Last week was all about Wednesday’s after-hours Nvidia (NVDA) earnings report. Since the stock accounts for more than 6% of the S&P 500's total market capitalization in terms of its index weight and its unique position as a proxy for the entire market-impacting narrative of AI, it has the capability to be a meaningful influence on the direction, trend and momentum of the entire stock market.

Which also means that even highly diversified index fund holdings in the form of mutual funds and ETFs in the 401(k)s, IRAs and brokerage accounts of regular people are going to be affected somewhat by the market reaction to the fortunes of just a single company. In advance of the data release, options markets were predicting a +/-10% move in the stock price either way after the opening bell on Thursday. So pretty much everyone had a reason to care.

Worrying developments in the Middle East over the weekend drove oil prices back up above $80 on Monday and bolstered the values of supposed “safe haven” assets. Stocks got off to a lethargic start with most of Wall Street’s attention squarely focused on the sizable risk event that was Wednesday evening’s long-awaited Nvidia earnings report and to a lesser extent, Thursday’s weekly jobless claims data and GDP estimate. But as the session wore on, markets became more apprehensive about a potential disappointment and tech and AI names (including Nvidia itself) got punished while the rest of the market barely stirred.

Monday’s losers stabilized on Tuesday but it was another light trading volume snoozer overall with everything very much on hold ahead of the Nvidia numbers and stock prices hardly shifted at all, despite a better-than-expected Consumer Confidence Index and some mixed housing data.

Markets churned lower again on Wednesday with investor jitters resuming about the effect of a possible Nvidia “letdown” (that is, anything less than total perfection) that evening versus the colossal market expectation level, resulting in tech and AI stocks getting particularly dumped on. Things weren’t helped by a brutal 26% intra-day plunge in the stock price of one of 2024’s unqualified winners, Super Micro Computer (SMCI) - see OTHER NEWS below.

When the report finally dropped after the closing bell, we learned that Nvidia delivered really strong Q2 revenue and earnings growth and a very robust financial outlook. Revenue for the quarter was an astonishing $32.5 billion which actually exceeded the average of all analyst estimates but didn’t match some of the more outlandish expectations of above $37 billion.

In the crazy, upside-down Alice In Wonderland world of Nvidia earnings, failing to beat even the most ridiculously optimistic forecasts was frowned upon by traders and the stock price tumbled in the after-market.

Wall Street’s attention finally began to zoom back out to a more macro perspective pre-market on Thursday morning when the weekly Jobless Claims number came in as expected at +231k and the latest Q2 Gross Domestic Product (GDP) data surprised to the upside with a raised growth estimate of +3.0% demonstrating that the economy is in great shape. Consumer Spending data came in better than expected, too. This all suggested a continued and orderly linear path towards the holy grail of a soft landing.

Stocks regained their footing when markets opened and the indexes initially rallied hard in spite of the price of Nvidia sliding over 6% and a continuation of the Super Micro Computer debacle. But the rally abruptly ran out of steam after lunch as it became clear that the dip-buyers weren’t yet ready to come to the rescue by piling straight back in to Nvidia at lower prices and the session’s gains swiftly evaporated.

It was yet another day of two very different narratives in the world of retail. Best Buy (BBY) surged 15% in a matter of minutes after a first-rate earnings report while Dollar General (DG) got crushed by a whopping 32% after a ghastly one as low income Americans appear to have simply stopped spending. The indexes ended the day unchanged.

The Fed got to see its preferred measure of inflation, the Personal Consumption Expenditures (PCE) price index, before the opening bell on Friday. Entirely as expected, it rose +0.2% in July and +2.5% from a year ago, clearing the final hurdle for the now locked-in September interest rate cut.

Despite the long weekend ahead, trading volume was vigorous but for most of the day stocks drifted around aimlessly in a narrow range. A late surge, however, pulled prices higher with tech names outperforming. With more than 86% of the stocks in the S&P 500 rising on the day and all eleven sectors posting gains, the index ended the week just a hair’s breadth below its all-time record high.

Since the carnage of August 5th, surveys have shown an explosion of positive stock market sentiment amongst investors (while, notably, surveyed financial advisors remain a bit more reserved about the outlook). This matters because extremely bullish sentiment is evidence of complacent markets and complacent markets are vulnerable to “air pockets” like we saw at the beginning of the month.

This is particularly important because September (historically a highly volatile month) is shaping up to be very important. Not only will we get the Fed decision to cut interest rates by either 0.25% or 0.50% on September 18th (for what it’s worth, my money is still very much on 0.25%), but we will also get some color on how quickly and by how much rates will fall after that. Additionally, we’ll learn at the end of this week just how much the labor market is slowing.

Because investors are so “bulled up” right now, the markets are legitimately vulnerable to a negative surprise from either event that could possibly cause a repeat of early August (or worse) as a lot of the Johnny-come-lately buyers turn around and stampede for the exits.

OTHER NEWS ..

Hindenburg Crash .. Server and data center tech maker Super Micro Computer (SMCI) shares lost over a quarter of their value in the space of a few minutes after it announced on Wednesday it would be delaying the filing of its routine mandatory annual Form 10K disclosure with the Securities and Exchange Commission (SEC), following the famous activist investigative research firm Hindenburg Research disclosing a short position in the stock, citing widespread accounting manipulation, family self-dealing and sanctions evasion.

"Additional time is needed for SMCI’s management to complete its assessment of the design and operating effectiveness of its internal controls over financial reporting as of June 30, 2024." the company mumbled.

The stock, which rose over 300% between January and March this year on the back of the AI craze, recovered slightly but still ended the week 19% lower than where it was before the report came out and down more than 63% from its high.

Shopping Around .. Americans are seeking to change their insurance coverage more frequently than ever, after a surge in premiums that’s squeezed household budgets, a new industry report shows.

For car insurance, the share of people with existing insurance who searched for quotes from a different provider jumped by 16% from a year earlier in Q2 2024. The figure climbed even higher in July, exceeding 30%.

The search for money-saving alternatives reflects a massive and sudden run-up in insurance premiums in recent years, driven partly by the rising cost of car parts and repairs and some changes in insurance company policies, partly impacted by an strong increase in climate-related claims.

It’s not entirely evident that consumers are proving successful in their quest for lower premiums. While the overall cost of living has climbed some 20% since the start of the pandemic in 2020, auto insurance bills have jumped by almost 50%.

ARTICLE OF THE WEEK ..

You’re not a billionaire. So stop trying to invest like one.

THIS WEEK’S UPCOMING CALENDAR ..

The start of a new month and a holiday-shortened week is headlined by a key Jobs Report. Stock and bond markets will be closed on Monday in observance of Labor Day.

There’ll be a smattering of earnings reports, including from Hewlett Packard, Broadcom, Dick's Sporting Goods, Dollar Tree and DocuSign but all eyes will be on Friday’s Jobs Report for August. Forecasts are for a gain of 155k in payrolls after a 114k increase in July. The unemployment rate is expected to edge down to 4.2% from 4.3%.

LAST WEEK BY THE NUMBERS ..

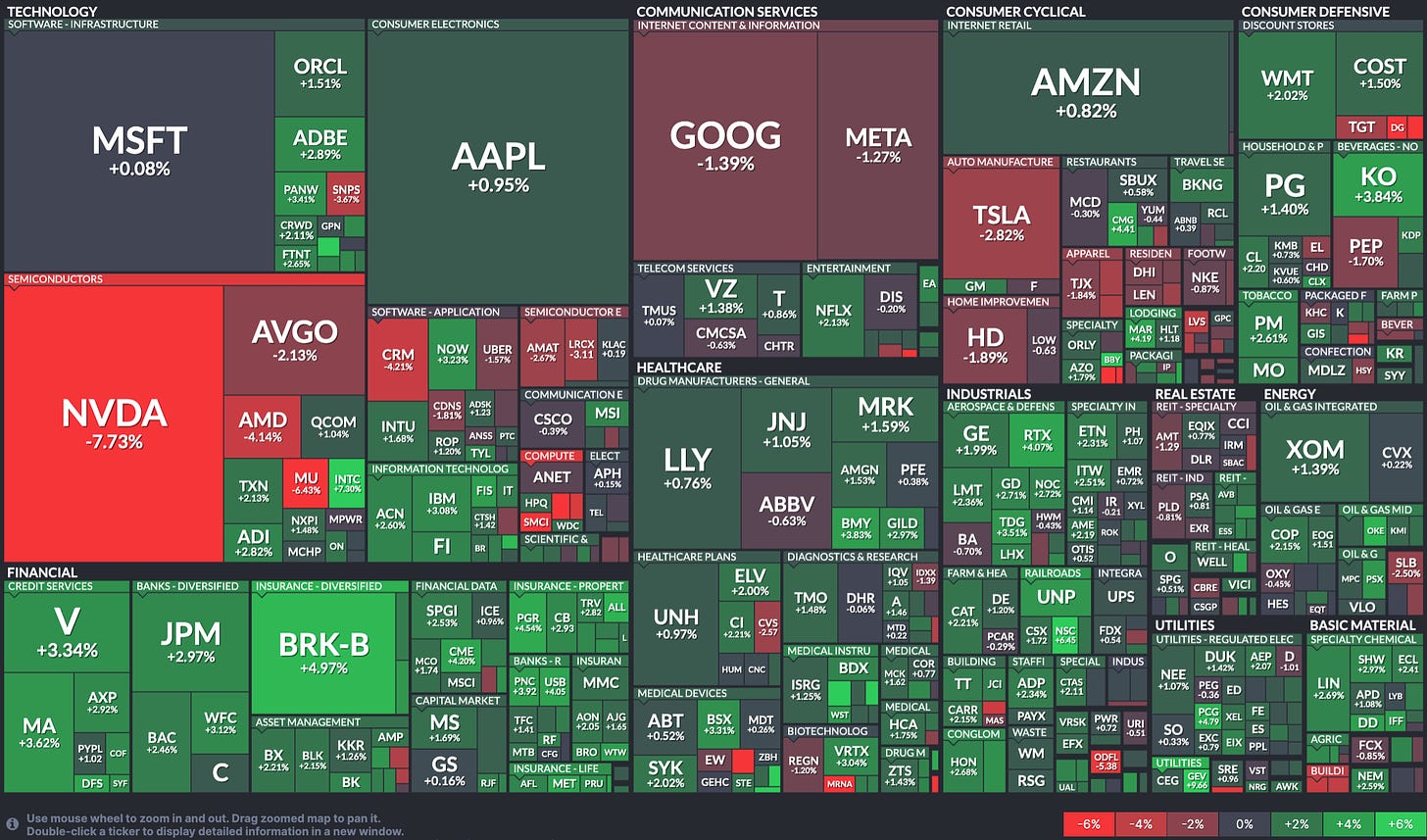

Last week’s market color courtesy of finviz.com

Last week’s best performing U.S. sector: Financials (two biggest holdings: Berkshire Hathaway, JPMorgan Chase) - up 2.9% for the week.

Last week’s worst performing U.S. sector: Technology (two biggest holdings: Nvidia, Microsoft)- down 1.7% for the week.

SPY, the S&P 500 Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from among the largest U.S. companies. Its price rose 0.2% last week, is up 18.6% so far this year and ended the week 0.2% below its all-time record closing high (07/16/2024).

IWM, the Russell 2000 Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a group made up from among 3,000 largest U.S. stocks. Its price fell 0.2% last week, is up 9.7% so far this year and ended the week 9.3% below its all-time record closing high (11/08/2021).

AVERAGE 30-YEAR FIXED MORTGAGE RATE ..

6.35%

One week ago: 6.46%, one month ago: 6.73%, one year ago: 7.18%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

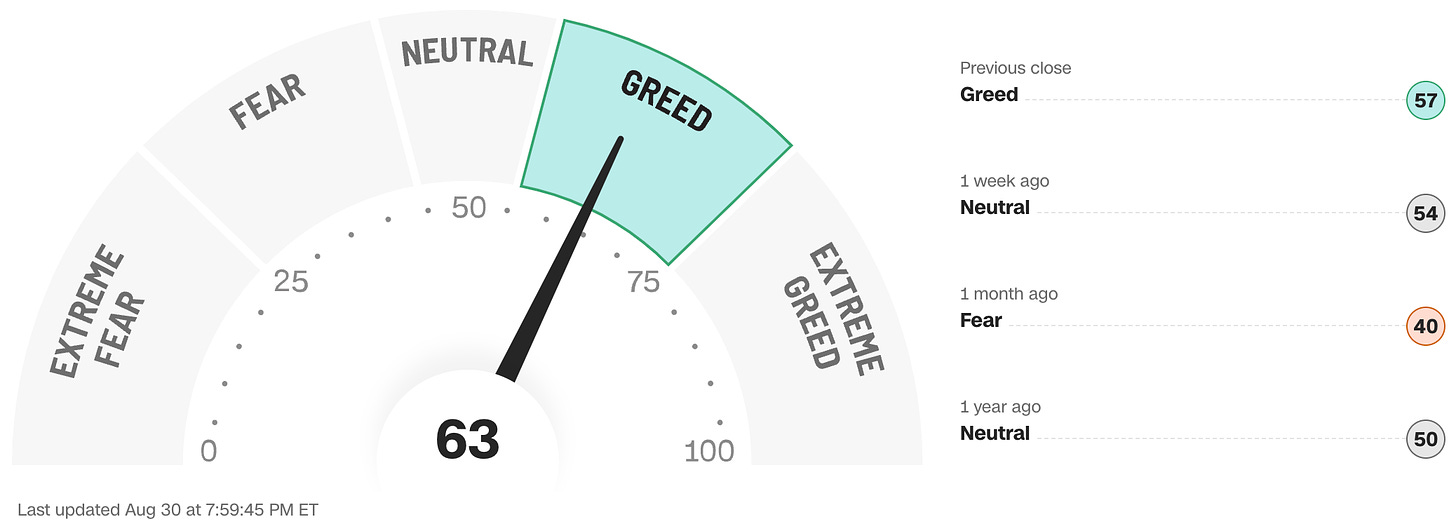

FEAR & GREED INDEX ..

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

FEDWATCH INTEREST RATE TOOL ..

Will interest rates be lower than they are now after the Fed’s next meeting on September 18th?

Yes .. 100% probability (100% a week ago)

No .. 0% probability (0% a week ago)

Where is the Fed Funds interest rate most likely to be at the end of 2024?

4.375% (1.00% lower than where we are now, implying four 0.25% rate cuts before the end of 2024)

One week ago: 4.375% (implying four rate cuts), one month ago: 4.625% (implying three rate cuts)

All data based on the Fed Funds rate (currently 5.375%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

% OF S&P 500 STOCKS TRADING ABOVE THEIR 50-DAY MOVING AVERAGE:

82% (408 of the S&P 500 stocks ended last week above their 50D MA and 92 were below)

One week ago: 79%, one month ago: 70%, one year ago: 46%

% OF S&P 500 STOCKS TRADING ABOVE THEIR 200-DAY MOVING AVERAGE:

78% (391 of the S&P 500 stocks ended last week above their 200D MA and 109 were below)

One week ago: 77%, one month ago: 77%, one year ago: 55%

Closely-watched measures of market breadth and participation, providing a real-time look at how many of the S&P 500 index stocks are trending higher or lower, as defined by whether the stock price is above or below their more sensitive 50-day (short term) and less sensitive 200-day (long term) moving averages which are among the most widely-followed of all stock market technical indicators.

The higher the reading, the better the deemed health of the overall market trend, with 50% considered to be a key pivot point. Readings above 90% or below 15% are extremely rare.

WEEKLY US INVESTOR SENTIMENT (outlook for the upcoming 6 months) ..

↑Bullish: 51% (51% a week ago)

⬌ Neutral: 22% (25% a week ago)

↓Bearish: 27% (24% a week ago)

Net Bull-Bear spread: ↑Bullish by 24 (Bullish by 27 week ago)

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

Survey participants are typically polled during the first half of the week.

Data courtesy of: American Association of Individual Investors (AAII).

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any investment or other financial decisions. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind. Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No advice may be rendered by Anglia Advisors unless or until an executed Client Engagement Agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?