With temperatures rising on the streets of Los Angeles, Wall Street remained cool to start the week with attention focused on the US/China talks in London as well as the prospect of a first peek at inflation data on Wednesday and Thursday that at least partially encompasses the new tariff era.

The path of least resistance for stocks is higher right now and that was the cautious direction of travel taken on Monday in the absence of any meaningful catalysts from London or anywhere else. The indexes closed in the green with the S&P 500 holding above 6000.

Traders were stuck in a rather pedestrian wait-and-see mode on Tuesday morning, watching for any progress reports from the ongoing US/China trade talks and bracing for the first May inflation release the next day. Commerce Secretary Lutnick came out in the afternoon and said that the London talks were “going really, really well”.

Possibly because Lutnick has never exactly been known throughout his career for the rock solid accuracy of what comes out of his mouth, stocks only shifted modestly higher in response but still completed a third straight day of gains.

Markets had a lot more to work with by the opening bell on Wednesday. A federal appeals court kept the Trump tariffs in effect for the time being - but said that it will fast-track its ultimate decision this summer. There was an official announcement (detail-free, of course) that the London talks had indeed resulted in the US and China agreeing some kind of preliminary framework to ease trade tensions which could revive the flow of goods between the world’s two largest economies.

Most impactful, however, was the pre-market release of the latest Consumer Price Index (CPI) measure of retail inflation which was subdued, showing only a small increase in the annualized rate to 2.4%. This was perhaps not too surprising since so many of the tariffs were on hold during the measured period.

Nevertheless, stocks jumped higher out of the gate on the perception of yet another dodged economic data bullet with the S&P 500 creeping to within 1.5% of its all-time record high and interest rates turned sharply lower.

But the indexes reversed their gains late in the session to close lower as Wall Street became somewhat concerned at the lack of any specifics surrounding the China trade deal and the sense that the agreement may not have achieved any more than putting us back to where we were right after the Geneva agreement.

Teeing up another test of the TACO narrative, Trump said after the market close that he would decide on unilateral global tariff rates within two weeks, ahead of the July 9th expiry of the pause. A letter will apparently be sent to countries with a tariff rate written on it and they will be told that they can either take it or leave it.

CPI’s baby brother, the Producer Price Index (PPI) measure of wholesale inflation experienced by manufacturers, came out pre-market on Thursday and confirmed the muted level of price increases, rising at an annualized 2.6%.

Stocks were fractionally higher by the close on low trading volume, ignoring Trump’s ongoing stream of further tariff threats (bumping the automobile levies this time) and more abuse aimed at Fed chairman Powell, who is apparently a "numbskull". Interest rates continued to trundle lower, boosting bond prices.

Overnight Israel launched a deadly attack on Iran. Asian and European markets plunged on the news and oil prices exploded higher by as much as 14%. Trump quickly endorsed Israel’s assault which he described as “excellent” and Iran vowed a “harsh response” to“ an act of war”.

US stocks opened in the red on Friday and stayed there as the air strikes put geopolitical, inflationary and supply chain risks front and center again and triggered a flight to safety. The indexes closed near session lows with the S&P 500 falling back below 6000 as traders chose to take chips off the table going into a potentially very unstable weekend. The day’s declines pushed stocks into negative territory for the week.

There’s no doubt that there’s now something new for markets to digest and it was interesting that the week’s steady decline in interest rates reversed somewhat on Friday on fears surrounding the inflation ramifications of this geopolitical twist.

Legendary investor Paul Tudor Jones went on Bloomberg TV last week and likened the the US national debt to pro wrestling and its concept of “Kayfabe” , the unspoken contract between wrestlers and spectators .. we'll present you something that is very clearly contrived and fake under the false insistence that it's real and in return for blindly accepting this obvious fabrication, you get to experience genuine emotion and gratification. Both sides choose to ignore reality and neither party acknowledges the bargain or else the magic is ruined.

Retail investors, institutional traders, hedge funds, pundits, analysts and politicians all know at their core that the massive US budget deficit is a huge problem and will unquestionably be exacerbated by the current terms of the tax and spending bill, but it suits all parties’ purposes to apply Kayfabe to the issue at this time, it’s just too toxic.

Jones postulated that this premeditated deliberate ignorance will one day become unsustainable, likely prompted by the actions of bond vigilantes, but it’s impossible to know when.

If you are not yet a client of Anglia Advisors and would like to explore becoming one, please feel free to reach out to arrange a complimentary no-obligation discovery call with me.

ARTICLE OF THE WEEK ..

This time it may actually be different.

.. AND I QUOTE ..

“I used to think that if there was reincarnation, I wanted to come back as the President or as a .400 baseball hitter. But now I think I would want to come back as the bond market. You can intimidate everybody.”

James Carville, political consultant

LAST WEEK BY THE NUMBERS:

Last week’s market color courtesy of finviz.com

Last week’s best performing US sector: Energy (two biggest holdings: Exxon-Mobil, Chevron) ⬆︎ 5.8% for the week

Last week’s worst performing US sector: Financials (two biggest holdings: Berkshire Hathaway, JP Morgan) ⬇︎ 2.5% for the week

SPY, the S&P 500 Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from a universe of the largest U.S. companies. Its price fell 0.3% last week, is up 1.9% so far this year and ended the week 2.6% below its all-time record closing high (02/19/2025).

IWM, the Russell 2000 Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a universe of 3,000 of the largest U.S. stocks. Its price fell 1.5% last week, is down 5.4% so far this year and ended the week 13.8% below its all-time record closing high (11/08/2021).

INTEREST RATES:

FED FUNDS * ⬌ 4.33% (unchanged)

PRIME RATE ** ⬌ 7.50% (unchanged)

3 MONTH TREASURY ⬆︎ 4.45% (4.43% a week ago)

2 YEAR TREASURY ⬇︎ 3.96% (4.04% a week ago)

5 YEAR TREASURY ⬇︎ 4.02% (4.13% a week ago)

10 YEAR TREASURY *** ⬇︎ 4.41% (4.51% a week ago)

20 YEAR TREASURY ⬇︎ 4.93% (4.99% a week ago)

30 YEAR TREASURY ⬇︎ 4.90% (4.97% a week ago)

Treasury data courtesy of ustreasuryyieldcurve.com as of the market close on Friday.

* Decided upon by the Federal Reserve. Used as a basis for interbank loans and for determining high yield savings rates.

** Wall Street Journal Prime rate. Used as a basis for determining many consumer loan rates such as credit cards, personal loans, home equity, securities-based lending and auto loans.

*** Used as a basis for determining mortgage rates.

AVERAGE 30-YEAR FIXED MORTGAGE RATE:

⬇︎ 6.84%

One week ago: 6.85%, one month ago: 6.78%, one year ago: 6.95%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

FEDWATCH INTEREST RATE TOOL:

Where will the Fed Funds interest rate be after the next rate-setting meeting on June 18th?

Unchanged from now .. ⬌ 100% probability (100% a week ago)

0.25% lower than now .. ⬌ 0% probability (0% a week ago)

What is the most commonly-expected number of remaining 0.25% Fed Funds interest rate cuts in 2025?

⬌ 2 (unchanged from a week ago)

All data based on the Fed Funds interest rate (currently 4.33%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

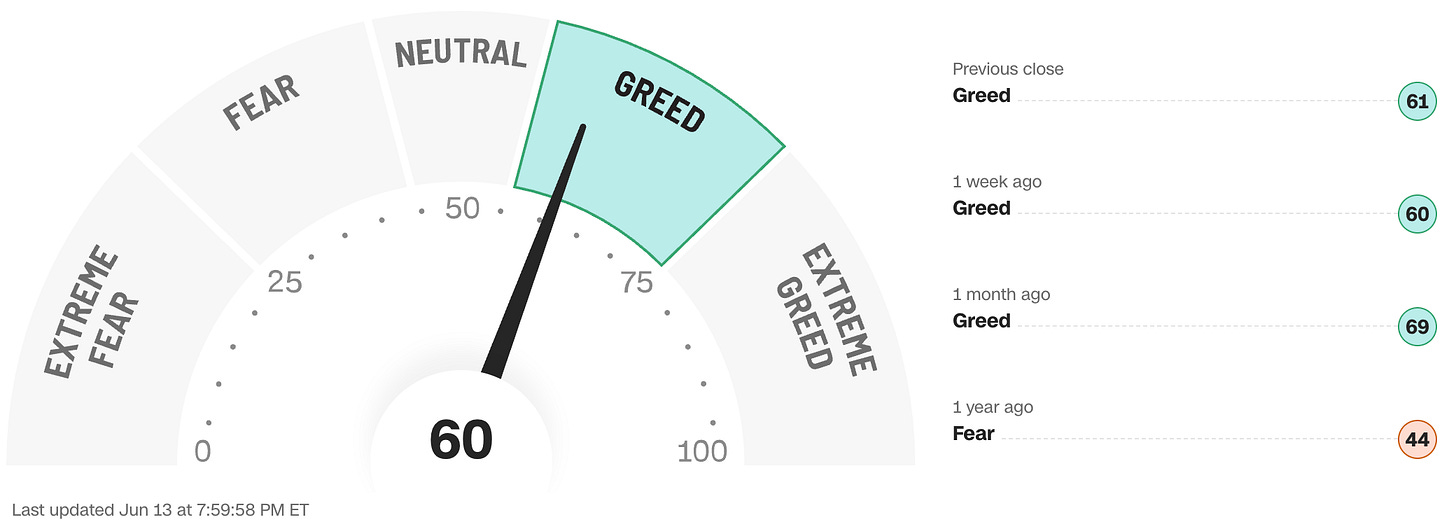

FEAR & GREED INDEX:

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any financial decisions, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any other Anglia Advisors published content.

Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No client advice may be rendered by Anglia Advisors unless and until a properly-executed Client Engagement Agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone?