Septembers can often be tricky as professional stock traders begin to liquidate some of their positions ahead of the year-end with tax considerations, regulatory filings and the process of locking in profits in mind. This becomes even more of a potential issue with the S&P 500 starting the month so close to its all-time highs and an economic soft landing entirely assumed without any questions asked.

This has created something of an “asymmetry of risk” where there is greater potential for stocks to fall further on any disappointments than there is for them to rise on any upside surprises. The effect is a skewed environment where the stock market will tend to be constantly stressing about landmines everywhere represented by multiple data points. The result was a miserable week for all risk assets, by some measures the worst since the dark days of late 2022.

Wall Street reopened on Tuesday after the Labor Day long weekend in an anxious mood ahead of a week of primarily labor market-related data that would provide the first tests of this potential risk asymmetry. Special attention was focused on Friday’s highly consequential Jobs Report, the last big labor market indicator before the Federal Reserve's September 18th interest rate-setting meeting. Everyone understood that the outcome of this report was capable of influencing the size and pace of the rate cuts.

An alarming 9.5% daily plunge in the price of Nvidia stock (the company ended up losing over $400 billion in value in just four days last week) and then late breaking news that the firm is the subject of an escalating anti-trust investigation from the Department of Justice resulted in poor old CEO Jensen Huang being booted out of the $100 billion net worth club. We also saw some rather bleak Chinese economic data which added to the gloomy tone. All the price gains from the month-end rally in the indexes quickly dissolved.

The decline then began to feed on itself and sharply intensified as the high volume session wore on. Stocks ended the day substantially lower with the misery being most heavily inflicted on the tech/AI stock universe. Evidence is growing that investors may be steadily starting to take advantage of any strength in these kind of names to take highly-appreciated chips off the table and then later reinvest the proceeds into more defensive areas of the market including Financials, Consumer Defensive, Utilities, Healthcare and Industrials.

Global stocks took their cue and the rout continued into the Asian and European timezones including a 5% tumble in Japan. By the time Wednesday’s New York session began, however, there was a calmer vibe and Nvidia’s free-fall had at least temporarily come to a halt.

The Job Openings and Labor Turnover Survey (JOLTS) showed that U.S. job openings fell in July by more than expected to the lowest level since the beginning of 2021 and layoffs rose, consistent with the multiple other signs of slowing demand for workers. The major indexes mercifully closed the day just a touch lower, but still with a sense of unease ahead of Friday’s Jobs Report.

After starting out with some rather hopeful price action, Thursday quickly deteriorated into another choppy down-day for stocks. Wall Street was seemingly very unimpressed with the economic babble that it was hearing from both of the presidential candidates (including Trump’s promise/threat to get Elon Musk involved in the governance of an actual country). If there was a silver lining it was that at least the bruised and battered tech/AI names managed to outperform the rest of the market.

Friday morning at long last arrived and the pre-market Jobs Report was finally unveiled. It was frankly a noisy mess that resolved nothing. 142k new jobs were added in August which was only slightly less than expected, but the July number was revised sharply downward. Unemployment, however, ticked down from 4.3% to 4.2% which was a bit of a pleasant surprise. Overall the report seemed to reinforce the idea of a labor market that is weakening but not yet weak.

Wall Street initially seemed frozen in place when markets opened, not really knowing how to react to the mixed numbers, but eventually the risk asymmetry kicked in and stock prices dived hard for a fourth straight day of losses to close out a very sour week. Tech/AI names were especially brutalized, resuming their role of biggest losers.

Futures markets ended the week indicating that there’s now a 70/30 chance of a “standard” 0.25% interest rate cut over a “jumbo” 0.50% cut at the Fed meeting later this month (just so you know, I’m very much with the majority on Team 0.25%).

A 0.50% cut could serve to possibly juice some growth assets at first, but it would also send out a signal about the Fed's nervousness about the economy and possibly create a sense that they may have lost control of the situation and were scrambling just to keep up with events. Not a good look.

In my opinion, a jumbo half point cut would be like the pilot hitting the oxygen mask deployment button on an airplane. Helpful? Absolutely. In the interests of all the passengers? Undoubtedly. But the message is still; “Brace yourselves everyone, something has gone wrong. Things are going to get rough and you can forget a soft landing.” Pun intended.

The most likely response would be some kind of mass panic on the plane. I think we can all figure out where this analogy takes us in terms of what might happen to stock prices.

OTHER NEWS ..

Steeling For Some Big Moves .. Normally stodgy US Steel (X) traded like a meme stock last week as the Washington Post reported on Tuesday that Biden is said to be preparing to block Nippon Steel’s $14.1 billion takeover of the troubled Pittsburgh-based company. The proposed deal, which is opposed by the United Steelworkers union, has been subject to a review by the government’s secretive Committee on Foreign Investment in the United States and Biden plans to kill it as soon as the committee’s referral lands on his desk, according to these reports. The deal has sparked an election-year firestorm in the crucial swing state of Pennsylvania. Shares of US Steel plunged as much as 24% after news of Biden’s plan broke.

Just Don’t Use These Things! .. Losses from Bitcoin ATM scams soared above $110 million in 2023, a nearly tenfold increase in just three years, new data from the Federal Trade Commission (FTC) shows. And the scams are only increasing in pace. In the first six months of 2024, the FTC disclosed that losses to Bitcoin ATM scams exceeded $65 million. Older adults, especially those over 60, were found to be more than three times as likely to fall victim to these scams compared with younger people. Across all age groups, the median loss during this period was a whopping $10k.

These specialized Bitcoin ATMs, often located in high-traffic areas like convenience stores and gas stations, accept cash in exchange for crypto-currency, making them an appealing tool for scammers who often impersonate government officials, businesses, state and local agencies or tech support agents, and create a fake yet seemingly urgent need for the victims to withdraw money from their bank accounts and deposit the funds at a Bitcoin ATM to "protect" their savings.

Made Up Money .. A remote province in Argentina has created its own currency to offset the so-called “shock therapy” being imposed on the nation by Elon Musk’s new BFF, President Javier Milei. When monthly cash subsidies from the central government were slashed, the province of La Rioja literally went broke. In February, it fell into default and then quickly into a deep recession.

So the governor came up with a radical plan. He created the province’s own money, which he called the Chacho, equal to one official Argentinian peso. He had sheets of it printed up and started doling it out in wads of 50k each (equal to about $40 in a place where the average monthly salary is equal to about $240) to all government employees as a bonus payment that was accepted locally to buy subsistence items that many could no longer afford.

ARTICLE OF THE WEEK ..

How to recognize different types of moves in the stock market. A timely guide to boring days, selloffs and total crashes (and the strange case of Wall Street’s obsession with 1%)

THIS WEEK’S UPCOMING CALENDAR ..

U.S. inflation data for August is this week's highlight and the last major economic release before the Federal Reserve's September 18th meeting. Earnings will come out from Adobe, Oracle, Kroger and - like a bad smell that won’t go away - GameStop.

On Wednesday, we get the Consumer Price Index (CPI) measure of retail inflation for August. Expectations are for an annualized rate of 2.6% vs. the Fed’s target of 2.0%. The next day, we will see the latest Producer Price Index (PPI) measure of wholesale inflation experienced by manufacturers.

The European Central Bank is widely expected to lower its interest rate target on Thursday, for the second time this year.

Other potential market-moving events scheduled for this week are Apple’s major product event on Monday and the first presidential debate between Harris and Trump on Tuesday.

LAST WEEK BY THE NUMBERS ..

Last week’s market color courtesy of finviz.com

Last week’s best performing U.S. sector: Real Estate (two biggest holdings: Prologis, American Tower) - up 1.5% for the week.

Last week’s worst performing U.S. sector: Technology (two biggest holdings: Nvidia, Microsoft) - down 6.4% for the week.

SPY, the S&P 500 Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from among the largest U.S. companies. Its price fell 3.5% last week, is up 13.7% so far this year and ended the week 4.3% below its all-time record closing high (07/16/2024).

IWM, the Russell 2000 Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a group made up from among 3,000 largest U.S. stocks. Its price fell 5.4% last week, is up 3.6% so far this year and ended the week 14.3% below its all-time record closing high (11/08/2021).

AVERAGE 30-YEAR FIXED MORTGAGE RATE ..

6.35%

One week ago: 6.35%, one month ago: 6.47%, one year ago: 7.12%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

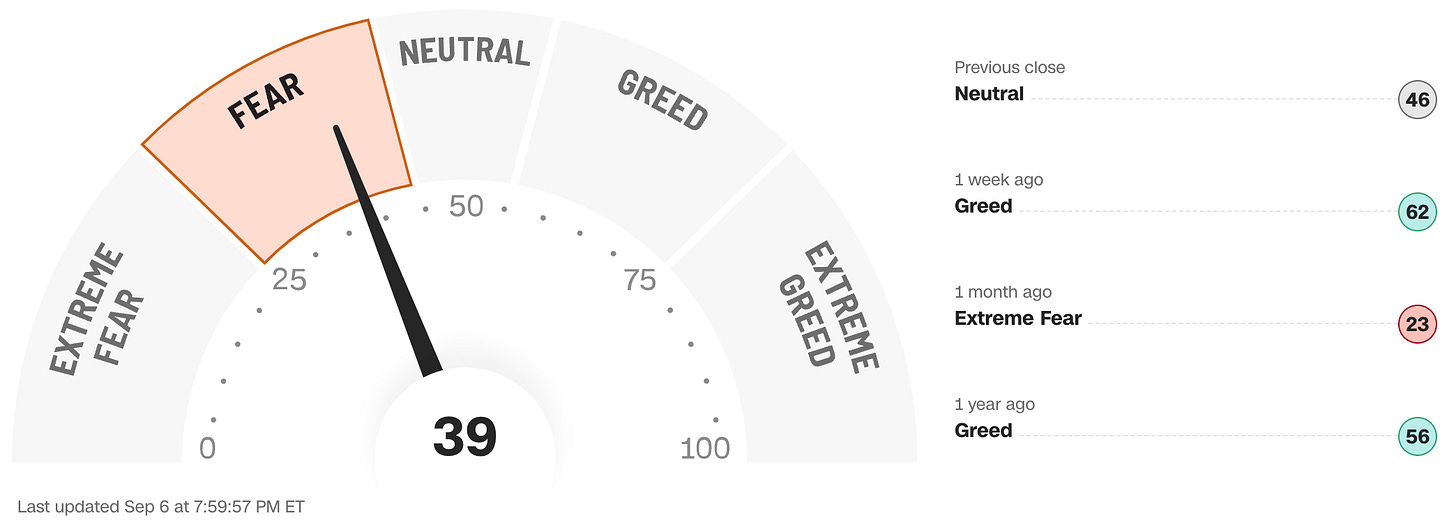

FEAR & GREED INDEX ..

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

FEDWATCH INTEREST RATE TOOL ..

Will interest rates be lower than they are now after the Fed’s next meeting on September 18th?

Yes .. 100% probability (100% a week ago)

No .. 0% probability (0% a week ago)

Where is the Fed Funds interest rate most likely to be at the end of 2024?

4.125% (1.25% lower than where we are now, implying five 0.25% rate cuts before the end of 2024)

One week ago: 4.375% (implying four rate cuts), one month ago: 4.375% (implying four rate cuts)

All data based on the Fed Funds rate (currently 5.375%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

% OF S&P 500 STOCKS TRADING ABOVE THEIR 50-DAY MOVING AVERAGE:

58% (291 of the S&P 500 stocks ended last week above their 50D MA and 209 were below)

One week ago: 82%, one month ago: 49%, one year ago: 34%

% OF S&P 500 STOCKS TRADING ABOVE THEIR 200-DAY MOVING AVERAGE:

67% (335 of the S&P 500 stocks ended last week above their 200D MA and 165 were below)

One week ago: 78%, one month ago: 64%, one year ago: 51%

Closely-watched measures of market breadth and participation, providing a real-time look at how many of the S&P 500 index stocks are trending higher or lower, as defined by whether the stock price is above or below their more sensitive 50-day (short term) and less sensitive 200-day (long term) moving averages which are among the most widely-followed of all stock market technical indicators.

The higher the reading, the better the deemed health of the overall market trend, with 50% considered to be a key pivot point. Readings above 90% or below 15% are extremely rare.

WEEKLY US INVESTOR SENTIMENT (outlook for the upcoming 6 months) ..

↑Bullish: 45% (51% a week ago)

⬌ Neutral: 30% (22% a week ago)

↓Bearish: 25% (27% a week ago)

Net Bull-Bear spread: ↑Bullish by 20 (Bullish by 24 week ago)

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

Survey participants are typically polled during the first half of the week.

Data courtesy of: American Association of Individual Investors (AAII).

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any investment or other financial decisions. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind. Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No advice may be rendered by Anglia Advisors unless or until an executed Client Engagement Agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?