Over the weekend, Nvidia and Advanced Micro Devices (AMD) entered into an unprecedented “pay-to-play” agreement with the US government whereby they will be allowed to continue to deal with China as much as they want so long as they kick back 15% of all revenues generated there to the Treasury, making a total mockery of the idea (that Wall Street never believed anyhow) that chip export prohibitions have ever had anything to do with national security concerns, fentanyl, creating American jobs or any other such poppycock.

This kind of purely transactional arrangement, which directly takes money out of the pockets of shareholders, could prove to be an almost Soviet-style central planning and state capitalism framework for other companies or sectors going forward.

There was a muted reaction on Monday morning in the prices of those two stocks but the broader indexes continued to surf all-time record highs although markets were somewhat unnerved by Trump’s decision to deploy the US military to patrol the streets of Washington DC and to federalize the city’s police force, falsely citing an increase in violent crime (in fact such crimes in the nation’s capital recently hit a 30-year low and are down 26% this year). TACO was on full display as the US/China trade talk deadline was extended by another 90 days. Stocks bled lower and closed moderately in the red for the session.

Markets learned overnight the troubling news that economist E.J. Antoni had been tapped to serve (subject to Senate confirmation) as the new head of the Bureau of Labor Statistics (BLS), a pick that was roundly ridiculed and does precisely nothing to allay serious concerns about the credibility of future economic data, especially when the first thing he did was to float the somewhat unhinged idea of halting the monthly public release of the Jobs Report.

Pre-market on Tuesday, after new all-time record highs were reached overnight in Japanese and Australian stock markets, the big reveal of the latest US CPI inflation data showed an as-expected acceleration to a 2.7% annualized retail inflation rate which was viewed with relief by markets since it very much left Fed Funds interest rate cuts on the table.

Stocks soared led by tech and Small Caps and short term interest rates fell to multi-month lows as traders further boosted bets on a likely September cut. The indexes built on those initial gains as the session wore on and both the S&P 500 and the NASDAQ comfortably closed yet again at their own fresh all-time record highs.

It was an uneventful Wednesday, but the sense remained that the Fed will dare not disappoint on September 17th. Stocks responded by continuing to grind higher to close at more new record levels.

The release on Thursday morning of PPI wholesale price data, which can often be a leading indicator for retail inflation, injected a strong note of caution following Tuesday’s benign CPI report by coming in massively hotter than expected and at its highest level in three years. One possible conclusion drawn by analysts from this is that heightened inflation may already be coursing through the economy, it just hasn’t made its way to the consumer quite yet.

Stocks initially retreated from their highs as a result with Small Caps falling hardest and the recent steady move south in interest rates came to a screeching halt and reversed course as traders dialed back their bets on a September Fed interest rate cut. The S&P 500 recovered its mojo after lunch, however, to close fractionally in the green for a third straight session of new all-time record highs.

Retail Sales and Industrial Production data were released on Friday morning and provided no surprises, but Consumer Sentiment continues to visibly slump. The indexes drifted gently lower over the course of the day on some profit-taking but still ended nicely higher for the week.

Based on the ridiculous sham of a “press conference” with no questions taken in Alaska on Friday evening, nothing of consequence seemed to have been achieved in the very odd Trump/Putin meeting and an obviously deflated US president came home empty-handed. As one analyst put it; “Lunch was cancelled but there were plenty of TACOs being served.”

The stock market is a powerful discounting mechanism that looks out six to nine months and frankly doesn’t care about the three-to-five year outlook where a lot of the perceived risks lie. And, with the economy generally holding up, interest rate cuts on the horizon and earnings still looking mostly wonderful, there isn’t a whole hell of a lot right now that calls for the indexes to cool down in the short term.

That can change very quickly at almost any moment, of course, and when the correction or even a bear market does hit (as it will), it is going to likely feel pretty painful since stock prices will be falling from their highly elevated levels.

Long term investors will need to hold their nerve, tune out the inevitable hysteria and look down the back of the sofa for a way to increase their systematic recurring buying of diversified ETF investments while prices are temporarily depressed.

If you are not yet a client of Anglia Advisors and would like to explore becoming one, please feel free to reach out to arrange a complimentary no-obligation discovery call with me.

ARTICLE OF THE WEEK ..

Five massive red flags. When you see these, don’t walk, run.

.. AND I QUOTE ..

"History suggests that we are heading towards an unhealthy level of investor optimism, but are not there just yet."

Nick Colas, co-founder of Datatrek

LAST WEEK BY THE NUMBERS:

Last week’s market color courtesy of finviz.com

Last week’s best performing US sector: Healthcare (two biggest holdings: Eli Lilly, Johnson & Johnson) ⬆︎ 3.8% for the week

Last week’s worst performing US sector: Real Estate (two biggest holdings: Welltower, Prologis) ⬇︎ 1.3% for the week

SPY, a US Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from a universe of the largest US companies. Its price rose 2.0% last week, is up 10.0% so far this year and ended the week 0.2% below its all-time record closing high (08/14/2025).

IWM, a US Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a universe of 3,000 of the largest US stocks. Its price rose 3.8% last week, is up 3.3% so far this year and ended the week 6.8% below its all-time record closing high (11/08/2021).

VXUS, a Global Non-US ETF, tracks the MSCI ACWI Ex-US index, made up of over 8,500 of the largest names from a universe of stocks issued by companies from around the world excluding the United States, in both developed and emerging markets. Its price rose 1.3% last week, is up 20.7% so far this year and ended the week 0.5% below its all-time record closing high (08/13/2025).

INTEREST RATES:

FED FUNDS * ⬌ 4.33% (unchanged)

PRIME RATE ** ⬌ 7.50% (unchanged)

3 MONTH TREASURY ⬇︎ 4.30% (4.32% a week ago)

2 YEAR TREASURY ⬇︎ 3.74% (3.76% a week ago)

5 YEAR TREASURY ⬇︎ 3.82% (3.84% a week ago)

10 YEAR TREASURY *** ⬆︎ 4.29% (4.27% a week ago)

20 YEAR TREASURY ⬆︎ 4.86% (4.84% a week ago)

30 YEAR TREASURY ⬆︎ 4.88% (4.85% a week ago)

Data courtesy of the Federal Reserve and the Department of the Treasury as of the market close on Friday.

* Decided upon by the Federal Reserve Open Market Committee. Used as a basis for overnight interbank loans and for determining high yield savings interest rates.

** Wall Street Journal Prime rate. Used as a basis for determining many consumer loan interest rates such as credit cards, personal loans, home equity loans/lines of credit, securities-based lending and auto loans.

*** Used as a basis for determining mortgage interest rates.

AVERAGE 30-YEAR FIXED MORTGAGE RATE:

⬇︎ 6.58%

One week ago: 6.63%, one month ago: 6.74%, one year ago: 6.49%

Data courtesy of: Freddie Mac Primary Mortgage Market Survey.

INTEREST RATE EXPECTATIONS:

Where will the Fed Funds interest rate be after the next rate-setting meeting on September 17th?

Unchanged from now .. ⬆︎ 15% probability (11% a week ago)

0.25% lower than now .. ⬇︎ 85% probability (89% a week ago)

With three more rate-setting meetings left in 2025, what is the most commonly-expected number of remaining 0.25% Fed Funds interest rate cuts this year?

⬇︎ Two (down one from a week ago)

All data based on the Fed Funds interest rate (currently 4.33%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

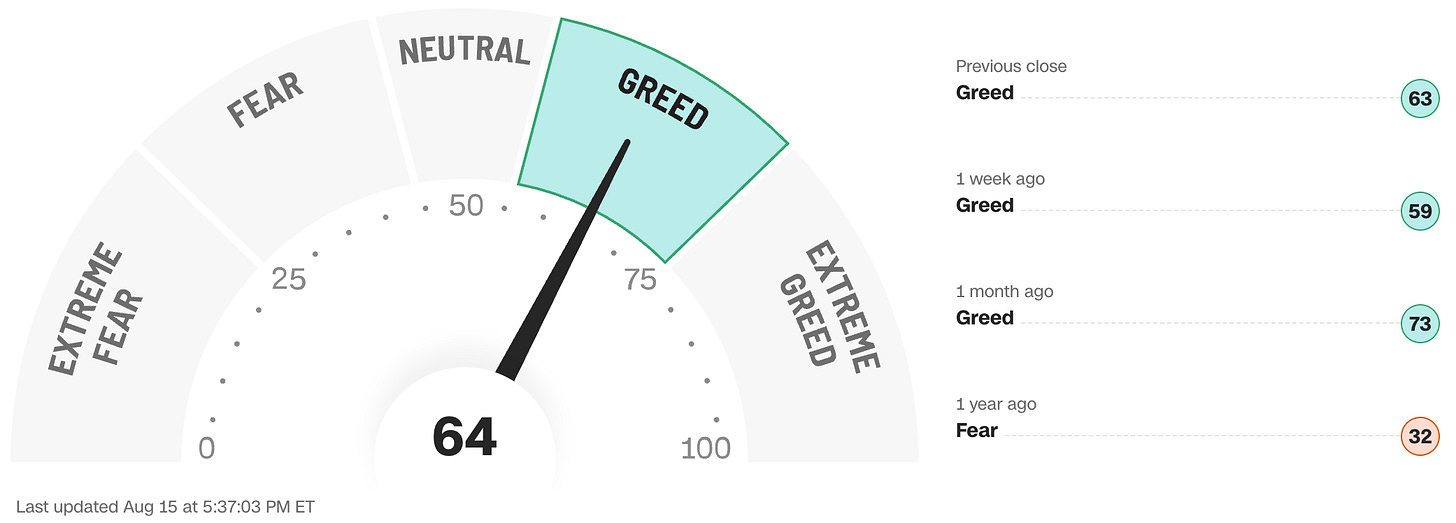

FEAR & GREED INDEX:

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

Note: Anglia Advisors has updated its Privacy Policy. You can view the latest version here.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated, speculative assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is ever given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee whatsoever of future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be relied upon as research or investment advice or as a sole basis for any financial determinations, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other fully-qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any other Anglia Advisors published content.

Under no circumstances is any Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained nor any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No formal client advice may be rendered by Anglia Advisors unless and until a properly-executed client engagement agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone?