Well, I did warn you with my closing line of last week’s recap.

The biggest news story of an otherwise generally quiet weekend was that, barely a month after reaching an all-time high, Bitcoin collapsed into free-fall and erased its entire gain for the year in the latest crypto massacre.

Wall Street began a week of important earnings and a long-overdue September Jobs Report in a cautious mood on Monday, with more institutional funds announcing a full sale of all their Nvidia holdings but others (including Warren Buffet’s) intending to raise their stakes in Google and Apple.

After initial indecision, stocks eventually settled on a downward trajectory and then leaned heavily into the decline with the bulls mostly paralyzed, wary of making any big bets ahead of earnings from Nvidia and the retail giants.

This sudden overall drop in risk appetite in the US, which included the ongoing crypto bloodbath, gave Asian markets the jitters on Tuesday, exacerbated by a China/Japan diplomatic spat and local stocks got brutalized. European stocks quickly followed suit and the downdraft continued into New York, with a miserable pre-market earnings report from Home Depot adding fuel to the fire.

It seemed like it was going to be another frightful session with continued and increasingly alarming signs of exhaustion from Mega Cap Tech/AI until early afternoon when bargain-hunting dip-buyers arrived for a brief cameo to at least pull the indexes up from their lows, but we still suffered a fourth straight day of losses in stocks.

Markets largely stabilized across Asia and Europe on Wednesday and as Nvidia Day dawned in the US, traders prepped for the after-market big reveal by digesting another disappointing pre-market retail earnings report, this time from Target, but better than expected results from Lowe’s.

The minutes from the most recent Fed interest rate-setting meeting showed that “many” committee members saw a December cut as “inappropriate”. Nevertheless, stocks seemed somewhat reinvigorated by more dip-buyers placing bets on the possibility of a juicy Nvidia report and gained a little over the course of the session to end the losing streak.

When it arrived, the report blew away even the most lofty of Wall Street’s sky-high expectations with sensational revenue, earnings (profits up 65% from a year ago) and forecasts and Nvidia’s stock, 10% cheaper than it was three weeks earlier, was gobbled up in the after-market and ripped higher.

There was another strong earnings report pre-market on Thursday, from Walmart this time, but we also got a stale September Jobs Report which proved mixed, with much higher job gains than expected but worrying downward revisions to previous months’ data and a tick-up in the unemployment rate, leaving the Fed Funds Rate cut picture still cloudy.

Wall Street began the session with a renewed spring in its step with Nvidia and Walmart initially rewarded for their outstanding reports which helped to pull the indexes higher.

But sentiment turned suddenly and sharply ugly and the early gains quickly dissolved and turned into significant losses as anxieties resurfaced about AI spending commitments vs. tangible benefits as well as elevated tech stock valuations. Things heating up in and around Venezuela didn’t help.

The crypto crap-out showed no signs of easing with Bitcoin’s price plunging to more than 30% below its October 7th high, representing more than a trillion dollars in lost value in the space of a month and a half and pushing the cryptocurrency closer to its biggest monthly drop in years.

Asian markets tumbled again on Friday following New York’s vicious intra-day whiplash. The rollercoaster ride continued when US markets opened higher again. The upside catalyst seemed to be Fed-speak, with highly influential New York Fed president Williams articulating the case for a December interest rate cut, triggering a serious spike in the probability of that outcome (see INTEREST RATE EXPECTATIONS below). Far less surprisingly, Trump stooge governor Miran went all in on the rate cut narrative, as per his master’s instructions.

The gains felt a little fragile, however, especially after sentiment data showed that the American consumer hasn’t felt this pessimistic and worried about the economy since the Great Financial Crisis of 2008. The indexes chopped around as the session went on, but eventually did finish higher on the day as dip buyers moved in to feast on Thursday’s declines.

Alphabet/Google took Microsoft’s spot on the podium as the world’s third biggest company by capitalization behind Nvidia and Apple. The broad indexes, however, still closed out their worst week since so-called “Liberation Day” in April and crypto continues to wallow in a world of pain.

Check out the Angles homepage for my new explainers on workplace benefits, new 401k/IRA contribution limits and tax brackets, HSAs, FSAs, BackDoor IRA and Mega BackDoor 401k contributions - all freshly updated for 2026.

If you are not yet a financial planning or investment management client of Anglia Advisors and would like to explore becoming one, please feel free to reach out to arrange a complimentary no-obligation discovery call with me.

ARTICLE OF THE WEEK ..

Callie Cox again and well worth a read as always .. No targets. No predictions. No sales pitches or marketing gimmicks. Just the themes to watch for in 2026 and what it could mean for your money.

.. AND I QUOTE ..

“Please! I’ve never seen a more blatant use of “democratization” as a disguise for selling someone else’s bags. Private equity needs exit liquidity and everyday Americans have it.”

Ritholtz Wealth Management’s COO Nick Maggiulli on the worrying prospect of increasing public “access” to illiquid private equity, including in 401k plans.

Private equity needs suckers to sell their shit to and is licking its lips at the prospect of skewering retail investors. Don’t fall for it.

LAST WEEK BY THE NUMBERS:

Last week’s market color courtesy of finviz.com

Last week’s best performing US sector: Healthcare (two biggest holdings: Eli Lilly and Johnson & Johnson) for the second week in a row ⬆︎ 1.8% for the week

Last week’s worst performing US sector: Technology (two biggest holdings: Nvidia, Microsoft) ⬇︎ 5.2% for the week

SPY, a US Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from a universe of the largest US companies. Its price fell 1.9% last week, is up 12.5% so far this year and ended the week 4.5% below its all-time record closing high (10/29/2025).

IWM, a US Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a universe of 3,000 of the largest US stocks. Its price fell 0.8% last week, is up 6.6% so far this year and ended the week 6.1% below its all-time record closing high (10/15/2025).

VXUS, a Global Non-US ETF, tracks the MSCI ACWI Ex-US index, made up of over 8,500 of the largest names from a universe of stocks issued by companies from around the world excluding the United States, in both developed and emerging markets. Its price fell 2.7% last week, is up 23.7% so far this year and ended the week 3.9% below its all-time record closing high (11/12/2025).

INTEREST RATES:

FED FUNDS * ⬌ 3.875% (unchanged from a week ago)

PRIME RATE ** ⬌ 7.00% (unchanged from a week ago)

3 MONTH TREASURY ⬇︎ 3.90% (3.95% a week ago)

2 YEAR TREASURY ⬇︎ 3.51% (3.62% a week ago)

5 YEAR TREASURY ⬇︎ 3.62% (3.74% a week ago)

10 YEAR TREASURY *** ⬇︎ 4.06% (4.14% a week ago)

20 YEAR TREASURY ⬇︎ 4.67% (4.73% a week ago)

30 YEAR TREASURY ⬇︎ 4.71% (4.74% a week ago)

Data courtesy of the Federal Reserve and the Department of the Treasury as of the market close on Friday

* Decided upon by the Federal Reserve Open Market Committee at periodic meetings 8x a year. Used as a basis for overnight interbank loans and for determining high yield savings interest rates.

** Wall Street Journal Prime Rate as of Friday’s close. Used as a basis for determining many consumer loan interest rates such as credit cards, personal loans, home equity loans/lines of credit, securities-based lending and auto loans.

*** Used as a basis for determining mortgage interest rates and some business loans

AVERAGE 30-YEAR FIXED MORTGAGE RATE:

⬆︎ 6.26%

One week ago: 6.24%, one month ago: 6.21%, one year ago: 6.84%

Data courtesy of Freddie Mac Primary Mortgage Market Survey

INTEREST RATE EXPECTATIONS:

Where will the Fed Funds interest rate be after the final rate-setting meeting of the year on December 10th?

Unchanged from now .. ⬇︎ 31% probability (56% a week ago)

0.25% lower than now .. ⬆︎ 69% probability (44% a week ago)

Data courtesy of CME FedWatch Tool

All data based on the Fed Funds interest rate (currently 3.875%). Calculated from Federal Funds futures prices as of the market close on Friday.

PERCENT OF S&P 500 STOCKS ABOVE THEIR OWN 200-DAY MOVING AVERAGE:

⬇︎ 53%

One week ago: 56%, one month ago: 64%, one year ago: 71%

Data courtesy of MacroMicro as of Friday’s market close

This widely-used technical measure of market breadth is considered to be a very robust indicator of the overall health of the S&P 500 index.

A high percentage (above 70%) generally suggests broad market strength and a bullish trend, while a low percentage (below 30%) may indicate market weakness and a bearish trend.

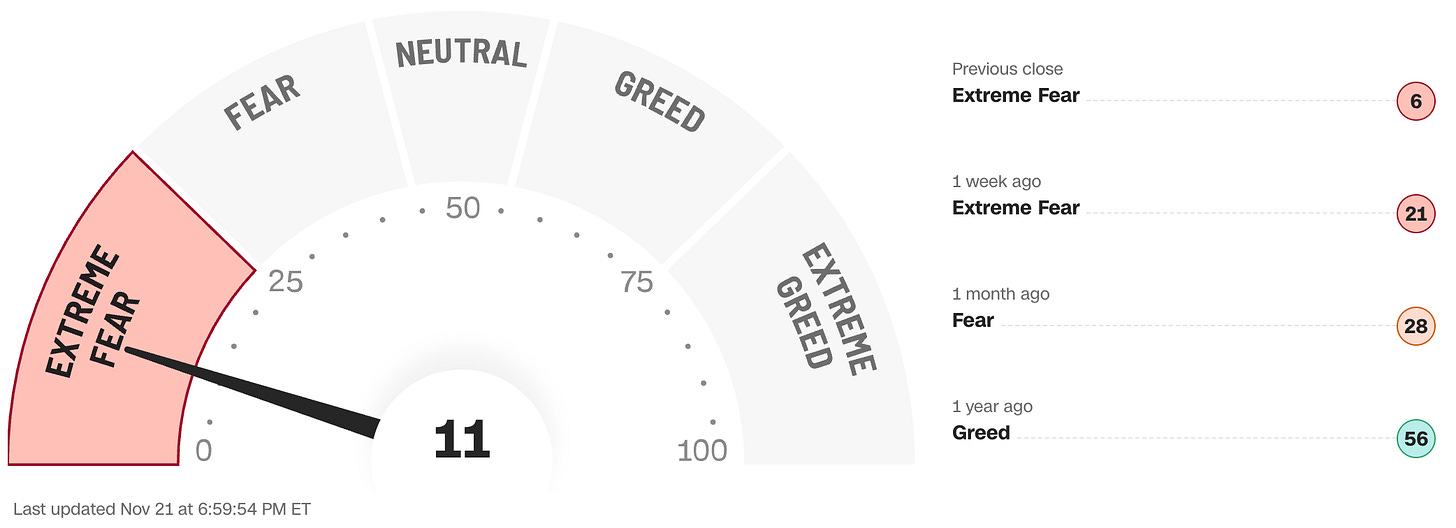

FEAR & GREED INDEX:

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

Data courtesy of CNN Business as of Friday’s market close

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Anglia Advisors has updated its Privacy Policy. You can view the latest version here.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated, speculative assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is ever given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee whatsoever of future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be relied upon as research or investment advice or as a sole basis for any financial determinations, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other fully-qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any other Anglia Advisors published content.

Under no circumstances is any Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained nor any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No formal client advice may be rendered by Anglia Advisors unless and until a properly-executed client engagement agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone?