The big news of the weekend was the announcement of a US/EU trade deal resulting in a 15% tariff on imports from most of mainland Europe (including on automobiles) similar to that agreed with Japan days earlier, representing the starkest example yet of TACO as it was a 50% rate that was being dangled just weeks ago.

Despite lingering confusion around some particulars of the agreement and backlash from quite a few corners of the EU (including from the Prime Minister of France), the pact was still viewed on Wall Street as the removal of a major risk for the global economy.

This was a potentially decisive jam-packed week that could set the tone for the rest of the year with 40% of S&P 500 firms reporting their Q2 earnings including four of the Magnificent Seven names, another round of US/China trade talks in Stockholm, a Fed interest rate announcement and a new Gross Domestic Product (GDP) report on Wednesday, more inflation data on Thursday followed by a critical Jobs Report on Friday which was also scheduled to be the latest tariff deadline day.

US stock markets initially celebrated the EU accord on Monday after a decent session in Europe, boosted by surprisingly not-terrible earnings from Boeing. But enthusiasm waned as the session wore on with traders unwilling to place big bets ahead of the bonanza of new information due over the coming days. A minuscule gain in the S&P 500 at the close was however enough to run its new all-time high winning streak to six straight days.

Tuesday morning’s earnings reports were mixed but the stock of international index heavyweight Novo Nordisk got wrecked following disheartening numbers. The indexes spent the session mostly treading water but eventually closed lower on the day. After the close, it became clear that the US and China were kicking the can down the road in their trade talks and a 25% tariff was slapped on India.

Fed day rolled around on Wednesday with a pre-market upside surprise to the initial estimate of Q2 GDP at +3.0% annualized. No surprises from the central bank however as the Federal Funds interest rate was left unchanged despite two dissenting committee members for the first time since 1993. The dissent was largely dismissed by markets as little more than performative stunts from two auditioning candidates simply bending the knee and kissing the ring of the president who will be selecting a new Fed chairman next year.

The current chairman Powell had one job to do at his press conference; to make it as boring as possible. He was largely successful, but his failure to overtly signal a September rate cut disappointed Wall Street. Stocks dropped to finish lower and interest rates jumped. After hours, both Meta and Microsoft issued outstanding earnings reports, each totally crushing expectations.

In general, strong Mega Cap Tech earnings have become expected rather than appreciated by this market but these were so sensational that the indexes ripped higher first thing on Thursday morning. Trump obviously shit-posted Powell (who is a “stubborn moron” apparently) again but Wall Street is now insensitive to the non-stop barrage of juvenile insults.

PCE inflation data, which is closely followed by the Fed, showed a pick-up in retail prices and further complicated the path to interest rate cuts. This took the gloss off the initial earnings exuberance and the indexes ended the session in the red.

Amazon and Apple were next up on the earnings docket. Despite kinda-ok Q2 numbers, Amazon disappointed on projected revenue, sales and profits in its forward guidance. And then there’s the tariffs. Apple did better, reporting its fastest quarterly revenue growth in three years and a renewed expansion of device sales around the world, particularly in China.

Pre-market on Friday, traders had a blitz of tariff announcements to get their heads around (see ARTICLE OF THE WEEK below), including the jacking up of the rate on non-USMCA imports from Canada from 25% to 35%.

They also had to deal with international markets plummeting in response to the levies and a very weak Jobs Report from the US Bureau of Labor Statistics (BLS) showing a dramatic fall in new jobs created along with massive downward revisions to previous months’ data. Manufacturing jobs are being particularly decimated. The unemployment rate ticked back up to 4.2%.

In response to the poor numbers, Trump promptly shot the messenger by firing the head of the BLS. This outrageous move shocked Wall Street which has always trusted BLS-generated economic data, long considered the gold standard in objectivity and accuracy that drives investment decisions around the world.

Stocks plunged and bonds surged as interest rates completely rolled over on the suddenly-strengthened prospect of an interest rate cut in September (see INTEREST RATE EXPECTATIONS below). Amazon stock was brutally punished for its shaky report and even Apple got hit hard. US nuclear submarines are on the move in response to “provocative” statements out of Russia. Adrianna Kugler, Fed governor and voting member of the interest rate-setting committee suddenly resigned under somewhat mysterious circumstances, opening up a seat to be filled by a hand-picked Trump appointee which should prove, to say the least, interesting.

The result was a rotten end to the week for the indexes with tech stocks and Small Caps getting especially beaten down as the extended benefit of the doubt that Wall Street has so far seemed to have given to the administration and the US economy seems to be suddenly crumbling.

I think we had all better buckle up.

If you are not yet a client of Anglia Advisors and would like to explore becoming one, please feel free to reach out to arrange a complimentary no-obligation discovery call with me.

ARTICLE OF THE WEEK ..

Here is the full list of tariffs by country/region and their effects (as of 08/01/2025)

.. AND I QUOTE ..

“We are all at a wonderful ball where the champagne sparkles in every glass and soft laughter falls upon the summer air. We know that, by the rules, at some moment, the Black Horseman will come shattering through the great terrace doors, wreaking vengeance and scattering the survivors. The ball is so splendid that no one wants to leave but everyone keeps asking “What time is it? What time is it?” But none of the clocks have any hands.”

Adam Smith (no, not that one), “Supermoney”.

LAST WEEK BY THE NUMBERS:

Last week’s market color courtesy of finviz.com

Last week’s best performing US sector: Utilities (two biggest holdings: Next Era Energy, Southern Co.) ⬆︎ 1.5% for the week

Last week’s worst performing US sector: Materials (two biggest holdings: Linde, Sherwin Williams) ⬇︎ 6.1% for the week

SPY, a US Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from a universe of the largest US companies. Its price fell 2.4% last week, is up 6.1% so far this year and ended the week 2.8% below its all-time record closing high (07/28/2025).

IWM, a US Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a universe of 3,000 of the largest US stocks. Its price fell 4.2% last week, is down 2.7% so far this year and ended the week 12.3% below its all-time record closing high (11/08/2021).

VXUS, a Global Non-US ETF, tracks the MSCI ACWI Ex-US index, made up of over 8,500 of the largest names from a universe of stocks issued by companies from around the world excluding the United States, in both developed and emerging markets. Its price fell 3.2% last week, is up 15.8% so far this year and ended the week 4.0% below its all-time record closing high (07/23/2025).

INTEREST RATES:

FED FUNDS * ⬌ 4.33% (unchanged)

PRIME RATE ** ⬌ 7.50% (unchanged)

3 MONTH TREASURY ⬇︎ 4.35% (4.42% a week ago)

2 YEAR TREASURY ⬇︎ 3.69% (3.91% a week ago)

5 YEAR TREASURY ⬇︎ 3.77% (3.95% a week ago)

10 YEAR TREASURY *** ⬇︎ 4.23% (4.40% a week ago)

20 YEAR TREASURY ⬇︎ 4.79% (4.92% a week ago)

30 YEAR TREASURY ⬇︎ 4.81% (4.92% a week ago)

Data courtesy of the Federal Reserve and the Department of the Treasury as of the market close on Friday.

* Decided upon by the Federal Reserve Open Market Committee. Used as a basis for overnight interbank loans and for determining high yield savings rates.

** Wall Street Journal Prime rate. Used as a basis for determining many consumer loan rates such as credit cards, personal loans, home equity loans/lines of credit, securities-based lending and auto loans.

*** Used as a basis for determining mortgage rates.

AVERAGE 30-YEAR FIXED MORTGAGE RATE:

⬇︎ 6.72%

One week ago: 6.74%, one month ago: 6.68%, one year ago: 6.73%

Data courtesy of: Freddie Mac Primary Mortgage Market Survey

INTEREST RATE EXPECTATIONS:

Where will the Fed Funds interest rate be after the next rate-setting meeting on September 17th?

Unchanged from now .. ⬇︎ 20% probability (38% a week ago)

0.25% lower than now .. ⬆︎ 80% probability (62% a week ago)

With three more meetings left in 2025, what is the most commonly-expected number of remaining 0.25% Fed Funds interest rate cuts this year?

⬌ Three (up by one from a week ago)

All data based on the Fed Funds interest rate (currently 4.33%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

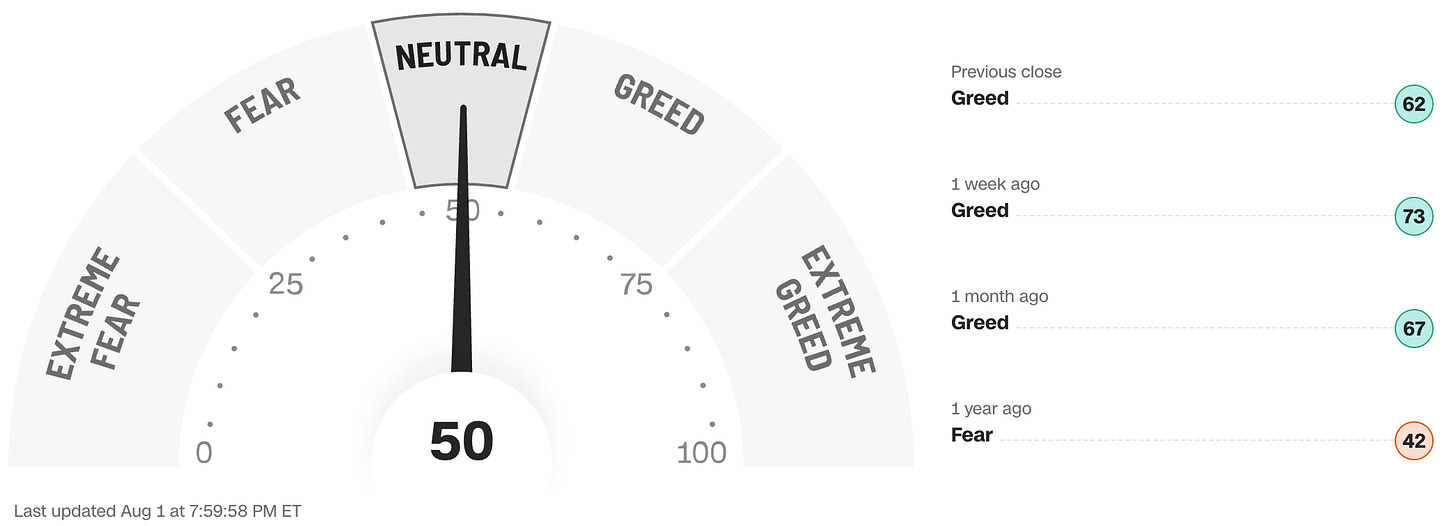

FEAR & GREED INDEX:

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

Note: Anglia Advisors has updated its Privacy Policy. You can view the latest version here.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated, speculative assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is ever given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee whatsoever of future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be relied upon as research or investment advice or as a sole basis for any financial determinations, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other fully-qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any other Anglia Advisors published content.

Under no circumstances is any Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained nor any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No formal client advice may be rendered by Anglia Advisors unless and until a properly-executed client engagement agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone?