After having risen for 14 of the last 15 weeks, the S&P 500 fell a smidge last week. It basically went on a wild ride to nowhere, driven mostly by messy economic data. There were two signals that inflation isn’t dying as quickly as markets (and the Federal Reserve) would like and there was also a sign that the prolific American consumer may finally be starting to close their wallet a little, all of which combined to hurt stocks, causing one index to have its worst day in years. Yet somehow the week also managed to contain more new all-time highs for Large Cap U.S. stocks.

Markets started out on Monday just as they had ended the previous Friday, although on lower volume - perhaps not that surprising on the day after the Super Bowl, when an estimated 16 million Americans skipped work. The result was at first another straight march higher but then, with the 5,050 level within sight for the S&P 500, nerves finally set in ahead of the following day’s retail inflation report. Traders decided that they wanted to maybe take a little off the table, being that many of them have been making some pretty big bets on the inflation-down/stocks-up narrative already this calendar year. Most indexes sank back and ended up down a touch for the day except for the Russell 2K Small Cap index which was having a moment, up almost another 2% on the session.

When it came out pre-market on Tuesday morning, the Consumer Price Index (CPI) measure of retail inflation caught Wall Street off guard and took a sledge hammer to stock prices. Core CPI rose 0.4% in January, climbing the most in eight months for a year-on-year rate of 3.9%. Both these data points were higher than expectations and stocks charged headfirst into a buzzsaw, plunging at the open and continuing lower all day.

This was the S&P 500’s worst reaction to a CPI release since September 2022. The NASDAQ-100 and the Russell 2K Small Cap index did even worse, the latter crapping out nearly 4% on the session, its worst day in years and bringing its recent short run of outperformance to a crashing halt.

Treasury yields soared, pushing bond prices lower as the reality seemed to finally hit home that there are now not going to be any interest rate cuts in March and very possibly not in May either. Those market-driven probabilities quickly tumbled to just 7% and 33% respectively. The deemed-most likely interest rate at the end of the year rose to 4.375%, a mere 1.0% lower than now, implying just four rate cuts in 2024 (which finally almost matches what the Fed has been consistently saying since November) as opposed to the market consensus expectation just over a month ago of as many as seven rate cuts this year.

There was something of a knee-jerk snap reversal though on Wednesday, as stocks clawed back a decent portion of Tuesday’s heavy losses as the apparent disgust that inflation had actually dared to pause its rapid downward decline wore off a little in something of a re-think of the need for the previous day’s freakout. The S&P 500 regained the 5000 level but stalled there as stocks ended the day priced almost exactly where they had closed on Thursday of the previous week. Rate cut probabilities recovered a little, too.

Most of the time American consumers can be firmly relied upon to spend lots of money that they don’t have on lots of stuff that they don’t need. But, in another piece of rather surprising economic data, we learned on Thursday that Retail Sales broadly declined last month, indicating that usually turbo-spending Americans finally took a breather. The value of retail purchases in January decreased 0.8% from December, its biggest drop in nearly a year.

Markets reacted by stumbling aimlessly around for much of the day, before Wall Street finally decided that recovering from Tuesday’s over-reaction was more important than running scared from some possibly temporary Retail Sales disappointment and stocks ended the day higher again with the S&P 500 back in all-time closing record high territory.

Next up on Friday morning was the Producer Price Index (PPI) measure of wholesale inflation experienced by manufacturers. The core number for January climbed 0.5% from the prior month and 2.0% from a year ago - both exceeding expectations and acting as something of a confirmation of Tuesday’s rough retail inflation number. Wall Street’s knee jerked yet again and the recovery rally stalled and the S&P 500 floated back down again to end the week about half a percent lower than where it started it.

I said in a recent report that if the probabilities of an interest rate cut in May fell far enough, then “look out below”. That’s what we saw on Tuesday, when the market-driven probability of such a cut fell below 50% on its way to crumbling further to eventually represent only a one-in-three chance by Tuesday’s closing bell.

Indeed an intriguing new narrative began to slowly and quietly emerge last week, initially restricted to the outer fringes of the financial media - but which moved into the mainstream when repeated on Bloomberg TV by somewhat-respected former Treasury Secretary Larry Summers, who said; “There’s a meaningful chance — maybe it’s 15% — that the next move is going to have be upwards in rates, not downwards. The Fed is going to have to be very careful.”

That scenario coming true would horrify Wall Street which has taken stocks on an almost unbroken powerful upward journey since late October of 2023 based primarily on the unshakeable assumption that interest rates were imminently moving lower. While there has maybe been a little disappointment surrounding the timing of such cuts, the idea that they will arrive sooner or later as the Fed’s next move remained totally unchallenged in public until last week.

It will take another couple of cycles of data releases to either establish a new alarming inflation trend or to show that last week’s data was just a bump in the road before we know if this rather frightening narrative will either take hold or fall silently into the (overflowing) garbage can of financial pundit hot takes that simply never come to pass.

OTHER NEWS ..

Sorry, What Did You Say? .. Ride-hailing provider Lyft had a bumbling, chaotic week. The firm saw the price of its shares soar 67% in after-hours trading on Tuesday after releasing results that showed projected earnings jumped by 11% and included a prediction that margins were set to expand this year by an eye-watering 500 basis points (5.00%).

But less than an hour later, company CFO Erin Brewer came out and said that in fact the company is actually expecting margins to expand by 50 basis points (0.50%), with a company spokesperson later attributing the extra-zero mistake to a “clerical error” .

Lyft’s rather annoying CEO David Risher did himself no favors by going into lamentably transparent spin mode on TV, casually saying it was “my bad” , acting like he had just spilled someone’s beer or something. He also attempted to minimize the issue by suggesting that it was only a case of just “one zero in a press release.” (false: the error also appeared in multiple documents and was repeated over again on the earnings call before eventually being corrected).

Rumors began to swirl (denied by Risher) that the misinformation was a result of the firm having used AI to generate its earnings report and associated documentation. By the time pre-market trading opened the following morning, the price gain had fallen all the way back to just 17%. The Securities and Exchange Commission (SEC) is quite correctly investigating the incident.

Gloomier And Gloomier .. The economic picture around the world darkened as both Japan and the UK fell into technical recessions last week. Adding to the gloom, the European Commission said it expects weaker economic growth across the EuroZone bloc in 2024 and 2025 — bad news for its largest economy, Germany, which is already stagnating economically as well as suffering from increasing political and social turmoil. Of course, these only add to the woes produced by a constantly worsening economic and financial situation in China.

Nice Place You’ve Got Here .. If a waterfront estate in Naples, FL sells for anywhere close to its $295 million asking price, it will set the record for the America’s most expensive residential real estate sale ever. Financier John Donahue paid a paltry $1 million for what was then a four-acre tropical retreat at the far edge of a peninsula in the exclusive Port Royal neighborhood, according to The Wall Street Journal. He continued to purchase nearby land, ultimately acquiring 60 acres.

A nine-acre portion of the property with 1,650 feet of waterfront, three houses and its own dock for a private yacht is being offered for sale. The homes include an 11,500-square-foot house with six bedrooms and a screened-in pool; a 5,500-square-foot residence with five bedrooms and an outdoor pool and another 5,800-square-foot structure added in 2013.

UNDER THE HOOD ..

Historically speaking, the upcoming four weeks on the calendar haven't been great during the fourth year of presidential terms. In fact, they have generally been pretty piss-poor for stocks.

The S&P 500 index had enjoyed a “start-stop” rally for months, characterized by rapid upside moves followed by longer periods of sideways consolidation, notably absent any material pullbacks or drawdowns. Until last Tuesday, when the hot retail inflation print gave at least a short-term win for the bears, before a swift reversal the next day mitigated most of the damage.

While it appeared that weeks-long negative divergences in shorter term indicators finally gave way to a meaningful decline in the major indexes, longer term trends continue to support a positive big-picture view. This was emphasized when most technical core indicators survived the mid-week fireworks to remain intact and stay in their uptrends dating from last October.

Anglia Advisors clients are welcome to reach out to me to discuss market conditions further.

THIS WEEK’S UPCOMING CALENDAR ..

U.S. stock and bond markets will be closed on Monday for Presidents’ Day. It will be another busy week of earnings reports once Wall Street returns, the really big news being Nvidia's results on Wednesday.

Also reporting this week, among others: Home Depot, Walmart, Medtronic, Moderna, Intuit, Block, Warner Bros., Etsy, Newmont Mining, Palo Alto Networks, Rivian, Keurig Dr. Pepper, Analog Devices and Booking Holdings.

Nerdy Federal Reserve-watchers (guilty as charged!) will be closely watching the release of minutes from the Fed’s last interest rate setting meeting on Wednesday. Officials left interest rates unchanged at the meeting, but may possibly have discussed conditions for lowering them later in 2024.

Unlike last week, the calendar is quiet for meaningful economic data this week.

ARTICLE OF THE WEEK ..

Dave Ramsey’s dangerous nonsense needs to finally be called out for the bad advice that it is. Here we go at last.

LAST WEEK BY THE NUMBERS ..

Last week’s market color courtesy of finviz.com

Last week’s best performing U.S. sector: Energy (two biggest holdings: Exxon-Mobil, Chevron) - up 2.7% for the week.

Last week’s worst performing U.S. sector: Technology (two biggest holdings: Microsoft, Apple) - down 2.6% for the week.

SPY, the S&P 500 Large Cap ETF, is made up of the stocks of the 500 largest U.S. companies. Its price fell 0.5% last week, is up 5.1% so far this year and ended the week 0.5% below its all-time closing record high (02/15/2024)

IWM, the Russell 2000 Small Cap ETF, is made up of the bottom two-thirds in terms of company size of the group of the 3,000 largest U.S. stocks. Its price rose 1.0% last week, is up 0.5% so far this year and ended the week 16.9% below its all-time closing record high (11/05/2021)

DXY, the U.S. Dollar index, is an index that measures the value of the U.S. Dollar against a weighted basket of six other major currencies (the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krone and the Swiss Franc). It rose 0.1% last week, is up 2.9% so far this year and is up 15.2% over the last three years.

AVERAGE 30-YEAR FIXED MORTGAGE RATE ..

6.77%

One week ago: 6.64%, one month ago: 6.60%, one year ago: 6.32%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

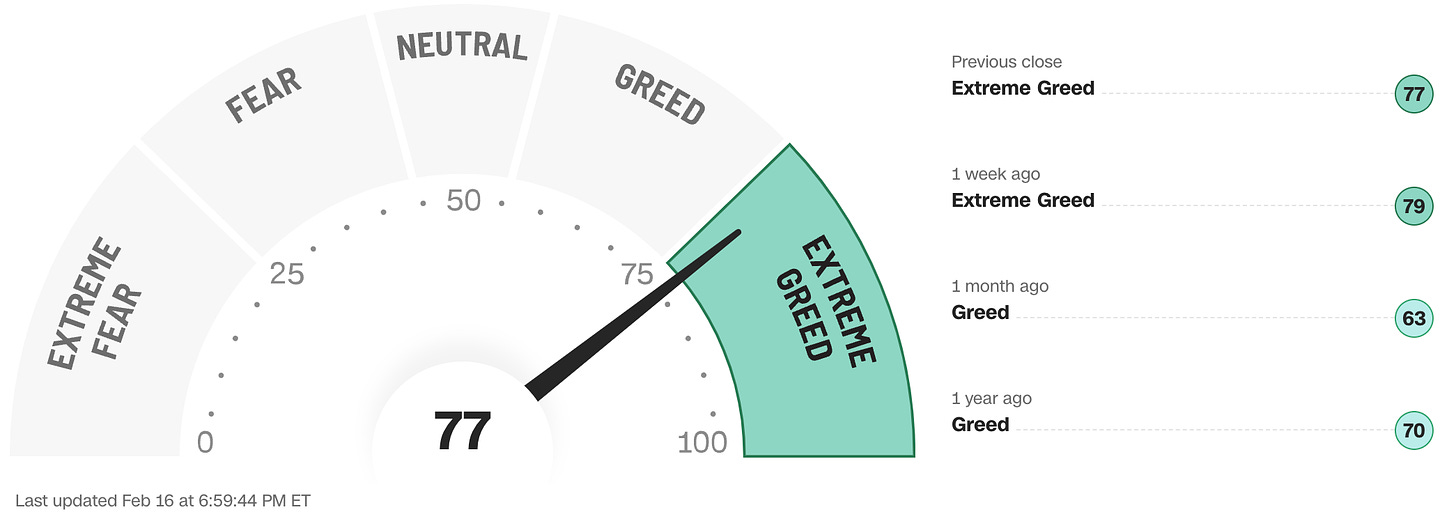

FEAR & GREED INDEX ..

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

The “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business.

The 50-day moving average of the S&P 500 remains above the 200-day. This is a continued indication of a technical uptrend.

% OF S&P 500 STOCKS TRADING ABOVE THEIR 50-DAY MOVING AVERAGE ..

59% (295 of the 500 largest stocks in the U.S. ended last week above their 50D MA and 205 were below)

One week ago: 62%, one month ago: 70%, one year ago: 49%

% OF S&P 500 STOCKS TRADING ABOVE THEIR 200-DAY MOVING AVERAGE ..

70% (348 of the 500 largest stocks in the U.S. ended last week above their 200D MA and 152 were below)

One week ago: 69%, one month ago: 65%, one year ago: 61%

Closely-watched measures of market breadth and participation, providing a real-time look at how many of the largest 500 publicly-traded stocks in the U.S. are trending higher or lower, as defined by whether the stock price is above or below their more sensitive 50-day (short term) and less sensitive 200-day (long term) moving averages which are among the most widely-followed of all stock market technical indicators.

The higher the reading, the better the deemed health of the overall market trend, with 50% considered to be a key pivot point. Readings above 90% or below 15% are extremely rare.

WEEKLY US INVESTOR SENTIMENT (outlook for the upcoming 6 months) ..

↑Bullish: 42% (49% a week ago)

⬌ Neutral: 31% (28% a week ago)

↓Bearish: 27% (23% a week ago)

Net Bull-Bear spread: ↑Bullish by 15 (Bullish by 26 a week ago)

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

Survey participants are typically polled during the first half of the week.

Data courtesy of: American Association of Individual Investors (AAII).

FEDWATCH INTEREST RATE TOOL ..

Will interest rates be lower than they are now following the Fed’s next meeting on March 20th?

Yes .. 10% probability (16% a week ago)

No .. 90% probability (84% a week ago)

Will interest rates be lower than they are now following the Fed’s following meeting on May 1st?

Yes .. 37% probability (61% a week ago)

No .. 73% probability (39% a week ago)

Where is the Fed Funds interest rate most likely to be at the end of 2024?

4.375% (1.00% lower than where we are now, implying four rate cuts of 0.25% each in 2024)

One week ago: 4.125% (implying five rate cuts), one month ago: 3.875% (implying six rate cuts)

All data based on the Fed Funds rate (currently 5.375%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

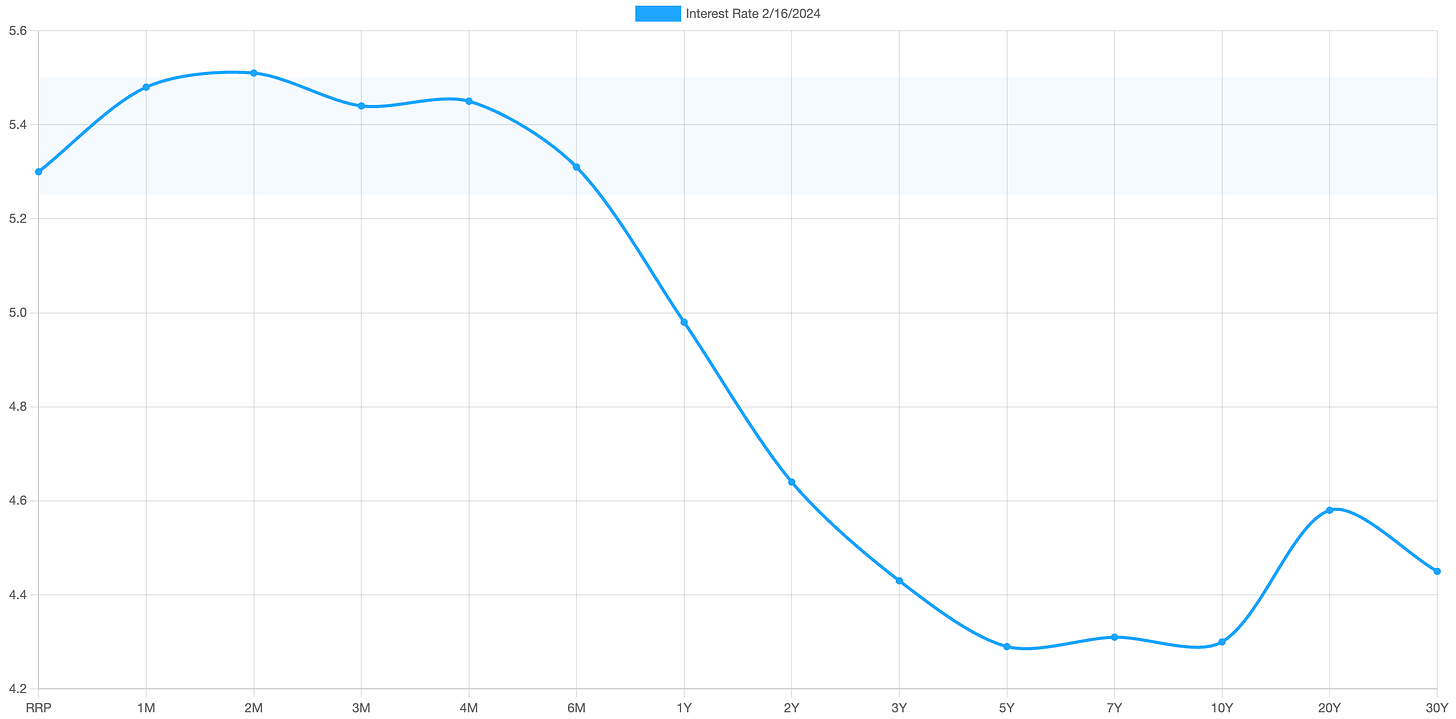

US TREASURY INTEREST RATE YIELD CURVE ..

The highest rate on the yield curve (5.51%) is being paid for the 2-month duration and the lowest rate (4.29%) is for the 5-year.

The most closely-watched and commonly-used comparative measure of the spread between the higher 2-year and the lower 10-year rose from 0.31% to 0.34%, indicating a steepening in the inversion of the curve.

The interest rate yield curve remains unusually “inverted” (i.e. shorter term interest rates are generally higher than longer term ones). Based on the 2-year vs. 10-year spread, the curve has been inverted since July 2022.

Historically, an inverted yield curve is not the norm and has been regarded by many as a leading indicator of an impending recession, with shorter term risk regarded to be unusually higher than longer term. The steeper the inversion, the greater the deemed risk of recession.

Data courtesy of ustreasuryyieldcurve.com as of Friday. Lightly shaded area on the chart shows the current Federal Funds rate range.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (929) 677 6774 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any investment or other financial decisions. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind. Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?