Investor attention was focused on the Capitol in Washington DC on Monday rather than on the New York Stock Exchange which was closed for Martin Luther King Day.

Once sworn in, Trump doubled down on much of his campaign rhetoric in his inaugural address, including some of the more “out-there” proposals, notably promising an expansion of U.S. territorial claims not only on earth but also in space (that had First Buddy Musk bouncing up and down in giddy excitement).

The new president and the Republicans have the wind in their sails with full control of Congress, a MAGA-friendly media ecosystem newly-unshackled from any kind of fact-checking or accountability and fawning fanboy executives of some of the largest U.S. companies bootlicking and kissing the ring. As a result, a blizzard of executive orders (many of which are sure to be the subject of extensive litigation) were issued after the market close. It should be noted that most of these orders tended to light a fuse rather than cause an immediate explosion.

From Wall Street’s perspective, Trump continues to ping-pong between the financially impactful (threatening, rather than imposing, tariffs on Mexico and Canada on day one, notably sparing China and Europe from his plans for the time being and barely a mention on his first day for crypto or the Federal Reserve) and what was nothing more than the tossing scraps of red meat to his voter base (renaming bodies of water and mountains, releasing armed rioters and drug kingpins from prison, declassifying JFK files, TikTok flip-flops, Panama, Greenland, Mars, blah, blah, blah).

The conclusion from traders was that it could all have been much worse on the tariff front and stocks shifted nicely higher in what was essentially a relief rally on Tuesday, also bolstered by a slate of well-received earnings reports. Interest rates drifted a little higher. Crypto bros sulked about being dissed on day one by their new hero and the recent dizzying price spike reversed sharply.

At the unveiling of an AI investment initiative called Stargate featuring Oracle, OpenAI and Softbank (the Japanese bank best known for having poured billions upon billions into the basket case of a company that was WeWork) on Tuesday evening, Trump began oddly riffing on other topics and vaguely floated the idea of a 10% tariff on all Chinese imports, raising eyebrows and lowering stock prices in Asia.

The creation of Stargate (which was, interestingly, heavily slammed by Musk - an avowed enemy of OpenAI and its management), a spectacular earnings report from Netflix and something of a stabilization of interest rates boosted stocks further on Wednesday (particularly tech/AI names) along with a continuing absence of clarity on tariffs, leading Wall Street to maybe start to believe in the possibility that Trump might just be bluffing as a negotiating tactic at least when it comes to the timing and extent of levies.

Yet more solid earnings reports carried stocks higher on Thursday on what was largely a Trump surprise-free day with tumbleweed continuing to blow around when it came to anything concrete on tariffs. The S&P 500 got back to doing what it does best, breaking records again, closing at the index’s first all-time record high of 2025.

Stocks took a breather at the open on Friday with a few less striking earnings reports, including disappointing news out of Boeing and Texas Instruments and traders taking some profits from the week’s gains leading to a slightly soggy ending to what was a respectable holiday-shortened week.

Trump’s ping-ponging continued on tariffs. Just a couple of days after musing about imposing 10% tariffs on China starting on February 1st in front of the world’s press, he told Fox News he’d “prefer not” to have to impose any levies on China at all. Decisiveness and clarity seem as far away as ever.

The lack of any hard tariff news was partially responsible for the rally in stocks last week. But that’s mostly because fears surrounding the extent of tariffs and their timing were probably overblown and not because the associated risks (higher inflation, damaged corporate earnings and slower economic growth) have diminished in any way. Tariff headlines will continue to be a volatility-inducing event for markets until we have full transparency on this administration’s actual plans.

It’s still a relatively small sample size, but the Q4 2024 earnings season has so far been extremely impressive with only a few exceptions. A good number of the big dogs are reporting this week (see THIS WEEK’S UPCOMING CALENDAR below) which may confirm or reverse that, but right now things are looking generally very positive on the earnings front and that is driving stocks higher despite all the other distractions that are flying around.

OTHER NEWS ..

Trump vs. The Bond Vigilantes? .. Speaking on Thursday, hours before the Bank of Japan’s decision to raise local interest rates to their highest level in 17 years, Trump told the Davos mob in a video call that he is going to “demand that interest rates drop immediately” around the world. The benchmark 10 year U.S. Treasury interest rate promptly rose higher. What Jerome Powell and company say this week when the Fed is fully expected to leave rates unchanged and the resulting actions of bond traders is going to be much more consequential. They have far more firepower than Trump can even dream of.

At least Trump’s first-week rhetoric had the healthy effect of diverting attention from the self-absorbed, detached-from-reality grandstanding nonsense spewed at the so-called World Economic Forum at Davos last week, much of which went mercifully under-reported in favor of the never-ending stream of stories pouring out of Washington DC.

New Addicts .. A new type of addict is showing up at Gamblers Anonymous meetings across the country; retail day-traders hooked on the market’s riskiest trades in stocks and crypto. Most of these addicts are younger men, according to report last week from the Wall Street Journal. In a world where buying and selling stocks on apps is as easy as ordering food delivery or buying a t-shirt on Amazon, doctors and counselors say they are seeing a rapidly increasing number of cases of compulsive gambling in financial markets, often with very damaging results, including, in extreme cases, suicide following devastating, life-altering losses.

ARTICLE OF THE WEEK ..

How much does it cost to be entertained by your investments? A lot, it turns out.

THIS WEEK’S UPCOMING CALENDAR ..

A packed agenda of Q4 2024 earnings reports and interest-rate decisions from the Federal Reserve and European Central Bank (ECB) will keep investors focused this week.

The Federal Reserve will announce an interest rate policy decision on Wednesday. Markets are overwhelmingly pricing in no change. All eyes, however, will be on the press conference with Fed chairman Jerome Powell having to answer what will likely be some very pointed questions from the financial press pack.

The ECB is expected to cut its benchmark interest rate target on Thursday.

Earnings season shifts into high gear this week with reports from Apple, Microsoft, Tesla, Meta/Facebook, Exxon- Mobil, Chevron, IBM, Intel, Mastercard, Visa, AT&T, Caterpillar, Southwest Airlines, Starbucks, General Motors, T-Mobile, Lockheed Martin, Comcast, General Dynamics and many others.

This week we will also get the latest estimate of Q4 Gross Domestic Product (GDP) as well as the latest Durable Goods report.

LAST WEEK BY THE NUMBERS:

Last week’s market color courtesy of finviz.com

Last week’s best performing U.S. sector: Technology (two biggest holdings: Apple, Nvidia) ⬆︎ 3.9% for the week.

Last week’s worst performing U.S. sector: Energy (two biggest holdings: Exxon-Mobil, Chevron) ⬇︎ 2.1% for the week.

SPY, the S&P 500 Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from a universe of the largest U.S. companies. Its price rose 2.7% last week, is up 3.7% so far this year and ended the week 0.3% below its all-time record closing high (01/23/2025).

IWM, the Russell 2000 Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a universe of 3,000 of the largest U.S. stocks. Its price rose 1.9% last week, is up 3.5% so far this year and ended the week 5.8% below its all-time record closing high (11/08/2021).

INTEREST RATES:

FED FUNDS* ⬌ 4.33% (unchanged)

PRIME RATE** ⬌ 7.50% (unchanged)

3 MONTH TREASURY ⬆︎ 4.35% (4.34% a week ago)

2 YEAR TREASURY ⬌ 4.27% (4.27% a week ago)

10 YEAR TREASURY*** ⬆︎ 4.63% (4.61% a week ago)

20 YEAR TREASURY ⬌ 4.91% (4.91% a week ago)

30 YEAR TREASURY ⬆︎ 4.85% (4.84% a week ago)

Treasury data courtesy of ustreasuryyieldcurve.com as of the market close on Friday.

* Decided upon by the Federal Reserve. Used as a basis for determining high yield savings accounts rates.

** Used as a basis for determining many consumer loan rates such as personal, home equity and auto.

*** Used as a basis for determining mortgage rates.

AVERAGE 30-YEAR FIXED MORTGAGE RATE:

⬇︎ 6.96%

One week ago: 7.04%, one month ago: 6.80%, one year ago: 6.69%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

FEDWATCH INTEREST RATE TOOL:

Where will the Fed Funds interest rate be after the next rate-setting meeting on January 29th?

Unchanged from now .. ⬆︎ 99% probability (98% a week ago)

0.25% lower than now .. ⬇︎ 1% probability (2% a week ago)

What is the most commonly expected number of 0.25% Fed interest rate cuts in 2025?

⬌ 1 (unchanged from a week ago)

All data based on the Fed Funds interest rate (currently 4.33%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

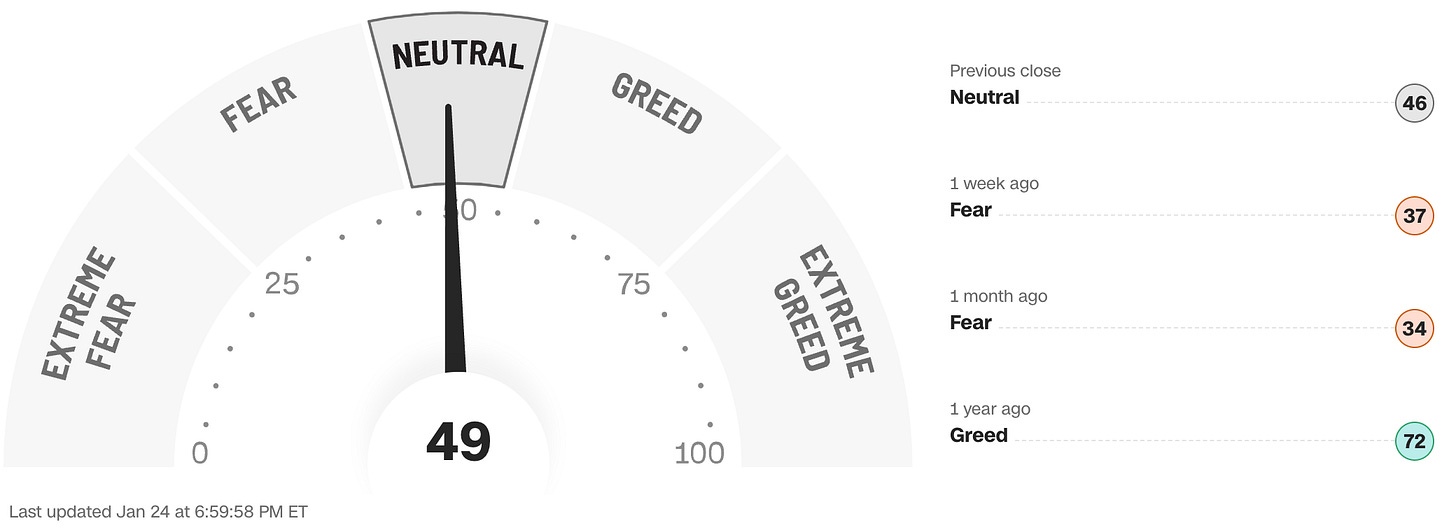

FEAR & GREED INDEX:

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any financial decisions, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind.

Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No client advice may be rendered by Anglia Advisors unless or until a properly-executed Client Engagement Agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?