Q3 2023 - A Market Review.

It seemed like nothing could stop the 2023 stock market rally. Then the third quarter showed up.

Q3 2023 market color courtesy of finviz.com:

The S&P 500 rose to the highest level since March 2022 early in Q3, but rising bond yields in the US and around the world, fears of a rebound in inflation and concerns about a future economic slowdown weighed on the major indices in August and September and the index finished the quarter with a modest loss.

The third quarter began largely the same way as the second quarter ended – with gains. Stocks rose broadly in July thanks primarily to “Goldilocks” economic data, meaning it showed solid economic growth, but not to the extent that would have implied the Federal Reserve needed to hike rates further than markets expected. Everything seemed under control and we saw a decline in inflation metrics to further boost stock prices, as investors cheered and embraced reduced near-term recession risks.

The Federal Reserve, meanwhile, increased interest rates in late July but it also signaled that this could possibly be the last rate hike of the cycle. That tone and commentary further fueled optimism that one of the most aggressive rate hike cycles in history was soon coming to an end. Finally, Q2 earnings season proved to be better-than-feared with mostly favorable corporate guidance which supported expectations for strong earnings growth into 2024. The S&P 500 finished with a strong monthly gain of over 3%.

But everything seemed to change on the first day of August when Fitch Ratings downgraded U.S. sovereign debt. The credit agency cited long-term risks of the current U.S. fiscal trajectory as the main reason for the downgrade and this put immediate downward pressure on U.S. bonds, kickstarting a rise in Treasury yields that lasted the entire month. It coincided with a rebound in anecdotal inflation indicators.

That rapid rise in yields weighed on stock prices throughout August and the S&P 500 posted its first negative monthly return since February, as higher interest rates raised concerns about a future economic slowdown. The S&P 500 finished August down 1.59%.

The August volatility subsided in early September as solid economic data and a pause in the rise in Treasury yields allowed stocks to stabilize through the first half of the month. But volatility returned with a vengeance following the September Fed decision to deliver a “hawkish” (bad for stocks and bonds) surprise in its rhetoric, despite not increasing interest rates.

Specifically, the majority of Fed members reiterated that they anticipated the need for an additional rate hike before the end of the year and forecasted only two rate cuts for all of 2024, neither of which pleased the market which had been banking on much lower rates than now by the end of next year. Then, late in the month, two additional developments weighed further on both stocks and bonds.

First, the United Auto Workers labor union began a general strike, a move that would disrupt automobile production and temporarily weigh on economic growth. Second, the U.S. careened towards another government shutdown as a small band of Republican ultras in Congress temporarily held the country and their party colleagues to ransom by blocking a “Continuing Resolution” to keep government funded.

The shutdown was eventually avoided but the issue were simply deferred until November 17th, when the whole embarrassing circus risks happening again. The S&P 500 declined towards the end of the month to hit a fresh three-month low, ending September down modestly.

In sum, volatility returned to markets during the third quarter, as rising bond yields pressured stock valuations, some inflation indicators pointed to a possible bounce back in inflation and the Fed aggressively reiterated a “higher for longer” interest rate outlook.

Q3 Performance Review

Rising interest rates were the main driver of market performance in Q3 as high Treasury yields caused reversals on a sector and index basis, relative to Q1 and Q2.

Starting with market capitalization, Large Cap stocks once again outperformed their smaller cousins, just as they did in the first two quarters of the year, although both posted negative returns. This relative outperformance is consistent with rising Treasury yields, as smaller companies are typically more reliant on debt financing to sustain operations and rising interest rates create stronger financial difficulty for these firms when compared to their larger peers.

From an investment style standpoint, however, we did see a performance reversal from the first two quarters of the year as value stocks relatively outperformed growth stocks in Q3, although both investment styles finished in the red. Rising bond yields tend to weigh more heavily on companies with higher valuations and since most growth funds overweight tech stocks, they lagged last quarter. Value funds that include stocks with lower price/earnings ratios are less sensitive to higher yields and as such, they did better.

On a sector level, nine of the eleven S&P 500 sectors finished the quarter with a negative return, which is a stark reversal from the broad gains of Q2. Energy was by far the best performing S&P 500 sector in the third quarter thanks to a surge in oil prices. Communications Services also finished Q3 with a slightly positive quarterly return on hopes integration of advanced artificial intelligence could boost search and social media companies’ future advertising revenues.

On the other hand, the impact of rising bond yields was again clearly visible as consumer defensive, utilities and real estate were Q3’s biggest losers. Those sectors offer some of the highest dividend yields in the market, but with bond yields quickly rising those dividend yields become less attractive and many investors rotated out of high-dividend stocks and into less-volatile bonds as a result.

Internationally, foreign markets saw moderate declines and again lagged the U.S. in the third quarter as disappointing economic data in Europe and China bolstered regional recession fears. Emerging markets did relatively outperform international developed markets thanks partly to the announcement of large-scale Chinese economic stimulus late in the quarter.

Commodities saw substantial gains and were the best performing major asset class in Q3 thanks mainly to a significant rally in the energy complex. Oil rose throughout the quarter on continued supply concerns as Saudi Arabia and Russia extended voluntary supply cuts to the end of the year.

Meanwhile, demand estimates rose late in the third quarter following the aforementioned announcement of the large-scale Chinese stimulus plans, causing prices to rise sharply late in the quarter. Gold, meanwhile, declined moderately as the U.S. Dollar rallied steadily over the course of Q3, hitting a fresh 2023 high in September.

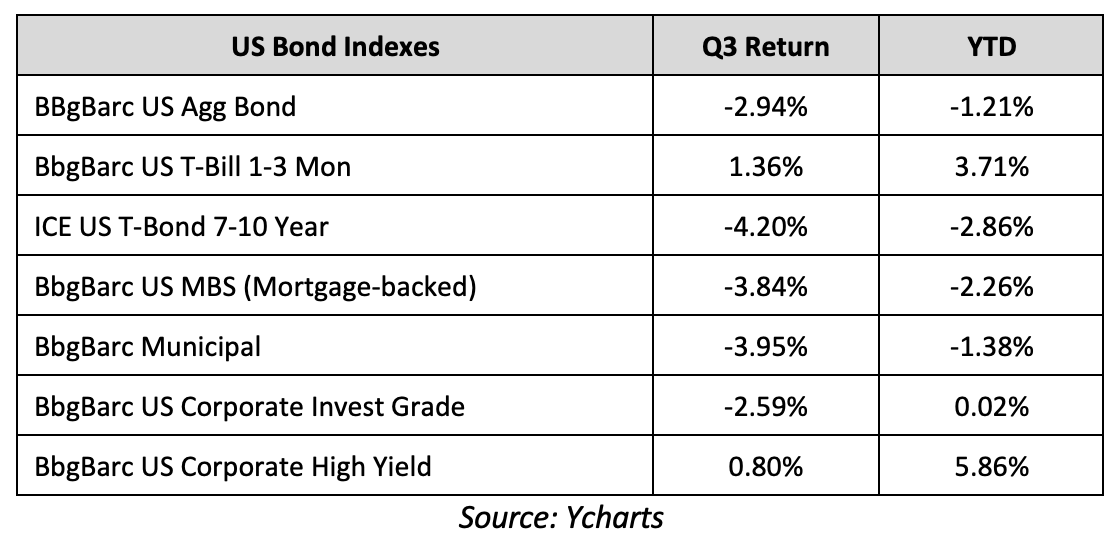

Switching to fixed income markets, the leading benchmark for bonds (Bloomberg Barclays US Aggregate Bond Index) declined moderately for a second consecutive quarter as hawkish Fed rhetoric and hints of a rebound in inflation weighed heavily on fixed income markets.

Looking deeper into the U.S. Treasury bond markets, shorter-duration securities posted a positive quarterly return and outperformed their longer duration equivalents, as the Fed failed to firmly signal that it intended to definitely end its rate hike campaign, instead implying “higher for longer.” interest rates into 2024 and maybe even beyond. Longer duration bonds were also pressured by the combination of a rebound in some inflation indicators.

In the corporate bond market, lower-quality but higher-yielding “junk” bonds rose slightly while higher-rated, investment-grade bonds declined moderately in Q3. The performance gap reflected continued optimism from investors regarding future economic growth, as investors “reached” for higher yields offered by riskier companies amidst broadly rising bond yields.

Q4 Market Outlook

Markets are beginning the final quarter of the year decidedly more anxious than they started the third quarter, but it’s important to realize that while the S&P 500 did hit multi-month lows in September and that there are legitimate risks to the outlook, underlying fundamentals remain generally strong.

Firstly, while there are reasonable concerns about a future economic slowdown, the economic data continues to come out looking solid. Employment, consumer spending and business investment were all resilient in Q3 and there simply isn’t much actual economic data that points to an imminent economic slowdown. So, while a recessionary downturn is still certainly possible given higher interest rates, the resumption of student loan payments and declining U.S. savings, the numbers are very clear: it ain’t happening yet.

Secondly, fears that inflation may bounce back are also legitimate, especially given the recent spike in oil prices. But the Federal Reserve and other central banks typically look past commodity-driven inflation and instead focus on “Core” inflation readings and that metric continues to decline in line with expectations.

Additionally, falling housing costs, both on the sales and rental front, from the recent peak are only now beginning to work their way into the official inflation statistics, and that could push core inflation lower in the months and quarters ahead.

Finally, regarding monetary policy, the Federal Reserve’s historic rate hike campaign is nearing an end, if not there already. And while we should expect the Fed to keep rates “higher for longer,” high interest rates do not automatically of themselves create an economic slowdown. Interest rates have merely returned to levels that were typical in the 1990s and early 2000s before the Great Financial Crisis and the economy performed perfectly well during those periods. Yes, the risk of higher rates causing a deeper economic slowdown than we would want is one that must be monitored closely, but for now, higher interest rates are not really causing a material loss of economic momentum.

In sum, there are real risks to both the markets and the economy as we begin the final three months of the year. But these are largely the same risks that markets have faced throughout 2023 and over that period the economy and stock prices have remained impressively resilient. So, while these risks and others must be watched closely, they don’t present any new significant challenges to stocks that haven’t existed for much of the year.

As we begin the final quarter of 2023, we must remain alert towards economic and market risks and I am focused on monitoring both risk and return potential for clients. I remain a firm believer that a well-thought-out, long-term-focused, and diversified investment plan can withstand virtually any market surprise and related bout of volatility, including “higher for longer” interest rates, stubbornly high inflation, geopolitical tensions, and recession risks.

I remain vigilant on behalf of Anglia Advisors’ clients regarding both portfolio risk and the economy and will continue to keep you informed of my views with my weekly market review every Sunday.

If you are already a client, I want to thank you for your ongoing confidence and trust. Please do not hesitate to contact me with any questions, comments or to schedule a portfolio review.

If you aren’t a client yet, please reach out and I’d be delighted to discuss bringing you into the Anglia Advisors family.

Simon Brady CFP® CETF®. Founder, principal Anglia Advisors.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (929) 677 6774 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing data at a specific point in time and is always subject to change at any time. No warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any kind of investment decision or action. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind. Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class.

Clients of, and those associated with, Anglia Advisors may maintain positions in securities and asset classes mentioned in this post.

Attached below is supporting documentation for this report: