Wall Street is suddenly staring at two existential questions that it never thought it would have to face; about the independence of the Federal Reserve and about the credibility of future economic data coming out of the 141 year-old Bureau of Labor Statistics (BLS) as both historically autonomous agencies face upcoming politicization with Trump set to insert his own hand-picked minions into highly influential positions (see SPECIAL NOTE below).

While these are very legitimate longer term anxieties, the short term effect was a renewed conviction that Fed interest rate cuts will resume in September and that was what boosted stock prices at the opening bell on Monday.

The indexes roared higher out of the gate, this time led by Big Tech and Small Caps who were the biggest victims of the previous Friday’s wipeout as well as the main potential beneficiaries of any interest rate reduction and they held on to those gains through the close to get back to within 1% of all-time highs.

The pharmaceutical sector was scratching its head on Tuesday morning, baffled and troubled by what it was hearing. Beaten and battered recently by the ridiculous Health Secretary Kennedy and his constant promotion of nonsensical and dangerous falsehoods about medical science (including canceling all grants for mRNA vaccine research just last week), it now found itself facing a US president who, after going on TV and bizarrely pledging to cut drug prices to the consumer by over a thousand percent (something that is not mathematically possible), then promptly proclaimed that tariffs on the sector’s imports could soon shoot as high as 250%.

The broad indexes sank early on after data gave off a whiff of stagflation in the service sector and stocks remained down in the dumps for the rest of the session, erasing the previous day’s gains.

Stocks opened moderately higher on Wednesday morning and spent the day climbing steadily deeper into the green as mostly solid earnings reports continued to pour in, including from McDonalds and Disney. But it was Big Tech that really drove the upward move, particularly Apple which announced some significant US investments.

The move higher was in spite of a trigger-happy Trump doubling tariffs on India and teasing “a lot more” new levies in the coming hours and days. But he waited until after the closing bell to drop the big one: a 100% tariff on chip and semiconductor imports (with some exemptions for US-based production) which risks upending global supply chains.

Markets largely shrugged off the new tariff turmoil on Thursday morning however, choosing instead to focus on the growing number of Fed officials seemingly falling into line when it comes to imminent interest rate cuts. The market-driven probability of a September Fed cut reached as high as 95%, having been around 40% going into the previous Friday’s Jobs Report.

The session then essentially became a microcosm of the state of financial markets right now; a tug of war between tariff bad news and interest rate cut good news which ended the day pretty much as a tie as the indexes blew their early lead to close basically unchanged.

Trump named the chairman of his Council of Economic Advisers Stephen Miran, a skeptic of central bank independence, to fill the vacant seat at the Federal Reserve but only as temporary five-month stop-gap measure until a permanent appointment is made next year, so markets were relatively relaxed about the decision.

In a separate development, the head of the IRS was removed by Trump just two months into his tenure and replaced by Treasury Secretary Bessent who will become the seventh head in eight months of the agency which has had its staff gutted by over 25% since the election.

Friday dawned with markets perky again, having sort of dodged a bullet with the short-term appointment of Miran. On the geopolitical front, there seem to be a few flickering hopes of some kind of possible de-escalation in Ukraine with a Trump/Putin summit scheduled for Friday in Alaska, but any end to the death and destruction in Gaza now seems further away than ever. The indexes stayed elevated into the close to bring a positive week to an end, with the NASDAQ-100 reaching new all-time highs yet again and the S&P 500 only a hair’s breadth away from accomplishing the same.

At around 6400 the S&P 500 has hardly any room for disappointment (as we saw two Fridays ago) and this week could possibly provide just such a potential pitfall with the release of the latest CPI inflation data on Tuesday.

If inflation comes in hot, it could massively complicate things and dent the new-found confidence that Fed interest rate cuts are just around the corner next month since cutting rates in an inflationary environment is not a smart thing to do and the Fed knows it.

If you are not yet a client of Anglia Advisors and would like to explore becoming one, please feel free to reach out to arrange a complimentary no-obligation discovery call with me.

SPECIAL NOTE:

I never discuss any specific custom-managed portfolio changes in this newsletter, but I will make an exception here.

What is happening at the Bureau of Labor Statistics is causing particular concern with Treasury Inflation Protected Securities (TIPS) which depend on data from agencies like this in order to be correctly priced by markets. If even the slightest doubt is cast upon the integrity and believability of such data, there is in my opinion a non-trivial chance that these types of securities could be heavily dumped by market participants.

Allocation to TIPS has only ever been extremely light in just a few of Anglia Advisors’ more defensive custom-managed portfolios but, while this risk persists, I have sold out of all TIPS positions in these accounts as a risk management measure and redeployed the proceeds to more generic fixed income ETFs.

THIS NOTE IS INFORMATIONAL ONLY AND IS ABSOLUTELY NOT INVESTMENT ADVICE. Anglia Advisors clients who hold any TIPS in their own self-managed portfolios or in allocations that may be guided by other advisors are welcome to reach out and talk things over with me.

ARTICLE OF THE WEEK ..

Trump last week signed off on legislation that will allow private equity, venture capital and hedge funds to possibly infect your 401k by being included as options. Don‘t fall for this terrible idea.

.. AND I QUOTE ..

“One of the important factors behind the fluctuation between bull and bear markets, between booms and crashes and bubbles, is that investor memory has to fail us – and fail universally – in order for these extremes to be reached.”

Howard Marks, co-founder and co-chairman of Oaktree Capital Management.

LAST WEEK BY THE NUMBERS:

Last week’s market color courtesy of finviz.com

Last week’s best performing US sector: Consumer Cyclical (two biggest holdings: Amazon, Tesla) ⬆︎ 3.6% for the week

Last week’s worst performing US sector: Energy (two biggest holdings: Exxon Mobil, Chevron) ⬇︎ 0.8% for the week

SPY, a US Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from a universe of the largest US companies. Its price rose 2.5% last week, is up 8.7% so far this year and ended the week 0.4% below its all-time record closing high (07/28/2025).

IWM, a US Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a universe of 3,000 of the largest US stocks. Its price rose 2.5% last week, is down 0.3% so far this year and ended the week 10.1% below its all-time record closing high (11/08/2021).

VXUS, a Global Non-US ETF, tracks the MSCI ACWI Ex-US index, made up of over 8,500 of the largest names from a universe of stocks issued by companies from around the world excluding the United States, in both developed and emerging markets. Its price rose 3.2% last week, is up 19.5% so far this year and ended the week 0.9% below its all-time record closing high (07/23/2025).

INTEREST RATES:

FED FUNDS * ⬌ 4.33% (unchanged)

PRIME RATE ** ⬌ 7.50% (unchanged)

3 MONTH TREASURY ⬇︎ 4.32% (4.35% a week ago)

2 YEAR TREASURY ⬆︎ 3.76% (3.69% a week ago)

5 YEAR TREASURY ⬆︎ 3.84% (3.77% a week ago)

10 YEAR TREASURY *** ⬆︎ 4.27% (4.23% a week ago)

20 YEAR TREASURY ⬆︎ 4.84% (4.79% a week ago)

30 YEAR TREASURY ⬆︎ 4.85% (4.81% a week ago)

Data courtesy of the Federal Reserve and the Department of the Treasury as of the market close on Friday.

* Decided upon by the Federal Reserve Open Market Committee. Used as a basis for overnight interbank loans and for determining high yield savings interest rates.

** Wall Street Journal Prime rate. Used as a basis for determining many consumer loan interest rates such as credit cards, personal loans, home equity loans/lines of credit, securities-based lending and auto loans.

*** Used as a basis for determining mortgage interest rates.

AVERAGE 30-YEAR FIXED MORTGAGE RATE:

⬇︎ 6.63%

One week ago: 6.72%, one month ago: 6.70%, one year ago: 6.47%

Data courtesy of: Freddie Mac Primary Mortgage Market Survey

INTEREST RATE EXPECTATIONS:

Where will the Fed Funds interest rate be after the next rate-setting meeting on September 17th?

Unchanged from now .. ⬇︎ 11% probability (20% a week ago)

0.25% lower than now .. ⬆︎ 89% probability (80% a week ago)

With three more Fed rate-setting meetings left in 2025, what is the most commonly-expected number of remaining 0.25% Fed Funds interest rate cuts this year?

⬌ Three (unchanged from a week ago)

All data based on the Fed Funds interest rate (currently 4.33%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

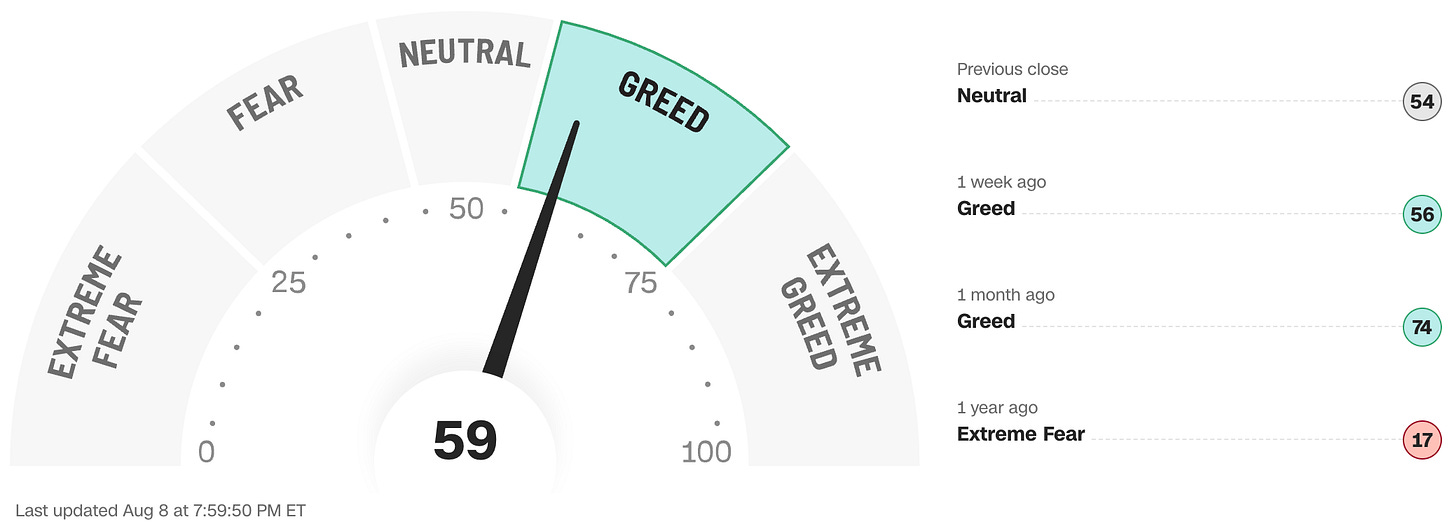

FEAR & GREED INDEX:

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

Note: Anglia Advisors has updated its Privacy Policy. You can view the latest version here.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated, speculative assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is ever given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee whatsoever of future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be relied upon as research or investment advice or as a sole basis for any financial determinations, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other fully-qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any other Anglia Advisors published content.

Under no circumstances is any Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained nor any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No formal client advice may be rendered by Anglia Advisors unless and until a properly-executed client engagement agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone?