Stocks began the week on Monday in a more upbeat mood, with buyers re-emerging to scoop up some of the discounted Tech/AI names following the previous week’s gloom, although the early momentum slowly dissipated as the session wore on and the day ended with only minimal gains. Energy stocks jumped as Trump decided that a fracking company CEO was a good idea to become the next head of the Department of Energy.

Things turned sour again on Tuesday morning following a really ugly session in Europe as tensions surrounding the Russia/Ukraine war were ramped up by apparently U.S.-sanctioned Ukrainian long-range missile attacks inside Russia, swiftly followed by an apparent re-write of Russia’s nuclear protocols and these concerns spilled into U.S. markets.

Indeed, the post-election bump seemed on the brink of disintegration at one point as stocks fell hard at the open and so-called “safe haven” assets like Treasury bonds, the U.S. Dollar and gold pushed notably higher. As the day went on though, stock traders seemed to become more sanguine, the early geopolitical panic subsided and prices moved back into the green and remained there until the close.

Wednesday was always going to feel like a waiting game, with superstar Nvidia reporting after the close that day, although some horrendous earnings and forward outlook from Target caught Wall Street’s attention at the open and it crashed the stock more than 20%. The indexes fell, in line with this miserable news from a major retailer and stayed rather depressed all day in advance of the main event of Nvidia’s earnings after the bell.

The chipmaker released a broadly-positive set of results but the revenue forecast fell short of some of the admittedly sky-high expectations, which arguably showed that its dizzying AI-fueled growth run might possibly be reaching its limits.

Dip-buyers quickly bought up the knee-jerk initial sharp fall in Nvidia’s after-market price and by the time the real market opened on Thursday morning, the stock was largely unchanged. Another very healthy Weekly Jobless Claims number provided a much-needed injection of hope into the December rate-cutting case and stocks drifted north to finish the day higher with Small Caps and the financial sector particularly shining.

The market chopped quietly sideways for a while on Friday, before finally shifting a little higher again on still-intact interest rate cut hopes with Small Caps and financial stocks continuing to lead the charge and tech names once again struggling to keep up.

At around 6000, the S&P 500 is currently priced for perfection and perfection means: Goldilocks growth, an ongoing Fed interest rate cutting cycle, falling inflation and pro-growth policies that aren't derailed or unduly delayed by political turmoil, drama or incompetence.

While the ultimate policy direction could well be positive for stocks (pro-growth) the path to get to that destination is likely to be a bumpy one given Trump’s inclination towards chaos and that’s something to keep in mind as we look ahead to next year. It’s pretty safe to say that 2025 will be a more volatile year than 2024 as markets will have to digest headlines associated with:

unorthodox policies from the incoming administration,

potential higher volatility in Treasury yields and the U.S. Dollar,

trade and tariff threats,

familiar unknowns from 2024 such as the strength of the economy, pace and size of Fed rate cuts, inflation and growing geopolitical uncertainty.

Put in plain English, the Trump administration and Republican government will have a pro-growth, low-regulation focus, but as 2016-2020 and recent post-election events have shown us, that can come with policy and rhetorical surprises and uncertainty and while the result of it all could still easily be higher stock prices, it’s unlikely to be as smooth a ride as 2024.

Higher volatility doesn’t necessarily mean a bear market and the technical setup for stocks in 2025 is still mostly positive. However, headline-driven volatility will rise and being able to determine what negative news stories are just flare-ups that will likely simply cause a mild and/or ultra-short term temporary pullback and what unfavorable news constitutes a real threat to the stock market rally will not be easy.

I’ll do my best to help.

OTHER NEWS ..

RIP the surveys - please! .. Sharp-eyed readers and listeners will have noticed that I almost never allude to consumer sentiment surveys in my main report, from which many analysts draw far-reaching conclusions about the state of the economy.

That is because they are utterly worthless nonsense. Many are still conducted by landline phone or snail mail paper, so are immediately compromised by selection bias. The response rate is pathetic and is subject to the extreme recency bias of the respondents (did they have a good/bad morning before they respond to the mailed survey in the afternoon?).

But the real reason that these surveys are absolute rubbish and should be completely ignored is that they are often nothing more than amateurish political opinion polling. That was on full display last week by the first post-election Expectations Index, which measures how consumers feel about the future as part of the Consumer Sentiment Survey from the University of Michigan, for some unknown reason the respected big daddy of all economic surveys.

Optimism jumped nearly 28 percentage points for Republican households from the previous survey right before the election and plunged almost 18 among Democratic ones. Say no more. What a useless data source upon which to base any kind of conclusion impacting what to do with your money.

?????? .. Concerns are growing on Wall Street about the quality and lack of political and diplomatic experience of some of Trump’s frankly bizarre cabinet picks and what they could mean for the fortunes of certain sectors and companies in the coming years. Trump has also proposed waiving any FBI or any other kind of background checks for his nominees.

On Tuesday, his selection of TV talk show host Dr. Oz to run Medicare/Medicaid was considered unlikely to soothe the worries of a severely distressed healthcare sector still reeling from the president-elect’s decision to give a shot in the arm to anti-vaxxers and tap Kennedy to head up Health and Human Services.

The Oz pick was swiftly followed by that of his old buddy Vince’s wife, former wrestling executive Linda McMahon, sued recently for enabling the sexual exploitation of children, to head up the Department of Education. Also last week, Trump loyalist Howard Lutnick, CEO of Cantor Fitzgerald, was chosen as Commerce Secretary with responsibility for managing policy on tariffs and international trade, Chris Wright, CEO of fracking company Liberty Energy was nominated to lead the Department of Energy and some ex-NFL footballer, Scott Turner, was named to run the Department of Housing and Urban Development.

Serious assault and sex trafficking allegations eventually forced Matt Gaetz off the ticket for Attorney General on Thursday but similar sexual assault accusations hang over another TV host, Pete Hegseth, the woefully inexperienced pick for Secretary of Defense, which could impact the fortunes of a number of defense and military contracting companies.

As the week’s trading closed, Wall Street was still on the edge of its seat bracing for what it viewed as the absolutely critical choice for Treasury Secretary with oversight of the world’s largest bond market, tax collection and economic sanctions. In the end, Scott Bessent, who was a largely unsuccessful macro hedge fund manager but who campaigned vigorously for Trump, got the nod after Friday’s closing bell.

ARTICLE OF THE WEEK ..

Sometimes what you should NOT believe about investing is even more important than what you should.

THIS WEEK’S UPCOMING CALENDAR ..

Some major retailer earnings and the Federal Reserve's preferred inflation measure will be the highlights of this holiday-shortened week. U.S. stock and bond markets will be closed on Thursday for Thanksgiving, before a half day of trading on Friday.

Still a few more earnings reports, many of them retailers, to come this week from Macy’s, Best Buy, Dick’s Sporting Goods, Bath & Body Works, Nordstrom, Dell, Hewlett Packard, Zoom Video Communications, Crowdstrike and Workday.

Wednesday will see the latest release the Personal Consumption Expenditures (PCE) price index measure of inflation, upon which the Fed relies heavily to determine its interest rate policy. The consensus estimate calls for a 2.3% year-over-year increase.

The minutes from the early November Fed interest rate-setting meeting will be published on Tuesday afternoon.

LAST WEEK BY THE NUMBERS ..

Last week’s market color courtesy of finviz.com

Last week’s best performing U.S. sector: Materials (two biggest holdings: Linde, Sherwin-Williams) - up 3.0% for the week.

Last week’s worst performing U.S. sector: Communications Services (two biggest holdings: Alphabet/Google, Meta/Facebook) - up 1.7% for the week.

SPY, the S&P 500 Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from a universe of the largest U.S. companies. Its price rose 1.8% last week, is up 25.3% so far this year and ended the week 0.5% below its all-time record closing high (11/11/2024)

IWM, the Russell 2000 Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a universe of 3,000 of the largest U.S. stocks. Its price rose 4.8% last week, is up 18.9% so far this year and ended the week 1.6% below its all-time record closing high (11/08/2021).

AVERAGE 30-YEAR FIXED MORTGAGE RATE ..

⬆︎ 6.84%

One week ago: 6.78%, one month ago: 6.54%, one year ago: 7.29%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

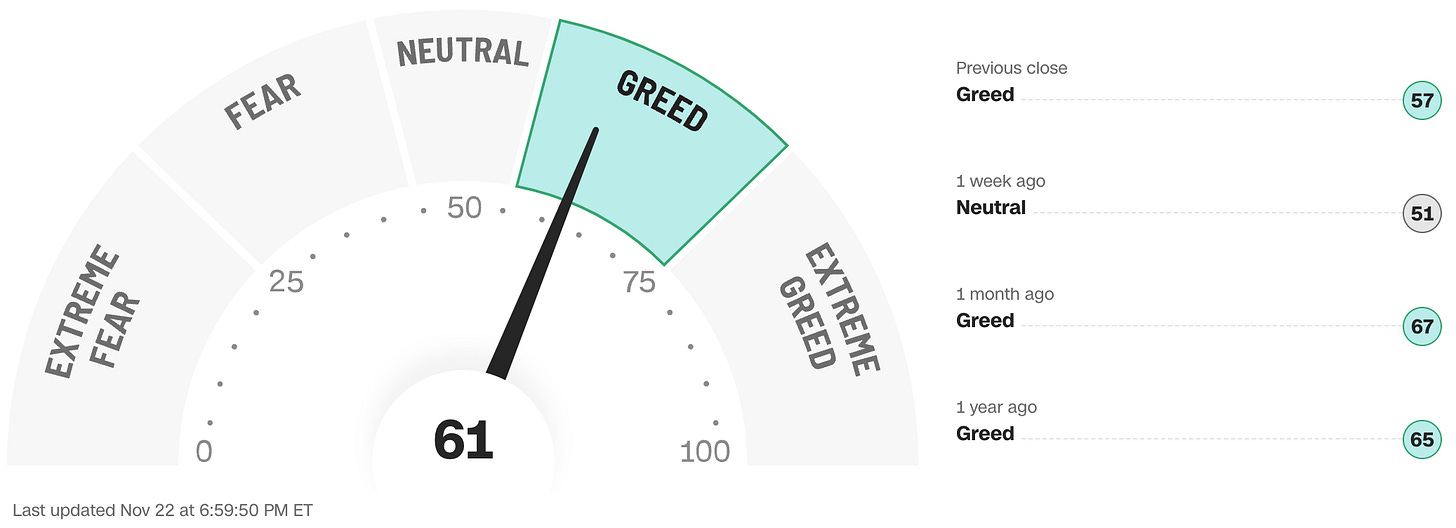

FEAR & GREED INDEX ..

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

FEDWATCH INTEREST RATE TOOL ..

Where will interest rates be after the Fed’s next meeting on December 18th?

Higher than now .. 0% probability (0% a week ago)

Unchanged from now .. ⬆︎43% probability (40% a week ago)

0.25% lower than now .. ⬇︎57% probability (60% a week ago)

0.50% lower than now .. 0% probability (0% a week ago)

All data based on the Fed Funds interest rate (currently 4.625%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

% OF S&P 500 STOCKS TRADING ABOVE THEIR 50-DAY MOVING AVERAGE:

⬆︎63% (314 of the S&P 500 stocks ended last week above their 50D MA and 186 were below)

One week ago: 55%, one month ago: 70%, one year ago: 70%

% OF S&P 500 STOCKS TRADING ABOVE THEIR 200-DAY MOVING AVERAGE:

⬆︎71% (357 of the S&P 500 stocks ended last week above their 200D MA and 143 were below)

One week ago: 68%, one month ago: 76%, one year ago: 52%

Closely-watched measures of market breadth and participation, providing a real-time look at how many of the S&P 500 index stocks are trending higher or lower, as defined by whether the stock price is above or below their more sensitive 50-day (short term) and less sensitive 200-day (long term) moving averages which are among the most widely-followed of all stock market technical indicators.

The higher the reading, the better the deemed health of the overall market trend, with 50% considered to be a key pivot point. Readings above 90% or below 15% are extremely rare.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any financial decisions, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind.

Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No advice may be rendered by Anglia Advisors unless or until a properly-executed Client Engagement Agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?