Stocks took a long road to nowhere, ending the week right back where they started it - with a sharp fall and then a solid comeback rally with yet more new all-time highs reached at one point. In the end, however, the S&P 500 just missed out on achieving a 17th week of gains out of the last 19.

Markets floated gently lower without real directional conviction on Monday, with a lack of any real catalysts ahead of (in order of appearance) Super Tuesday, Fed Chair Jerome Powell’s testimony to a House committee, Biden’s State of the Union address and the Jobs Report, all later in the week.

Sentiment turned properly negative on Tuesday, due in large part to an intensification of the ongoing splintering of the so-called Magnificent Seven, with both Apple and Tesla tanking hard, primarily as a result of increasingly concerning negative trends in sales in China for both firms. Contagion spread to to other corners of the tech and tech-adjacent space and all the indexes, particularly the tech-heavy NASDAQ, took a significant dive.

Super Tuesday also pretty much cemented the matchup that no-one wants; Trump/Biden II in November. It would be naïve to think that there is not going to be associated uncertainty and volatility in late summer and into the fall (or potentially even earlier) and most likely for weeks or even months afterward. Markets have not yet factored this in.

Wednesday saw Powell show up in Congress, presenting us with the ludicrous spectacle of a highly intelligent chairman of the Federal Reserve being grilled by some of the financially illiterate law-makers that put the economy in peril every few weeks by risking government shutdowns through grandstanding and political posturing.

Predictably, he stayed entirely on message; rates have peaked, they will be cut, but it’s not happening soon because the Fed needs more proof inflation is going to get to 2%. Which of course was saying absolutely nothing new and Wall Street took a kind of “nothing-to-see-here” attitude to his words and instead proceeded to try and repair the damage from the previous day’s selloff, with the S&P 500 clawing back about half of the week’s losses.

On Thursday, the European Central Bank held interest rates steady at 4.0%. Markets now expect the first rate cut in the EuroZone will come in June. Jerome Powell Day Two in Washington DC saw him go a little further than on Day One, stating that the central bank is “not far” from being confident enough to cut rates and these rate reductions “can and will begin” this year. U.S. stocks responded positively, resuming their rally from the previous day and completing a full recovery from the losses of Monday and Tuesday to reach yet more new all-time highs.

The Jobs Report on Friday proved ambiguous, showing an increase in payrolls of 275k in February, topping forecasts, but both the January and December numbers were revised downwards and the unemployment rate moved up to 3.9% (a two-year high). Average hourly earnings, watched closely as an inflation indicator, rose just 0.1% on the month and 4.3% from a year ago, lower than both estimates and January’s rate. Biden’s spikier-than-expected State of the Union speech from the previous evening gave Wall Street nothing to focus on one way or another.

Traders eventually opted for the “glass is half empty” interpretation of the employment data, perhaps in combination with some profit-taking from recent gains. Momentum petered out, particularly in tech names and the S&P 500 shifted lower to finish the week almost unchanged.

The market’s relentless rally, in which it embraces even the mostly slightly bullish news and ignores any bad news, is raising the question: can anything make the stock market decline? The answer, of course, is “yes,” but in order for this market to decline, something actually bad has to happen. Negative nuance is no longer enough.

What kind of bad things are we are talking about here? Knowing this not only helps when looking for red flags pointing to a possible big decline but also when trying to differentiate between what is just a healthy pullback of a few percent which can help create a springboard for further advances and a true and sustained change of direction for stock prices.

There are a few, but the four main categories are:

AI turns out not to represent a fundamental change in business productivity or profitability (so much of the rally is built on this premise). In the end, AI will have to make non-tech companies money and it’s not yet clear exactly how many end-user companies will be able to utilize AI to actually meaningfully increase revenue and/or produce substantial and sustainable cost savings.

Economic growth decelerates or even contracts to a level that threatens the earnings growth of major U.S. companies. That’s very different than the rather gentle easing that we are currently seeing.

The Fed explicitly or even implicitly rules out any interest rate cuts this year and in fact appears to be even entertaining the idea that the next move in rates may actually be higher again. If there is no negative impact from high rates on the labor market and inflation is in large part continuing to decline, then there’s simply no urgency to cut interest rates preemptively and take a risk with a bounce-back in inflation.

Consumer inflation reignites and begins a persistent move higher again. So far all we are really seeing is something of a flatlining of the rate at which inflation is decreasing.

This is the stuff to watch out for.

OTHER NEWS ..

Elon’s Vengeance .. Poor old Elon Musk had yet another rough week. He fell below Jeff Bezos on the Global Rich List (mostly as a result of the diverging performance of their respective stock holdings), there was an embarrassing email dump from OpenAI with whom he is having a childish toxic spat, Tesla’s stock keeps on crapping out (not helped by arsonists successfully targeting a production plant near Berlin) and he is facing yet another big lawsuit, this time by four former top executives of Twitter, who are demanding $128 million in unpaid severance.

The executives, former CEO Parag Agrawal, former CFO Ned Segal, former chief legal officer Vijaya Gadde and former general counsel Sean Edgett filed the lawsuit in California federal court on Monday. The lawsuit contends that, as his $44 billion takeover deal neared its completion in October 2022, Musk tried to back out but failed and then concocted a made-up reason to fire the four executives simply to get out of paying them the severance packages to which they were all legally entitled (he cited “gross negligence” and “willful misconduct” as reasons).

The executives were running Twitter at the time when the company sued Musk to force him to close on the deal to which he had earlier contractually committed, but had then unsuccessfully tried to squirm out of and “for their efforts, Musk vowed a lifetime of revenge,” the lawsuit said.

It added; “Under Musk’s control, Twitter has become a scofflaw, stiffing employees, landlords, vendors and others. Musk doesn’t pay his bills, believes the rules don’t apply to him and uses his wealth and power to run roughshod over anyone who disagrees with him.”

Want A Job? ..There are some new positions available where work-from-home is unlikely to be an option. NASA is seeking new astronaut candidates for the first time in four years. Competition, unsurprisingly, is always fierce. In 2020, there were more than 12,000 applicants for 10 positions. This year is likely to be a crowded race as well, but America’s return to the moon is providing more opportunities for astronaut missions.

Stay-at-home dad duties .. The share of fathers caring for their households were higher in western states than those in the South, according to the Burning Glass Institute. Alaska, Oregon and New Mexico topped the list of states with the highest ratio of men—age 18 to 59—who weren’t in the labor force, with a child under 14, had a working spouse and were the main caregivers. Alabama and Louisiana had the lowest ratios.

UNDER THE HOOD ..

One effect of all these new all-time highs we are experiencing with the indexes in 2024 is that levels that had formerly been resistance levels in a rising market suddenly become strong support levels when markets start to fall. So it is with the S&P 500 and the NASDAQ in particular right now. The S&P 500 has been in technically overbought territory for about seven weeks now, but markets can remain in this state for remarkably long periods of time - although the ugliness of the reversal can often be worse when an extended overbought condition eventually does come to an end.

Demand is noticeably broadening from Large Caps to include Mid Caps and so Small Caps are worth monitoring, especially should the big dogs begin to show any vulnerability. As Mid Caps have joined the Large Caps in ascending to new highs in recent weeks, it is apparent that investors are slowly expanding their portfolios to include smaller names and the consequence is a healthy widening of the breadth of the rally.

Despite lingering short term concerns about a possibly overbought condition, we saw yet again last week that when stocks fall, there seem to be plenty of buyers lying in wait at the lower prices to scoop up what they see as bargains. The difference recently is that we are finally beginning to also witness this phenomenon with Small Cap stocks.

Anglia Advisors clients are welcome to reach out to me to discuss market conditions further.

THIS WEEK’S UPCOMING CALENDAR ..

Just a few more Q4 2023 earnings reports to go, this week we will see Adobe, Oracle, Dollar Tree, Dollar General, Dick’s Sporting Goods, Williams-Sonoma and Ulta Beauty.

The big economic release will be the Consumer Price Index (CPI) measure of retail inflation on Tuesday.

ARTICLE OF THE WEEK ..

What is extremely overrated in personal finance? Spoiler: retiring early and owning an investment property both make the list.

LAST WEEK BY THE NUMBERS ..

Last week’s market color courtesy of finviz.com

Last week’s best performing U.S. sector: Utilities (two biggest holdings: NextEra Energy, Southern Co.) - up 3.3% for the week.

Last week’s worst performing U.S. sector: Consumer Cyclical (two biggest holdings: Amazon, Tesla) - down 2.5% for the week.

SPY, the S&P 500 Large Cap ETF, is made up of the stocks of the 500 largest U.S. companies. Its price fell 0.2% last week, is up 7.7% so far this year and ended the week 0.6% below its all-time closing record high (03/07/2024)

IWM, the Russell 2000 Small Cap ETF, is made up of the bottom two-thirds in terms of company size of the group of the 3,000 largest U.S. stocks. Its price rose 0.4% last week, is up 3.1% so far this year and ended the week 14.7% below its all-time closing record high (11/08/2021)

DXY, the U.S. Dollar index, is an index that measures the value of the U.S. Dollar against a weighted basket of six other major currencies (the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krone and the Swiss Franc). It fell 1.1% last week, is up 1.3% so far this year and is up 11.2% over the last three years.

AVERAGE 30-YEAR FIXED MORTGAGE RATE ..

6.88%

One week ago: 6.94%, one month ago: 6.64%, one year ago: 6.73%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

