Despite a valiant comeback effort on Friday, stocks endured a mostly jittery week and ended lower as some generally-accepted market narratives began to shift. Good news for the economy is finally becoming good news for stocks. The S&P 493 (without the so-called Magnificent Seven) is finally looking in good shape relative to the S&P 500 (which is dominated by the Magnificent Seven) and, according to an emerging heresy straight from the mouth of a leading Fed official no less, we may not be getting any interest rate cuts at all in 2024!

Trading on Monday was thinner than usual with many markets around the world still closed for Easter. Inflation figures released when the market was closed the previous Friday did little to bring forward the expected interest rate cut start date. The market-driven probability of a June rate cut briefly dipped below 50% for the first time and is now considered to be a coin flip (see FEDWATCH INTEREST RATE TOOL below). Market interest rates spiked higher, driving both stock and bond prices lower.

The retreat in stock prices accelerated on Tuesday with all indexes declining substantially as traders grew more anxious about higher market interest rates and the possibility of a “too-hot” Jobs Report on Friday. It also didn’t help the inflation outlook that oil prices shifted significantly higher to multi-month highs as the temperature of the Middle East conflict rose after Israel killed seven food aid workers in Gaza including American, British, Australian and Polish citizens and simultaneously launched fatal airstrikes on an Iranian consulate in Syrian sovereign territory.

On Wednesday, the fall in bond prices caused by the increasing market interest rates started looking more like a rout. The deadly Taiwanese earthquake caused some brief concern in the chip space, but giant chip producer TSMC quickly reported only a negligible effect on production, successfully calming market nerves, but Intel sank over 8% in a matter of minutes on poor profit and sales data, obviously unrelated to the earthquake.

Fed chairman Jerome Powell pretty much came right out and said it in a speech at Stanford; a soft landing seems to be happening and that just because the path to 2% inflation is bumpy doesn't mean we're off it. This encouraged a few dip buyers to finally move in to stabilize things and take most stock prices a smidge higher for the session after a pretty rough couple of days.

Thursday started out with the indexes chugging along nicely until that well-known Fed big-mouth, the Minneapolis president Neel Kashkari (who has never met a media microphone that he could resist speaking into) suggested that if progress falters in the fight against inflation, there may well be a grand total of zero interest rate cuts in 2024. This possibility has always been whispered about in hushed tones on the fringes, but for a senior Fed official to come out and openly put it out there caused havoc in an already nervy market and stock prices tumbled far and fast.

Friday was Jobs Day, with the critical data release from the Bureau of Labor Statistics coming out before the market open. We learned that job growth surged in March, as employers added 303k new positions, almost 100k more than expected and January and February’s job creation was revised upward. Unemployment ticked down to 3.8% but, importantly for inflation calculations, average hourly earnings fell to the lowest level in nearly three years at 4.1% annualized. This was the 39th consecutive month of job growth in the U.S. which has seen a total of 15 million new jobs added over that time and the unemployment rate has been not been above 4% for over two years now.

With the U.S. economy now showing signs of re-accelerating and recession risk seemingly as far away as ever, a relieved stock market took prices solidly higher in response - erasing the previous day’s losses but not those of the week as a whole.

Interestingly, this upward move in stock prices was in violation of the recent conventional formula of; strong economic data = higher inflation risk = a delay in interest rate cuts = lower stock prices. As I have alluded to of late, this old school line of logic appears to be breaking down in an environment where the Fed is showing signs of tolerance of >2% inflation, at least for a while. The updated formula would now seem to be; strong economic data = less chance of a damaging recession = improvement in earnings outlook = higher stock prices.

The shaky news last week did not really threaten the pillars upon which the rally since October has been built, but with the S&P 500 currently priced for perfection and at such very high valuations (21X earnings, vs. a long term average of around 19X), it doesn’t need to be game-changing to cause a correction of a few percent.

The merest suggestion of a challenge to an accepted orthodoxy (in last week’s case, that of the assumption of multiple interest rate cuts in 2024 following Kashkari’s comments) can have a swift and nasty effect on stock prices. In other words, there’s ample room for disappointment with markets at these levels. Wall Street seems to be beginning to take the view that the chances of a 5%-10% pullback are probably greater in the short term than the chances of a further 5%-10% rally.

Even if stock prices are able to continue higher, there are signs that investors may finally be tiring of Big Tech in general and the Magnificent Seven (which has frankly shrunk to the Fab Five now) in particular and looking to move into into other sectors that have more reasonable valuations.

OTHER NEWS ..

Tesla Crashing .. Tesla continues to get battered as a shockingly lower sales report on Tuesday saw a record miss of even the most pessimistic of estimates which, along with higher inventory data, confirmed that the world is rapidly falling out of love with the company’s products and very possibly with a very distracted Elon Musk’s unhinged antics as well. Then on Friday, Reuters reported that Tesla’s long-held plans for a new lower price-point ($25k) vehicle have been scrapped although this was initially denied by Musk in a rather detail-free tweet that simply accused Reuters of lying.

Tesla is the worst performing stock in the S&P 500 index this year, indeed if you had bought the stock at the beginning of the year, you’d be down about 34% on that trade on Friday, while the S&P 500 (of which Tesla is a major component) has moved up 9% over the same time frame.

In other Elon news, Fidelity last week cut the valuation of its position in X/Twitter by 5.7% from just a month earlier. That now implies a 73% drop in the company’s value since his 2022 purchase.

Insurance Premium Storm .. U.S. home insurance rates are expected to reach a record high this year, with the biggest increases occurring in states prone to severe weather events. The average premium for homeowners’ insurance in the U.S. is expected to hit $2,522 by the end of the year, driven largely by intensifying natural disasters, rising reinsurance costs and higher fees for home repair. That figure would represent a 6% increase over that of 2023, and follows a roughly 20% increase across the past two years.

One of the motivations to buy a home is the idea that housing costs will remain relatively fixed or stable, compared to renting, but this trend of regular and meaningful insurance rate hikes is up-ending that narrative.

UNDER THE HOOD ..

With the S&P 500 considerably overheated and overbought on a fundamental valuation basis and the threat of volatility on the rise, three potential technical downside “gap fills” were in play for the index in Q2 , the lowest of which is 4,982, which would mean a roughly 4.3% further pullback from Friday’s closing price.

While the long-term market uptrend remains firmly intact, several short-term factors increase the probabilities of an overdue pullback. In the context of the healthy long-term trend, any short term turbulence that arises is likely best viewed as just that. Since March 7th, Selling Pressure has been slowly rising as Buying Power has moved sideways, though still in the dominant position relative to Selling Pressure

The NASDAQ, which led the rally off the 2022 lows, has begun to lag, Value is beginning to outperform Growth, oil is at multi-month highs adding upward pressure on inflation expectations which has hawkish policy implications for all major global central banks.

Bottom line, the 2024 equity market rally continues to demand respect and the constant new highs are inherently bullish for the broader equity market as we turn the corner into Q2. At the same time these developments mean that we are probably at the highest risk of a pause in the market’s primary uptrend, however temporary, in stock markets and other risk assets since we bounced off the lows back in October of last year.

Anglia Advisors clients are welcome to reach out to me to discuss market conditions further.

THIS WEEK’S UPCOMING CALENDAR ..

The shit-show that is the U.S. Congress returns this week, with the narrative surrounding a support package for Israel having changed significantly since lawmakers last focused on it and there’s a possible challenge to the position of Speaker. Buckle up for endless posturing nonsense.

Back in the real world, Q1 2024 earnings season kicks off in earnest on Friday with results from several big U.S. banks such as Citigroup, JPMorgan Chase, Wells Fargo, BlackRock and State Street. Other companies releasing their results next week will include Delta Air Lines, CarMax, Constellation Brands, and Fastenal .

The economic-data highlight of the week will be highly-anticipated March inflation figures. On Wednesday, the Consumer Price Index (CPI) measure of retail inflation is expected to be up by 3.4% from a year earlier, with Core up 3.7%. The March Producer Price Index (PPI) measure of wholesale inflation comes out the next day.

On the central bank front, the minutes from the last Fed rate-setting meeting will be published on Wednesday and the European Central Bank will announce a monetary-policy decision on Thursday.

ARTICLE OF THE WEEK ..

Can your portfolio survive a Near Death Experience? Probably not. But, to be honest, who cares?

LAST WEEK BY THE NUMBERS ..

Last week’s market color courtesy of finviz.com

Last week’s best performing U.S. sector: Energy (two biggest holdings: Exxon-Mobil, Chevron) - up 3.8% for the week.

Last week’s worst performing U.S. sector: Real Estate (two biggest holdings: Prologis, American Tower) - down 3.2% for the week.

SPY, the S&P 500 Large Cap ETF, is made up of the stocks of the 500 largest U.S. companies. Its price fell 0.8% last week, is up 9.0% so far this year and ended the week 0.9% below its all-time closing record high (03/27/2024)

IWM, the Russell 2000 Small Cap ETF, is made up of the bottom two-thirds in terms of company size of the group of the 3,000 largest U.S. stocks. Its price fell 2.8% last week, is up 1.9% so far this year and ended the week 15.7% below its all-time closing record high (11/08/2021)

DXY, the U.S. Dollar index, is an index that measures the value of the U.S. Dollar against a weighted basket of six other major currencies (the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krone and the Swiss Franc). It fell 0.7% last week, is up 2.9% so far this year and is up 12.7% over the last three years.

AVERAGE 30-YEAR FIXED MORTGAGE RATE ..

6.82%

One week ago: 6.79%, one month ago: 6.90%, one year ago: 6.28%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

FEAR & GREED INDEX ..

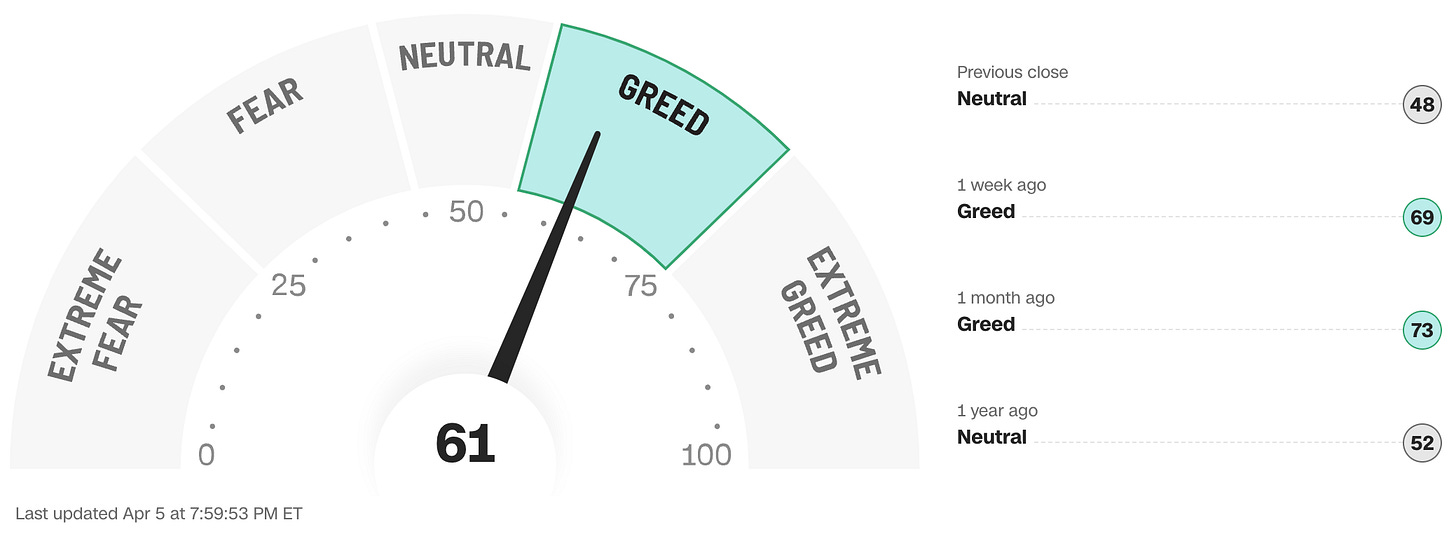

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

The “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

The 50-day moving average of the S&P 500 remains above the 200-day. This is a continued indication of an ongoing technical uptrend.

% OF S&P 500 STOCKS TRADING ABOVE THEIR 50-DAY MOVING AVERAGE ..

71% (354 of the S&P 500 stocks ended last week above their 200D MA and 146 were below)

One week ago: 83%, one month ago: 67%, one year ago: 42%

% OF S&P 500 STOCKS TRADING ABOVE THEIR 200-DAY MOVING AVERAGE ..

76% (381 of the S&P 500 stocks ended last week above their 200D MA and 119 were below)

One week ago: 83%, one month ago: 73%, one year ago: 54%

Closely-watched measures of market breadth and participation, providing a real-time look at how many of the largest 500 publicly-traded stocks in the U.S. are trending higher or lower, as defined by whether the stock price is above or below their more sensitive 50-day (short term) and less sensitive 200-day (long term) moving averages which are among the most widely-followed of all stock market technical indicators.

The higher the reading, the better the deemed health of the overall market trend, with 50% considered to be a key pivot point. Readings above 90% or below 15% are extremely rare.

WEEKLY US INVESTOR SENTIMENT (outlook for the upcoming 6 months) ..

↑Bullish: 47% (50% a week ago)

⬌ Neutral: 31% (28% a week ago)

↓Bearish: 22% (22% a week ago)

Net Bull-Bear spread: ↑Bullish by 25 (Bullish by 28 a week ago)

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

Survey participants are typically polled during the first half of the week.

Data courtesy of: American Association of Individual Investors (AAII).

FEDWATCH INTEREST RATE TOOL ..

Will interest rates be lower than they are now following the Fed’s next meeting on May 1st?

Yes .. 5% probability (4% a week ago)

No .. 95% probability (96% a week ago)

Will interest rates be lower than they are now following the Fed’s following meeting on June 12th?

Yes .. 53% probability (64% a week ago)

No .. 47% probability (36% a week ago)

Where is the Fed Funds interest rate most likely to be at the end of 2024?

4.625% (0.75% lower than where we are now, implying three rate cuts of 0.25% each in 2024)

One week ago: 4.625% (implying three rate cuts), one month ago: 4.625% (implying three rate cuts)

All data based on the Fed Funds rate (currently 5.375%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

HIGH YIELD CREDIT SPREAD ..

3.24%

One week ago: 3.12%, one month ago: 3.31%, one year ago: 4.84%

This closely-watched spread is a strong indicator of the risk inherent in the professional marketplace and the extent to which such risk is growing or easing. The high-yield credit spread is the difference between the interest rates offered for riskier low-grade, high yield (“junk”) bonds and those for stable high-grade, lower yield bonds, including deemed risk-free government bonds, of similar maturity.

A reading that is high/increasing indicates that “junkier” bond issuers are being forced to move their yields higher to compensate for a greater risk of default and is considered to be a reflection of broadly deteriorating economic and market conditions which could well lead to lower stock prices.

A reading that is low/decreasing indicates a reduced necessity for higher yields. This reflects less prevailing market risk and more stable or improving conditions in the overall economy and for stock prices.

For context .. this reading was regularly below 3.00% for much of the 1990s, got as high as 10.59% after 9/11 and the subsequent Dotcom Crash of 2002, peaked at 21.82% in the Great Financial Crisis in December 2008 and spiked from 3.62% to 10.87% in the space of about a month during the February/March 2020 COVID crash. The historical average since 1996 is a little over 4.00%.

Data courtesy of: FRED Economic Data, St. Louis Fed as of Friday’s market close.

US TREASURY INTEREST RATE YIELD CURVE ..

The highest rate on the yield curve (5.50%) is being paid for the 2-month duration and the lowest rate (4.38%) is for the 5-year.

The most closely-watched and commonly-used comparative measure of the spread between the higher 2-year and the lower 10-year fell from 0.39 to 0.34%, indicating a flattening in the inversion of the curve.

The interest rate yield curve remains unusually “inverted” (i.e. shorter term interest rates are generally higher than longer term ones). Based on the 2-year vs. 10-year spread, the curve has been inverted since July 2022.

Historically, an inverted yield curve is not the norm and has been regarded by many as a leading indicator of an impending recession, with shorter term risk regarded to be unusually higher than longer term. The steeper the inversion, the greater the deemed risk of recession.

Data courtesy of ustreasuryyieldcurve.com as of Friday. The lightly shaded area on the chart shows the current Federal Funds rate range.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any investment or other financial decisions. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind. Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?