The bond market was closed on Monday for Veterans’ Day, but the stock market was up and running and squeaked out a tiny further extension of its winning streak on light trading volume with Small Caps leading and Tech/AI lagging. The slight gain was enough, however, to achieve a first-ever S&P 500 close above the 6000 level (just 263 days after first breaking through 5000) and the first-ever Dow Jones Industrial Average close above 44,000.

Election outcome uncertainty transformed into policy uncertainty as Trump began to show his hand with cabinet appointments. The election-fueled rally finally cooled on Tuesday as stocks ran out of steam, easing lower with Small Caps in particular giving back a chunk of their recent gains.

Things were not helped when bond traders returned from their long weekend and proceeded to spike interest rates and send bond prices spiraling lower on the back of concerns that many of Trump's proposed policies, ranging from tariffs to mass deportations, will simply stoke higher inflation and a possible resulting slowdown in the rate-cutting cycle.

Before the open on Wednesday, we got the latest Consumer Price Index (CPI) measure of retail inflation which came in exactly as expected, up +0.2% for the month of October and an annualized rate of +2.6%. Wall Street is tending to treat “as expected” inflation numbers with some relief these days as they keep stock-friendly interest rate cut hopes alive and prices opened in the green before pulling back to close unchanged for the session. The Tech/AI sector once again struggled to keep up with the performance of the rest of the market.

Wednesday also saw the largely-predicted final confirmation of a Republican clean sweep as the party officially retained control of the House of Representatives to add to the presidency and the Senate.

Thursday began with the release of CPI’s baby brother, the Producer Price Index (PPI) measure of wholesale inflation experienced by manufacturers which often foreshadows what consumers will pay in the future. It rose by a smidge more than anticipated, up +0.2% in October and +2.4% annualized.

Stocks initially responded positively, shifting higher at the open but then abruptly changed direction to finish the day in the red again. The sudden decline could mostly be put down to the Fed chairman Jerome Powell catching Wall Street off guard by telling business leaders in Dallas that the U.S. economy is "not sending any signal that we need to be in a hurry to lower rates" and that the central bank’s interest rate-cutting process “could be on the verge of a pause”.

Uh-oh.

Also unsettling investors were concerns about the possible impact of some of Trump’s often head-scratching cabinet picks and Musk’s growing role in policy-making (see OTHER NEWS below). For example, healthcare stocks plummeted on Thursday when it became clear that the president-elect had tapped vaccine-skeptic and all-around strange person Robert Kennedy to head up the Department of Health and Human Services.

Despite a pre-market release of some very healthy Retail Sales numbers, the reversal lower in stock prices resumed on Friday with the recurring pattern of stumbling Tech/AI. Losses intensified as the day went on, as bonds fell hard again on higher interest rates and the massacre continued in the healthcare sector as a result of the Kennedy pick. A tough week ended on a very sour note.

Whenever the market makes a dramatic move such as the one we saw in the wake of the election, it is always good practice to step back and at least consider certain scenarios that could play out that are different from the consensus outlook.

5%+ weekly moves up in stock prices generally tend to occur when the market outlook is uncertain, trader conviction is low and investors are far more worried about missing out on additional upside and far less focused on capital preservation.

There are market risks to the pro-growth agenda and proposed policies of the incoming administration. Do we take Trump literally in what he says he’s going to do, particularly in the area of tariff impositions, deportations and powers given to his recently-announced Musk/Ramaswamy-led Department of Government Efficiency or is it indicative of simply a broad direction of travel?

If the Republicans’ radical growth plan threatens to further balloon the deficit then the bond market taking interest rates substantially higher and crashing bond prices will inject significant volatility, no matter what any economic growth actually ends up looking like.

Higher yields in fixed income always suck capital from equities and make stocks less attractive on a risk-adjusted basis relative to the deemed-safer alternative of bonds.

The tailwinds provided by the vibrant economy may cause the Fed to slow the pace of interest rate cuts and markets have priced in two or three quarter point reductions over the course of ten meetings in 2025. That’s a lot of pauses where the central bank simply sits on its hands and does nothing.

Right now Wall Street seems to be just about at peace with that, but if the Fed is seen to row back a bit on even those cuts, that is going to strongly disappoint markets and likely throw a wrench into any stock market rally.

Economically speaking, 2024 has been a perfect storm in a good way. Everything went right. But what that means is that, going into 2025, we are riding the crest of a wave and that, while things can definitely still remain positive, it’s not going to be easy to build much further on that and get meaningfully better.

OTHER NEWS ..

Distracted .. Tesla shares soared 30% in the week of the election, but there is world where even gains of that size could soon become fleeting. Since then, there’s already been a sixth recall of all the company’s Cybertrucks, the proposed cancellation of the existing tax incentive for consumers to buy electric vehicles and the selection of Musk to head up a Department of Government Efficiency and even spending time getting involved in geopolitical diplomatic roles likely to cause yet more distraction from his duties at Tesla will be of concern to shareholders.

There is also a non-trivial possibility that he might just become the most hated man in America depending on exactly what this new department may implement in terms of spending cuts. That is unlikely to be good news for Tesla’s stock price and the company’s relatively high weighting in index funds means that the effect could be felt by many millions of investors.

ARTICLE OF THE WEEK ..

How boomers’ money secrets are a ticking time bomb for their kids.

THIS WEEK’S UPCOMING CALENDAR ..

Earnings from Nvidia after-market on Wednesday will be this week's highlight, as Q3 earnings season starts to draw to a close.

Other earnings of note include Walmart, Target, Lowe’s, Medtronic, Snowflake, Deere and Intuit.

Economic data coming out this week will be mostly housing-related.

