Q3 came to an end last week with the S&P 500 pulling off its best first three quarters in any year since 1997. It also completed its fourth straight quarterly gain, the longest such stretch since 2021.

It marked the beginning of a crucial and potentially volatile five week period in the lead-up to a knife-edge election and the next Fed meeting right afterwards during which time we will get to see multiple new economic data points including two Jobs Reports and one set of CPI/PPI inflation figures which could indicate whether Wall Street’s recent happy-clappy assumptions are correct (at which point the resulting stock market gains become further supported) or if they were overly optimistic (at which point anything from a 5% to 10% pullback could easily happen).

Proceedings kicked off on a downbeat note on Monday in the final trading session of the month and the quarter, following a big slide in Japanese stocks after a new prime minister was appointed, a dire German economic outlook, zero signs of any easing of the violence in the Middle East and the prospect of a massive strike by over 25,000 dockworkers at many East Coast and Gulf shipping ports for the first time in 50 years.

The indexes were in the red for most of the session but actually finished a touch higher after a late-day surge took the S&P 500 to yet another new all-time record high, boosted by more promising rhetoric on upcoming interest rate cuts in a speech from Fed chairman Jerome Powell as well as quarter-end almost literally last-minute portfolio adjustments by professional money managers.

The final quarter of 2024 started out with stocks under pressure on Tuesday as Israel moved troops into Lebanon with Iran launching (mostly ineffective) retaliatory attacks which spiked the prices of oil and other commodities and also the dockworkers strike began. The Job Openings and Labor Turnover Survey (JOLTS) showed an unexpected jump in job vacancies but a fall in the rate at which Americans feel able to quit their jobs.

After being pulled meaningfully lower early in the session, most of the indexes moderated their losses in the afternoon, although the partial recovery was absent among the higher valuation names such as those in tech and AI which remained stuck notably lower.

A tediously cordial vice presidential debate on Tuesday night seemed unlikely to move any needles and Wall Street had already brushed it off as irrelevant by the time the opening bell rang on Wednesday morning. The focus was more on the Middle East with some investors beginning to draw a line from the escalation of the conflict to commodity price increases and then all the way through to a possible increase in U.S. inflation.

As the day wore on, markets decided that, for the time being at least, the risks of contagion in the Middle East were somewhat limited and decided to take a wait-and-see attitude and the result was a nothing burger of a session with the indexes unchanged.

Thursday was another choppy but mostly inconclusive session with a slightly negative outcome as oil prices continued their relentless march higher, experiencing their biggest daily jump in over a year. Most of the market’s attention, however, was focused on positioning for the Jobs Report the following morning. After the close, the dockworkers’ strike was suspended following an improved wage offer.

The unveiling of the Jobs Report finally took place before the open on Friday morning. Given that the Fed is now cutting interest rates, it is important that economic data points like this continue to reinforce the soft landing narrative.

It was an astonishingly strong report, with +254k new payrolls that obliterated estimates of +147k, the previous month was revised upwards and the unemployment rate fell from 4.3% to 4.1% (in fact, very close to 4.0% when you look at the rounding). Average hourly earnings were also higher than expected.

This monster upside surprise that points to an incredibly strong economy completely demolished market bets on another jumbo half point interest rate cut next time around at the Fed’s November 7th meeting (see the dramatic weekly changes in the FEDWATCH INTEREST RATE TOOL below), with a quarter point reduction now considered a near-certainty, although - as mentioned earlier - there will be a lot of new inflation data, one more Jobs Report and an election before then.

Wall Street loved the blowout report, ripping higher at the opening bell, led by tech and Small Caps. The giddiness subsided a little as the session went on as it dawned on investors that they were now likely not going to get the second jumbo rate cut that they had been hoping for, but stocks still finished the day nicely higher and with slight gains for the week.

OTHER NEWS ..

Not-So-Smart Money .. Harvard University’s once-legendary endowment fund is now close to a laughing stock after two decades of poor returns. Your average office worker throwing a few dollars into a target date fund in their 401k every two weeks has comfortably outperformed the Harvard Endowment over that time and certainly paid much lower fees.

The dreadful performance stems from a classic investment mistake: shifting strategies and fund managers at the absolute worst times, otherwise known a chasing shiny objects and paying exorbitant fees to outside advisors and hedge funds for extremely lackluster results.

The endowment remains the biggest in higher education but that may not last much longer as the University of Texas system is being turbocharged by oil revenue.

“Don’t Fall For The Hype” .. AI will only replace 5% of jobs performed by humans, and will be far from the game-changer that the media and Big Tech is constantly telling us it will be, according to MIT economist Daron Acemoglu. “A lot of money is going to get wasted.” Acemoglu said. He predicted that the frenzy could build for another year or so, but AI could then collapse under the bloated weight of its own deluded self-importance after driving up corporate costs much faster than it improves revenues and that could lead to disenchantment among investors, employees, executives and students who quickly flee.

Frozen .. Just 2.5% of homes in the US changed hands this year in the first eight months, the lowest turnover rate in over 30 years, according an analysis by Redfin. The latest data underscores just how much the housing market has become frozen in 2024 as Americans faced a toxic combination of record-high home prices and elevated mortgage rates, creating one of the most unaffordable housing markets in generations.

A big interest rate cut by the Federal Reserve this month has fueled hopes that the interest rate-sensitive housing market will soon experience a fresh jolt, but that still remains to be seen (mortgage rates are no lower now than they were on the day the Fed made the cut).

Genius? Yeah, Right .. The value of X, formerly known as Twitter, has crashed by 79% since supposed genius Elon Musk bought it just two years ago. A newly-released disclosure report from Fidelity’s Blue Chip Growth Fund, which has an equity stake in the social media company, has once again adjusted the value of that holding based on transactional data. By Fidelity’s calculations, the company is now worth $9.4 billion dollars versus the $44 billion that Musk paid for it.

The news will come as a blow to another major X shareholder, Sean Combs, although he’s currently facing bigger problems, behind bars charged with sex trafficking, assault and rape involving scores of women and young girls.

ARTICLE OF THE WEEK ..

That 5% CD Is a Great Deal. Until the Bank Calls It Back.

THIS WEEK’S UPCOMING CALENDAR ..

Q3 earnings season kicks off this week, with results from major U.S. financial institutions like JP Morgan, Wells Fargo, Bank of New York Mellon and Blackrock and several other big companies like Pepsico and Delta Airlines.

On Thursday morning, the latest Consumer Price Index (CPI) measure of retail inflation will come out, with an expectation of a 2.3% increase from a year earlier after a 2.5% reading a month before. The Producer Price Index (PPI) measure of wholesale inflation experienced by manufacturers is released a day later.

Market nerds like me will also be paying close attention to the minutes from the Fed's September interest rate meeting on Wednesday. There will be plenty of interest in the details of the debate over whether to lower interest rates by a quarter or a half of a percentage point, which this time around included some rare dissent.

LAST WEEK BY THE NUMBERS ..

Last week’s market color courtesy of finviz.com

Last week’s best performing U.S. sector: Energy (two biggest holdings: Exxon-Mobil, Chevron) - up 7.0% for the week.

Last week’s worst performing U.S. sector: Materials (two biggest holdings: Linde, Sherwin Williams) - down 2.0% for the week.

SPY, the S&P 500 Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from among the largest U.S. companies. Its price rose 0.2% last week, is up 20.6% so far this year and ended the week 0.3% below its all-time record closing high (09/30/2024).

IWM, the Russell 2000 Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a group made up from among 3,000 largest U.S. stocks. Its price fell 0.6% last week, is up 9.2% so far this year and ended the week 9.7% below its all-time record closing high (11/08/2021).

AVERAGE 30-YEAR FIXED MORTGAGE RATE ..

6.12%

One week ago: 6.08%, one month ago: 6.40%, one year ago: 7.50%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

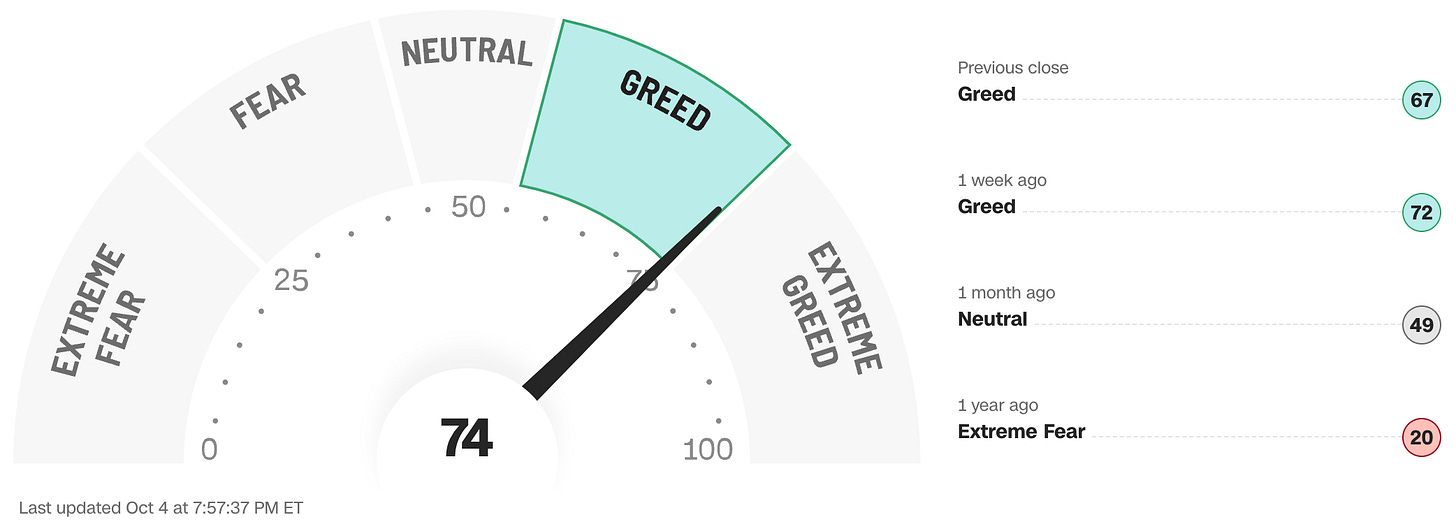

FEAR & GREED INDEX ..

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

FEDWATCH INTEREST RATE TOOL ..

Where will interest rates be after the Fed’s next meeting on November 7th?

Higher than now .. 0% probability (0% a week ago)

Unchanged from now .. 3% probability (0% a week ago)

0.25% lower than now .. 97% probability (46% a week ago)

0.50% lower than now .. 0% probability (54% a week ago)

All data based on the Fed Funds interest rate (currently 4.875%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

% OF S&P 500 STOCKS TRADING ABOVE THEIR 50-DAY MOVING AVERAGE:

74% (370 of the S&P 500 stocks ended last week above their 50D MA and 130 were below)

One week ago: 83%, one month ago: 70%, one year ago: 11%

% OF S&P 500 STOCKS TRADING ABOVE THEIR 200-DAY MOVING AVERAGE:

76% (372 of the S&P 500 stocks ended last week above their 200D MA and 128 were below)

One week ago: 80%, one month ago: 71%, one year ago: 37%

Closely-watched measures of market breadth and participation, providing a real-time look at how many of the S&P 500 index stocks are trending higher or lower, as defined by whether the stock price is above or below their more sensitive 50-day (short term) and less sensitive 200-day (long term) moving averages which are among the most widely-followed of all stock market technical indicators.

The higher the reading, the better the deemed health of the overall market trend, with 50% considered to be a key pivot point. Readings above 90% or below 15% are extremely rare.

WEEKLY US INVESTOR SENTIMENT (outlook for the upcoming 6 months) ..

↑Bullish: 46% (49% a week ago)

⬌ Neutral: 27% (27% a week ago)

↓Bearish: 27% (24% a week ago)

Net Bull-Bear spread: ↑Bullish by 19 (Bullish by 25 a week ago)

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

Survey participants are typically polled during the first half of the week.

Data courtesy of: American Association of Individual Investors (AAII).

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any financial decisions, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind.

Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No advice may be rendered by Anglia Advisors unless or until an executed Client Engagement Agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?