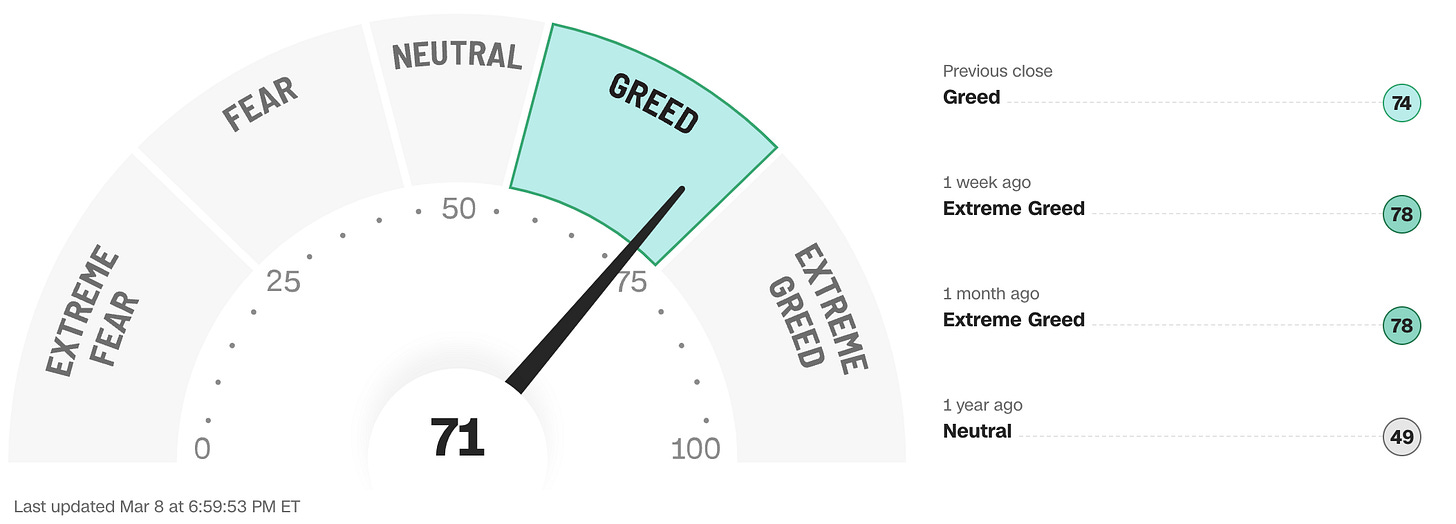

FEAR & GREED INDEX ..

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

The “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business.

The 50-day moving average of the S&P 500 remains above the 200-day. This is a continued indication of a technical uptrend.

% OF S&P 500 STOCKS TRADING ABOVE THEIR 50-DAY MOVING AVERAGE ..

76% (379 of the 500 largest stocks in the U.S. ended last week above their 50D MA and 121 were below)

One week ago: 68%, one month ago: 62%, one year ago: 37%

% OF S&P 500 STOCKS TRADING ABOVE THEIR 200-DAY MOVING AVERAGE ..

76% (382 of the 500 largest stocks in the U.S. ended last week above their 200D MA and 118 were below)

One week ago: 73%, one month ago: 70%, one year ago: 54%

Closely-watched measures of market breadth and participation, providing a real-time look at how many of the largest 500 publicly-traded stocks in the U.S. are trending higher or lower, as defined by whether the stock price is above or below their more sensitive 50-day (short term) and less sensitive 200-day (long term) moving averages which are among the most widely-followed of all stock market technical indicators.

The higher the reading, the better the deemed health of the overall market trend, with 50% considered to be a key pivot point. Readings above 90% or below 15% are extremely rare.

WEEKLY US INVESTOR SENTIMENT (outlook for the upcoming 6 months) ..

↑Bullish: 52% (47% a week ago)

⬌ Neutral: 26% (32% a week ago)

↓Bearish: 22% (21% a week ago)

Net Bull-Bear spread: ↑Bullish by 30 (Bullish by 18 a week ago)

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

Survey participants are typically polled during the first half of the week.

Data courtesy of: American Association of Individual Investors (AAII).

FEDWATCH INTEREST RATE TOOL ..

Will interest rates be lower than they are now following the Fed’s next meeting on March 20th?

Yes .. 4% probability (5% a week ago)

No .. 96% probability (95% a week ago)

Will interest rates be lower than they are now following the Fed’s following meeting on May 1st?

Yes .. 24% probability (25% a week ago)

No .. 76% probability (75% a week ago)

Where is the Fed Funds interest rate most likely to be at the end of 2024?

4.375% (1.00% lower than where we are now, implying four rate cuts of 0.25% each in 2024)

One week ago: 4.375% (implying four rate cuts), one month ago: 4.125% (implying five rate cuts)

All data based on the Fed Funds rate (currently 5.375%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

US TREASURY INTEREST RATE YIELD CURVE ..

The highest rate on the yield curve (5.51%) is being paid for the 2-month duration and the lowest rate (4.06%) is for the 5-year.

The most closely-watched and commonly-used comparative measure of the spread between the higher 2-year and the lower 10-year remained unchanged at 0.39%, indicating no change in the inversion of the curve.

The interest rate yield curve remains unusually “inverted” (i.e. shorter term interest rates are generally higher than longer term ones). Based on the 2-year vs. 10-year spread, the curve has been inverted since July 2022.

Historically, an inverted yield curve is not the norm and has been regarded by many as a leading indicator of an impending recession, with shorter term risk regarded to be unusually higher than longer term. The steeper the inversion, the greater the deemed risk of recession.

Data courtesy of ustreasuryyieldcurve.com as of Friday. The lightly shaded area on the chart shows the current Federal Funds rate range.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (929) 677 6774 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any investment or other financial decisions. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind. Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?