LAST WEEK BY THE NUMBERS ..

Last week’s market color courtesy of finviz.com

Last week’s best performing U.S. sector: Financials (two biggest holdings: Berkshire Hathaway, JP Morgan Chase) - up 1.5% for the week.

Last week’s worst performing U.S. sector: Healthcare (two biggest holdings: Eli Lilly, United Health Group) - down 5.4% for the week.

SPY, the S&P 500 Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from among the largest U.S. companies. Its price fell 2.0% last week, is up 23.2% so far this year and ended the week 2.2% below its all-time record closing high (11/11/2024)

IWM, the Russell 2000 Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a group made up from among 3,000 of the largest U.S. stocks. Its price fell 3.9% last week, is up 13.8% so far this year and ended the week 5.8% below its all-time record closing high (11/08/2021).

AVERAGE 30-YEAR FIXED MORTGAGE RATE ..

↓ 6.78%

One week ago: 6.79%, one month ago: 6.44%, one year ago: 7.44%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

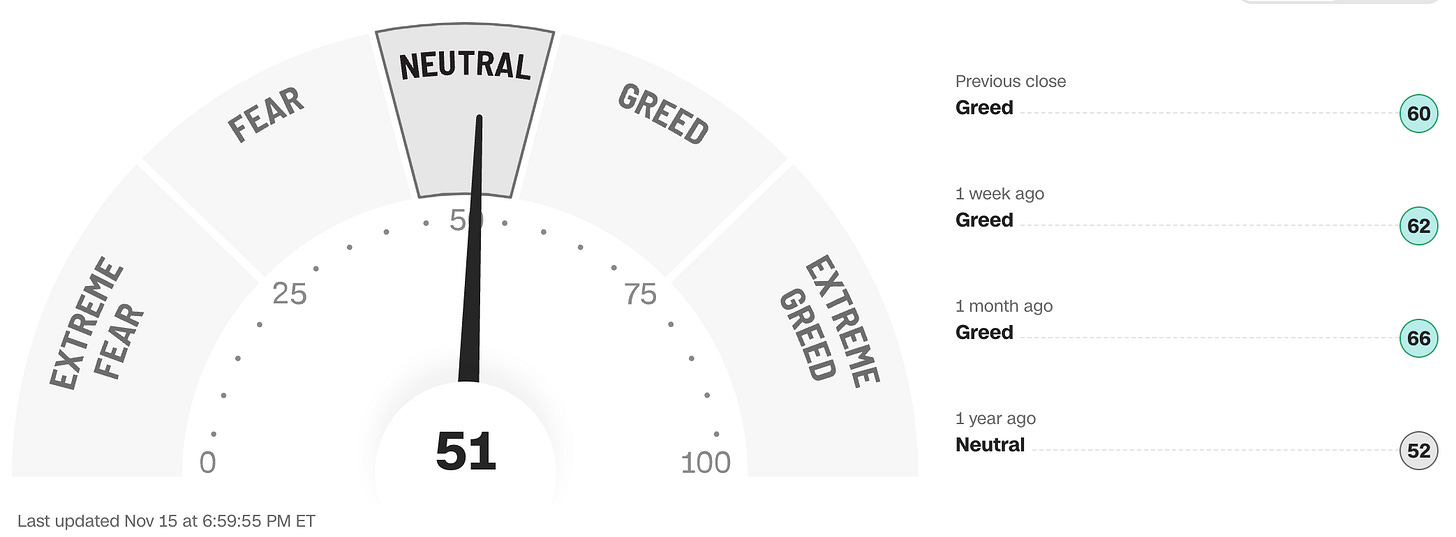

FEAR & GREED INDEX ..

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

FEDWATCH INTEREST RATE TOOL ..

Where will interest rates be after the Fed’s next meeting on December 18th?

Higher than now .. 0% probability (0% a week ago)

Unchanged from now .. 40% probability (35% a week ago)

0.25% lower than now .. 60% probability (65% a week ago)

0.50% lower than now .. 0% probability (0% a week ago)

All data based on the Fed Funds interest rate (currently 4.625%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

% OF S&P 500 STOCKS TRADING ABOVE THEIR 50-DAY MOVING AVERAGE:

↓55% (275 of the S&P 500 stocks ended last week above their 50D MA and 225 were below)

One week ago: 65%, one month ago: 76%, one year ago: 69%

% OF S&P 500 STOCKS TRADING ABOVE THEIR 200-DAY MOVING AVERAGE:

↓68% (341 of the S&P 500 stocks ended last week above their 200D MA and 159 were below)

One week ago: 74%, one month ago: 78%, one year ago: 50%

Closely-watched measures of market breadth and participation, providing a real-time look at how many of the S&P 500 index stocks are trending higher or lower, as defined by whether the stock price is above or below their more sensitive 50-day (short term) and less sensitive 200-day (long term) moving averages which are among the most widely-followed of all stock market technical indicators.

The higher the reading, the better the deemed health of the overall market trend, with 50% considered to be a key pivot point. Readings above 90% or below 15% are extremely rare.

WEEKLY US INVESTOR SENTIMENT (outlook for the upcoming 6 months) ..

↑Bullish: 50% (42% a week ago)

⬌ Neutral: 22% (31% a week ago)

↓Bearish: 28% (27% a week ago)

Net Bull-Bear spread: ↑Bullish by 22 (Bullish by 15 a week ago)

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

Survey participants are typically polled during the first half of the week.

Data courtesy of: American Association of Individual Investors (AAII).

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any financial decisions, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind.

Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No advice may be rendered by Anglia Advisors unless or until a properly-executed Client Engagement Agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?