US/China trade tensions flared up over the weekend with both sides aggressively accusing the other of violating the Geneva agreement that is currently capping tariffs between the two countries. US manufacturing data pre-market on Monday confirmed the slowdown in the economy with both imports and exports falling sharply. One analyst described the tariff policy as “raising hell” right now among American manufacturers who are increasingly unwilling to take any inventory risk or make hiring decisions due to the colossal uncertainty.

Along with an intensification in both the Russia-Ukraine and Gaza conflicts, this all caused stock prices to stumble to start the second half of 2025 when markets opened. The recent resilience of the indexes shone through again however and the BTFD crowd carried them to Tech/AI-fueled gains by the close. This was the tenth day so far this year that the S&P 500 has been lower intraday by at least 0.85% only to close the session higher.

The stock indexes struggled to find direction on a quiet Tuesday morning before eventually deciding to grind north, closing nicely higher. As everyone knew it would, the Trump/Musk bromance finally crashed and burned as the former head of DOGE described the president's beloved signature tax and spending bill as a "disgusting abomination" and urging Americans to “KILL the BILL”. Interestingly, the tirade came right after the Tesla chief had failed to secure any preservation of the Biden-era electric vehicle tax credits in the legislation.

The non-partisan Congressional Budget Office then released an estimate that, in its current form, the bill will spiral the budget deficit by over $2.4 trillion over the next decade. This revelation is unlikely to help ease its passage through the Senate, despite Trump’s best efforts to strong-arm its many Republican opponents in the chamber.

Trump’s additional steel and aluminum tariffs took effect on Wednesday and were touted by White House Press Secretary Leavitt as an example of the president “walking the walk”, clearly an attempt to push back on the widely-held TACO narrative. Trump also resumed barking at Fed chairman Powell about the lack of Fed Funds interest rate cuts on the part of the central bank.

But the stock indexes barely moved all day, finishing slightly higher as evidently Wall Street is finally learning to no longer fear the president’s attempts at shock-and-awe trade tactics and capitalized social media insults aimed at Powell.

Pre-market on Thursday, the European Central Bank (ECB) made an entirely anticipated 0.25% cut in local interest rates. It was a cautious start to the day for stocks with attention beginning to turn to the following day’s Jobs Report. The news then broke that Trump and Chinese premier Xi Jinping had held what was apparently a positive phone call with the promise of an upcoming in-person meeting and that briefly pulled the indexes from slightly red to slightly green.

The box-office Trump/Musk spat descended into a surreal tweet-storm as Musk chose to highlight the president’s connection to Jeffrey Epstein and call for his impeachment. MAGA-world suddenly started openly questioning the legitimacy of the South African’s US immigration credentials. But Wall Street only began to care when Trump threatened to terminate billions of dollars in federal contracts and tax subsidies for all of Musk’s companies.

Just like its CEO, Tesla’s stock melted down, losing more than $150 billion in value in a matter of minutes to bring its losses from the all-time high of just six months ago to over 35%. Musk’s personal wealth dumped by $34 billion in less than three hours. As one analyst put it; “we are witnessing the rapid dismantling of Musk’s empire in real time”. More importantly, TSLA’s high weighting in the major indexes caused broad markets to spin lower into the close.

The Jobs Report dropped pre-market on Friday and came in slightly better than expected but with small downward revisions to previous data. The unemployment rate held steady at 4.2%. In other words, a complete nothing-burger. Traders breathed a huge sigh of relief at what was perceived to be a dodged bullet and stock indexes skyrocketed. But interest rates also raced higher (see INTEREST RATES below) as the “nothing to see here” numbers give the Fed additional cover to wait even longer before making any cuts.

Adding to the general sense of enthusiasm, imminent US/China trade talks in London were announced and a very solid week (despite the TSLA drag) came to an end with further gains and the S&P 500 returning to an official bull market above 6,000 and the NASDAQ closing in on 20,000.

Markets are very noisy right now. Retail investors are uneasy. What they need to try to do, particularly those with extended time horizons, is tune out the noise, remaining focused on the longer term fundamentals that ultimately drive markets and create wealth and suppressing the emotional anxiety brought about by scary political headlines or fear of shorter term drawdowns.

It’s worth remembering that in the midst of all the tariff chaos and market volatility, global stocks (that’s US plus international equities, as measured by the MSCI All-Country World Index) reached new all-time record highs last week, rewarding investors who have stuck with geographically-diversified portfolios.

If you are not yet a client of Anglia Advisors and would like to explore becoming one, please feel free to reach out to arrange a complimentary no-obligation discovery call with me.

ARTICLE OF THE WEEK ..

Trump announced new travel bans last week including a country-specific one and a Harvard-specific one. My good friends at D&S Immigration have published a detailed analysis and guide to anyone who may be affected.

.. AND I QUOTE ..

“The whole thing is idiotic. People in these kinds of positions should know better than to act like kids in junior high. What makes this especially hard for Tesla is that you can’t separate the value of the company from Musk .. If there was huge intrinsic value in Tesla, it wouldn’t be plunging the way it is now. It has never traded on fundamentals.”

Wayne Kaufman, chief market analyst, Phoenix Financial Services (06/05/2025)

LAST WEEK BY THE NUMBERS:

Last week’s market color courtesy of finviz.com

Last week’s best performing US sector: Technology (two biggest holdings: Nvidia, Microsoft) ⬆︎ 3.3% for the week

Last week’s worst performing US sector: Consumer Defensive (two biggest holdings: Costco, Walmart) ⬇︎ 1.6% for the week

SPY, the S&P 500 Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from a universe of the largest U.S. companies. Its price rose 1.7% last week, is up 2.2% so far this year and ended the week 2.2% below its all-time record closing high (02/19/2025).

IWM, the Russell 2000 Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a universe of 3,000 of the largest U.S. stocks. Its price rose 3.5% last week, is down 4.1% so far this year and ended the week 12.6% below its all-time record closing high (11/08/2021).

INTEREST RATES:

FED FUNDS * ⬌ 4.33% (unchanged)

PRIME RATE ** ⬌ 7.50% (unchanged)

3 MONTH TREASURY ⬆︎ 4.43% (4.36% a week ago)

2 YEAR TREASURY ⬆︎ 4.04% (3.89% a week ago)

5 YEAR TREASURY ⬆︎ 4.13% (3.96% a week ago)

10 YEAR TREASURY *** ⬆︎ 4.51% (4.41% a week ago)

20 YEAR TREASURY ⬆︎ 4.99% (4.93% a week ago)

30 YEAR TREASURY ⬆︎ 4.97% (4.92% a week ago)

Treasury data courtesy of ustreasuryyieldcurve.com as of the market close on Friday.

* Decided upon by the Federal Reserve. Used as a basis for interbank loans and for determining high yield savings rates.

** Wall Street Journal Prime rate. Used as a basis for determining many consumer loan rates such as credit cards, personal loans, home equity, securities-based lending and auto loans.

*** Used as a basis for determining mortgage rates.

AVERAGE 30-YEAR FIXED MORTGAGE RATE:

⬇︎ 6.85%

One week ago: 6.89%, one month ago: 6.76%, one year ago: 6.99%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

FEDWATCH INTEREST RATE TOOL:

Where will the Fed Funds interest rate be after the next rate-setting meeting on June 18th?

Unchanged from now .. ⬆︎ 100% probability (98% a week ago)

0.25% lower than now .. ⬇︎ 0% probability (2% a week ago)

What is the most commonly-expected number of remaining 0.25% Fed Funds interest rate cuts in 2025?

⬌ 2 (unchanged from a week ago)

All data based on the Fed Funds interest rate (currently 4.33%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

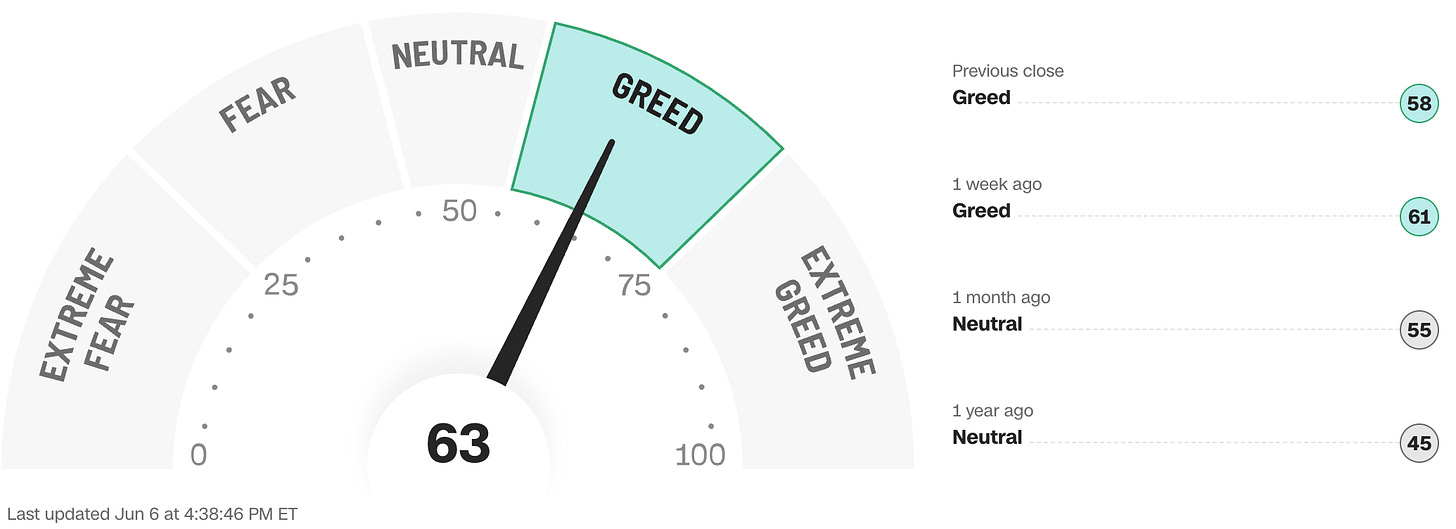

FEAR & GREED INDEX:

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any financial decisions, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any other Anglia Advisors published content.

Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No client advice may be rendered by Anglia Advisors unless and until a properly-executed Client Engagement Agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone?