Q4 2023 - A Market Review.

Stocks and bonds came into the final quarter of 2023 under pressure, but the positive reversal in Q4 was spectacular.

Q4 2023 market color courtesy of finviz.com:

Markets staged an impressive recovery in Q4 partly thanks to a rather surprise dovish pivot by the Federal Reserve, which combined with solid economic activity and declining inflation to push stocks sharply higher and send the S&P 500 index to two-year highs.

The eventual strong performance in Q4 somewhat wipes from the memory the fact that stocks and bonds began the quarter under significant pressure. First, Treasury yields continued to move higher in early October which weighed on stocks and bonds, just like in Q3. Then the Middle East exploded into new conflict. The market fallout was immediate, as oil prices spiked on fears a broader regional war would ensue bringing in the likes of Lebanon and Iran. Higher oil prices fueled a further increase in Treasury yields as investors priced in a possible oil-price-driven reappearance of higher inflation.

Those factors, combined with a relatively lackluster prior earnings season, resulted in the S&P 500 falling to the lowest levels since mid-May in late October while the 10-year Treasury yield reached 5.00% for the first time since the mid-2000s. However, markets quickly reversed when Fed Governor Chris Waller made comments that implied rate hikes were over and rate cuts may be coming in 2024. The reaction was immediately positive as stocks and bonds rallied hard into month-end to finish well off the lows and with just a 2% monthly decline.

That positive momentum continued into what ended up being a sensational November as the S&P 500 posted its best monthly return of 2023, rising more than 9%. There were several factors that fueled this rally.

First, numerous Fed officials echoed Waller’s commentary and Wall Street priced in interest rate cuts as early as March or May, substantially earlier than previously expected. Additionally, the Israel/Hamas conflict remained contained and oil prices declined sharply as a result (see below), easing inflation concerns. Finally, broad inflation metrics continued to decline. The year-over-year increase in the Consumer Price Index (CPI) dropped to 3.1% and that further fueled investor expectations that rate cuts would come in the first half of 2024.

Those factors combined with generally favorable seasonality to fuel a much-welcomed “Santa Claus Rally” which continued and even accelerated into December, courtesy of the Federal Reserve. At its December 13th rate-setting meeting, Fed officials clearly signaled that rate hikes were over and forecasted three rate cuts in 2024, one more than previously envisioned. Additionally, Fed Chair Powell did little to push back at his press conference against the markets’ expectations for rate cuts. Put plainly, the Fed abruptly pivoted to a more dovish policy stance to the surprise of many and that fueled a further extension of the rally that had started in late October with Waller’s comments. The S&P 500 index rose to the highest level since January 2022 and to within a whisker of a new all-time high.

In summary, 2023 was a year of surprises for the markets as the expectations for a recession never materialized, inflation fell faster than forecast, corporate earnings proved resilient and the Fed surprised markets by pivoting to a more dovish future policy. The result was substantial gains for almost all asset classes.

Q4 and Full Year 2023 Performance Review

Stocks enjoyed a broad and powerful rally in Q4 as all four major U.S. stock indices posted strong quarterly gains. Investor expectations for rate cuts in 2024 were a major influence on markets in the quarter as the Small Cap Russell 2000 and tech-heavy NASDAQ-100 outperformed the S&P 500 over the final three months, as companies represented in those two indices are expected to benefit most from a sustainable decline in interest rates. For the full year, however, the dual influences of 1) artificial intelligence (AI) enthusiasm and 2) rate cut expectations drove performance as the NASDAQ-100 massively outperformed the other major stock indices, surging more than 50%. The S&P 500 also logged a substantial gain of over 20% thanks mostly to the weighting of the technology stocks in the index, particularly the so-called “Magnificent Seven” (Apple, Microsoft, Alphabet/Google, Nvidia, Tesla, Amazon and Meta/Facebook).

The less-tech-stock-intensive Dow Industrial Average and Russell 2000 also enjoyed strong returns in 2023, but relatively underperformed the NASDAQ-100 and S&P 500.

Notably, the index performance for the full year 2023 was the exact opposite of 2022, when we saw the tech and Small Caps decline substantially more than the more generic Large Caps of the S&P 500.

By market capitalization, Small Caps outperformed Large Caps in Q4 thanks to those surging rate cut expectations, as lower rates are typically most beneficial for smaller companies. For the full year, however, Large Caps handily outperformed Small Caps, thanks primarily to strength in large tech stocks and as the higher rates in the first three quarters of 2023 weighed on Small Cap performance earlier in the year.

From an investment style standpoint, Growth significantly outperformed Value both in the Q4 and for the full year. The reasons were familiar: AI enthusiasm powered tech-heavy growth names early in 2023 - while in the final quarter expectations for rate cuts were seen as positive for growth stocks. Growth outperforming Value is also the polar opposite of 2022, when higher rates and recession fears resulted in Value nicely outperforming Growth.

On a sector level, ten of the eleven S&P 500 sectors finished Q4 with a positive return (the sole exception was Energy), while eight of the eleven ended 2023 with gains. Not surprisingly, the afore-mentioned dual influences of AI enthusiasm and expectations for rate cuts drove sector trading throughout the year. In Q4, the influence of expected lower rates was dominant as Real Estate was the best performing sector, followed by Technology stocks. Both stand to benefit from falling interest rates.

Cyclical sectors also outperformed over the past three months as expectations for stable economic growth rose as the Fed telegraphed future rate cuts. For the full year, however, the influence of AI enthusiasm was clearly the principal influence on sector trading, as the three most “AI sensitive” sectors (technology, consumer cyclical and communications services) massively outperformed the other eight.

Looking at sector laggards for Q4 and for the full year, more defensive sectors including consumer defensive and utilities lagged as economic growth was more resilient than expected while higher rates (for most of 2023) reduced the demand for high dividend yielding sectors. Both consumer defensive and utilities posted negative returns for calendar year 2023 after being the best relative performers in 2022.

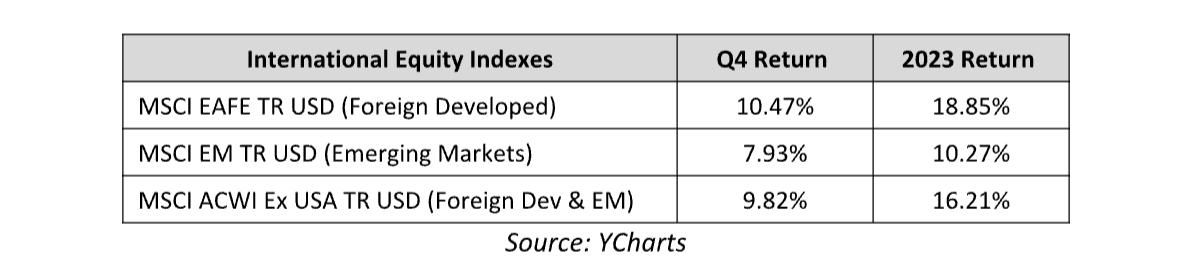

Internationally, foreign markets once again lagged the United States in Q4 thanks mostly to muted gains in Emerging Markets following increased geopolitical tensions in the Middle East and on continued lackluster Chinese economic growth. Foreign Developed markets outperformed Emerging Markets in the quarter on better-than-feared inflation readings in Europe and rising expectations that other major central banks will follow the Fed’s lead and cut interest rates in 2024.

For the full-year 2023, Foreign Developed markets registered solidly positive returns but still meaningfully underperformed the S&P 500 thanks primarily to those large gains in U.S. tech stocks not being matched by anything in Europe or Asia.

Commodities declined broadly in the quarter as weakness in oil, which was driven by reduced geopolitical fears and rising global economic growth concerns, offset a solid gain in the price of gold. Gold rallied on a falling U.S. dollar and hit a new all-time high in early December. For 2023, commodities saw modestly negative returns as concerns about economic growth, especially from China and parts of Europe, weighed on commodity demand expectations. Gold, however, did finish the year with a positive return, much of it thanks to Q4’s dollar decline.

Switching to fixed income/bond markets, the leading benchmark for bonds, the Bloomberg Barclays U.S. Aggregate Bond Index, realized a positive return for Q4 and for the full year 2023 as falling inflation and expectations for rate cuts in 2024 pushed bond prices higher.

Looking deeper into the fixed income markets, longer-duration bonds outperformed those with shorter durations in the final quarter as bond investors reacted to lower-than-expected inflation and priced in future Fed rate cuts. For the full year, however, shorter-duration debt outperformed longer-term bonds as high inflation readings through the first half of 2023 weighed on the long end of the yield curve.

Turning to the corporate bond market, both high yield and investment grade bonds posted sharply positive returns in Q4 as investors embraced the idea of lower interest rates and the reduced likelihood of recession. For the full year, high yield corporate bonds posted a very strong return and outperformed investment grade corporate debt as the resilient economy pushed investors to embrace more risk in return for a higher yield.

Q1 and 2024 Market Outlook

What a difference a year makes.

At this time last year, the S&P 500 had just logged its worst annual performance since the financial crisis, the Fed was in the midst of the most aggressive rate hike campaign in decades, inflation was above 6% and concerns about an imminent recession were pervasive across Wall Street.

Now, as we begin 2024, the market outlook couldn’t be much more positive. The Fed is done with interest rate hikes and cuts are on the way, possibly in early 2024. Economic growth has proven more resilient than most could have expected and fears of a recession have been drowned out by a tsunami of optimism. Inflation dropped substantially in 2023 and is headed back towards the Fed’s target while markets expect corporate earnings growth to resume in the coming year.

Undoubtedly, that’s a more positive environment for investors compared to the start of 2023, but just as the overly pessimistic forecasts for 2023 proved to be incorrect, as we look ahead to 2024, we must guard against complacency because at current levels both stocks and bonds have already priced in a lot of the positives.

Starting with Fed policy, Fed officials are forecasting three rate cuts in 2024 but investors are currently pricing in six such cuts, with the first one occurring in March or May. That’s a very aggressive assumption on the part of Wall Street and if does not come to pass, we should expect an increase in volatility in both stocks and bonds.

Regarding economic growth, it makes no sense to assume that just because the economy was resilient in 2023 means that it must stay resilient in 2024. Obviously, that’s the hope, but hope isn’t a strategy. The longer that interest rates stay high, the more of a drag they create on the economy. Meanwhile, all the remaining scraps of pandemic-era stimulus are now gone and some economic data is starting to point towards reduced consumer spending. Point being, it is premature to believe the economy is “in the clear” and a slowing of growth is something we will need to be on alert for as we start the new year, because that could also increase market volatility.

Inflation as measured by the CPI, meanwhile, has declined sharply but it still remains well above the Fed’s 2% target. Many investors expect inflation to continue to decline while economic growth stays resilient, a concept traders have coined “Immaculate Disinflation”. However, while that’s possible, it’s important to point out it’s historically extremely rare as declines in inflation are usually accompanied by economic slowdowns.

Finally, corporate earnings have proven resilient but companies are now facing margin compression as inflation declines and economic growth potentially slows. Q3 earnings results and guidance reported during Q4 were not as strong as earlier in 2023 and if earnings are weaker than expected, that will be another potential headwind on markets.

Bottom line, while undoubtedly the outlook for markets is more positive right now than it was a year ago, we should not allow that to breed a sense of complacency because, as the recent years have shown, markets and the economy rarely behave according to Wall Street’s expectations (see or listen to my weekly market report from last weekend, “Not Quite” for what I mean by that).

As such, while we are prepared and hopeful for the positive outcome currently expected by investors, we also need to be focused on managing both risks and return potential because the past several years demonstrated that a well-planned, long-term focused and diversified financial plan and investment strategy can withstand virtually any market surprise and related bout of volatility, including multi-decade highs in inflation, historic Fed rate hikes, and geopolitical unrest.

I remain constantly vigilant on behalf of Anglia Advisors’ clients regarding both portfolio risk and the economy and will continue to keep you informed of my opinions with my weekly market review every Sunday.

If you are already a client, I want to thank you for your ongoing confidence and trust. Please do not hesitate to contact me with any questions, comments or to schedule a portfolio review.

If you aren’t a client yet, please reach out and I’d be delighted to discuss bringing you into the Anglia Advisors family.

Simon Brady CFP® CETF®. Founder, principal Anglia Advisors.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (929) 677 6774 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM