollar (which hit a three-year low in Q2) and elevated geopolitical tensions. Oil prices, meanwhile, were volatile but ended the quarter with a moderate loss as geopolitical tensions eased following the Israel/Iran ceasefire and in response to some rather lackluster US economic readings in June.

Commodity Indexes

Switching to fixed income markets, the leading benchmark for bonds (the Bloomberg US Aggregate Bond Index) realized a modestly positive return for the second quarter, as stable inflation readings and some cooling of US economic growth late in the quarter boosted demand for bonds and pushed rates lower.

Looking deeper into the fixed income markets, longer duration bonds outperformed shorter duration bonds because of the aforementioned stable inflation data and slightly underwhelming economic readings. Shorter term bonds lagged as the Fed maintained a “wait-and-see” approach to cutting interest rates given that the central bank wants to wait to see the impacts from tariffs on both growth and inflation.

In the corporate bond market, both investment grade and lower quality high yield “junk” bonds posted solidly positive quarterly returns. High yield outperformed investment grade debt, however, as generally resilient economic growth and the promise of looming tax cuts gave investors confidence to reach for higher yields and assume more credit risk.

US Bond Indexes

Q3 Market Outlook

The markets begin the third quarter following an impressive first half performance, as the S&P 500 hit a new all-time record high despite much-larger-than-expected tariffs on US imports, a dramatic increase in policy volatility and more hostilities in the Middle East.

While investors expected tariffs and a tougher stance on trade from the new administration, the moves taken in the first half of 2025 exceeded expectations as tariffs were both higher and more far reaching than most analysts anticipated. But backtracking by the Trump administration on tariffs combined with the court decision invalidating reciprocal tariffs boosted market confidence that the administration would not allow tariffs to derail economic growth. That belief helped stocks look past what is still a dramatic increase in international levies.

Importantly, tariffs matter to the markets primarily because they could cause an economic slowdown or even dreaded stagflation where growth slows but inflation rises. Theses fears were the contributing factors behind the April drop in stocks. Positively, economic data remained mostly resilient throughout Q2 and no major economic indicators are pointing squarely to a material slowing of growth or a sudden rise in inflation. That resilient data contributed to the strong market rebound.

Finally, geopolitical risks undoubtedly rose with direct conflict between Israel and Iran and US involvement on the side of Israel. There was no progress on a ceasefire on the now three year-long war between Russia and Ukraine. Death and destruction continued in Gaza with no end in sight. However, the market views these conflicts as largely isolated and not at risk of spreading into larger regional wars that could disrupt oil production or the global economy. Because of that, markets were able to largely ignore the increase in geopolitical tensions during the quarter.

Having said all that, there remain a lot of risks facing the economy and financial markets.

First, while Wall Street has assumed that tariffs won’t rise substantially from current rates, there’s no guarantee of that. To that point, the deadline for the reciprocal tariff delay is July 9th and if that deadline is not extended, we could see tariff rates on major trading partners surge once again. The reality is that global tariff rates are at multi-decade highs and it’s impossible to predict how that will impact the economy in the months ahead. Risks of a tariff-induced slowdown or rise of stagflation can’t be dismissed.

Turning to geopolitics, while the various conflicts have not negatively impacted global markets, risks remain elevated. If Iran takes steps to disrupt global oil production or transit, that will increase oil prices and create a new headwind on markets. Similarly, if any of these isolated conflicts begin to spread into wider arenas that will also lift oil prices and weigh on stocks and bonds.

Finally, markets still expect two to three interest rate cuts from the Federal Reserve between now and year-end; however, the unknown impact from tariffs on economic growth and inflation make any rate cuts at all in 2025 far from certain. If the Federal Reserve does not cut rates in the coming months, that will increase concerns about an eventual economic slowdown and that could weigh on prices.

Bottom line, markets have been impressively resilient so far this year, but as we start the second half of 2025 there remain numerous, potentially significant risks to the markets and the economy and we should not let the market’s resilience create a sense of complacency.

In my present and former professional life, I have experienced these types of markets before and I am committed to helping clients effectively navigate this challenging environment. Successful investing is a marathon, not a sprint and through both bull and bear markets, I will remain focused on the diversified approach set up to meet clients’ long-term investment goals.

I remain constantly vigilant on behalf of Anglia Advisors’ clients regarding their portfolio risk, as well as economic and geopolitical factors and will continue to keep you informed of my opinions with my weekly market recap every Sunday morning.

If you are already a client, I want to thank you for your ongoing confidence and trust. Please do not hesitate to contact me with any questions, comments or to schedule a portfolio review.

If you aren’t a client yet, please reach out and I’d be delighted to discuss bringing you into the Anglia Advisors family.

Simon Brady CFP® CETF®. Founder, principal Anglia Advisors.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM