Over the weekend we learned of Trump’s proposed 30% tariff on imports from Mexico (non-USMCA) and the European Union, supposedly to take effect on August 1st, with not-so-veiled threats of a rate increase in the case of any retaliation.

Wall Street traders’ strong confidence in the TACO narrative that I talked about in last week’s report wavered somewhat on Monday morning after the weekend’s decrees and stocks sank at the open, following down-sessions in Asia and Europe. The stock indexes recovered but rather listlessly on low trading volume as the session wore on when Trump quickly dialed back the rhetoric with the EU to finish the day a smidge higher, ahead of the week’s inflation data and the Q2 earnings season kickoff.

Just hours after Trump proclaimed that inflation in the United States was dead, the Consumer Price Index (CPI) measure of retail inflation begged to differ when it came out pre-market on Tuesday, showing an acceleration to an annualized rate of 2.7% which was higher than expected, although not by much. Under the hood, price increases in tariff-impacted goods like apparel, footwear, furniture/appliances, toys, sporting goods etc. all jumped disproportionately while more muted inflation in components broadly unaffected by tariffs like housing, insurance and travel etc. were what kept a lid on the overall rate.

Markets once again took the attitude that a lack of really bad news counts as good news these days and stocks initially shifted higher, boosted also by decent Q2 earnings reports from the likes of JP Morgan and Citibank. But the indexes spent the afternoon drifting lower again on fading hopes of interest rate cuts in either of the Fed’s next two meetings to finish fractionally in the red.

More solid earnings from financial and pharmaceutical firms and a benign Producer Price Index (PPI) measure of wholesale inflation experienced by manufacturers pushed stocks into the green on Wednesday morning.

However, lunchtime reports that Trump was on the brink of trying to fire Federal Reserve chairman Powell sent stocks and the US Dollar into a swift tailspin and longer-dated interest rates soared, pushing the 20- and 30-year Treasury rates above 5.00% and the 10-year close to 4.50%. The president quickly backed down during another of his chaotic press conferences but still took the opportunity to refer to the head of his own central bank as a “dummy” and a “knucklehead”. Markets recovered their mojo and stocks closed the session back in positive territory.

Pre-market data for Retail Sales on Thursday showed an unexpectedly strong rebound in consumer spending after two months of declines and drove stocks higher at the open. With the additional tailwinds of highly respectable earnings reports from the likes of Pepsico and Taiwan Semiconductor, both the S&P 500 and the NASDAQ cruised to new all-time record highs again.

Stocks took a breather on a low-volume summer Friday, finishing the session unchanged although earnings reports continued to generally look really good, to cap a slightly positive week. Interest rates pulled back a bit following Wednesday’s spike.

The president’s assault on Fed chairman Powell is unrelenting and intensified last week, with White House advisor Kevin Hassett and former Fed governor Kevin Warsh now both brazenly auditioning for the job, frantically falling over themselves to see who can echo Trump’s views the loudest and become the anointed one. Existing Fed governor Chris Waller is also desperately trying to squeeze himself into the unseemly beauty contest, suddenly scrambling to shift his stance in favor of early interest rate cuts and publicly downplaying tariff concerns.

As JP Morgan’s Jamie Dimon and other high-level financial institution CEOs warned on Tuesday and as markets very briefly made clear on Wednesday, it’s impossible to overstate how badly Wall Street could react to any damage to the US central bank’s sacred independence with the installation of a presidential glove puppet at its head. The US Dollar, in particular, could decline significantly and that would be highly inflationary which would, ironically, make interest rate cuts even more difficult.

Stocks appear to have been rallying to all-time highs on vibes rather than actual fundamentals. The relative nonchalance of financial markets is clearly emboldening Trump to escalate the global trade war and reach for even higher tariffs. The gap between what’s being threatened and what the market expects to happen is vast right now.

Such a degree of disconnect can’t stay in place for long and a non-trivial risk is steadily rising that Wall Street will one day abruptly start to care all of a sudden and if that happens, stock prices could drop sharply and extremely rapidly from these levels.

If you are not yet a client of Anglia Advisors and would like to explore becoming one, please feel free to reach out to arrange a complimentary no-obligation discovery call with me.

ARTICLE OF THE WEEK ..

“Don’t just hold onto your wallet, digital or otherwise, but run the other way as fast as you possibly can because you are about to be scammed.”

We’ve all seen them. Social media posts, spam text and WhatsApp messages aggressively promoting obscure investments and promising stock riches.

What exactly is going on here?

.. AND I QUOTE ..

“Volatility is going to be a feature, not a bug, of the new world order.”

Jane Fraser, CEO of Citigroup

LAST WEEK BY THE NUMBERS:

Last week’s market color courtesy of finviz.com

Last week’s best performing US sector: Technology (two biggest holdings: Nvidia, Microsoft) ⬆︎ 1.6% for the week

Last week’s worst performing US sector: Healthcare (two biggest holdings: Eli Lilly, Johnson and Johnson) ⬇︎ 2.6% for the week

SPY, a US Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from a universe of the largest US companies. Its price rose 0.4% last week, is up 7.2% so far this year and ended the week 0.1% below its all-time record closing high (07/17/2025).

IWM, a US Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a universe of 3,000 of the largest US stocks. Its price fell 0.4% last week, is up 1.3% so far this year and ended the week 8.6% below its all-time record closing high (11/08/2021).

VXUS, a Global Non-US ETF, tracks the MSCI ACWI Ex-US index, made up of over 8500 of the largest names from a universe of stocks issued by companies from around the world excluding the United States, in both developed and emerging markets. Its price fell 0.3% last week, is up 17.6% so far this year and ended the week 0.4% below its all-time record closing high (07/03/2025).

INTEREST RATES:

FED FUNDS * ⬌ 4.33% (unchanged)

PRIME RATE ** ⬌ 7.50% (unchanged)

3 MONTH TREASURY ⬇︎ 4.40% (4.42% a week ago)

2 YEAR TREASURY ⬆︎ 3.88% (3.86% a week ago)

5 YEAR TREASURY ⬆︎ 3.96% (3.93% a week ago)

10 YEAR TREASURY *** ⬆︎ 4.44% (4.35% a week ago)

20 YEAR TREASURY ⬆︎ 4.99% (4.87% a week ago)

30 YEAR TREASURY ⬆︎ 5.00% (4.86% a week ago)

Data courtesy of the Federal Reserve and the Department of the Treasury as of the market close on Friday.

* Decided upon by the Federal Reserve. Used as a basis for interbank loans and for determining high yield savings rates.

** Wall Street Journal Prime rate. Used as a basis for determining many consumer loan rates such as credit cards, personal loans, home equity, securities-based lending and auto loans.

*** Used as a basis for determining mortgage rates.

AVERAGE 30-YEAR FIXED MORTGAGE RATE:

⬆︎ 6.75%

One week ago: 6.72%, one month ago: 6.82%, one year ago: 6.77%

Data courtesy of: Freddie Mac Primary Mortgage Market Survey

FEDWATCH INTEREST RATE TOOL:

Where will the Fed Funds interest rate be after the next rate-setting meeting on July 30th?

Unchanged from now .. ⬆︎ 95% probability (93% a week ago)

0.25% lower than now .. ⬇︎ 5% probability (7% a week ago)

What is the most commonly-expected number of remaining 0.25% Fed Funds interest rate cuts in 2025?

⬌2 (unchanged from a week ago)

All data based on the Fed Funds interest rate (currently 4.33%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

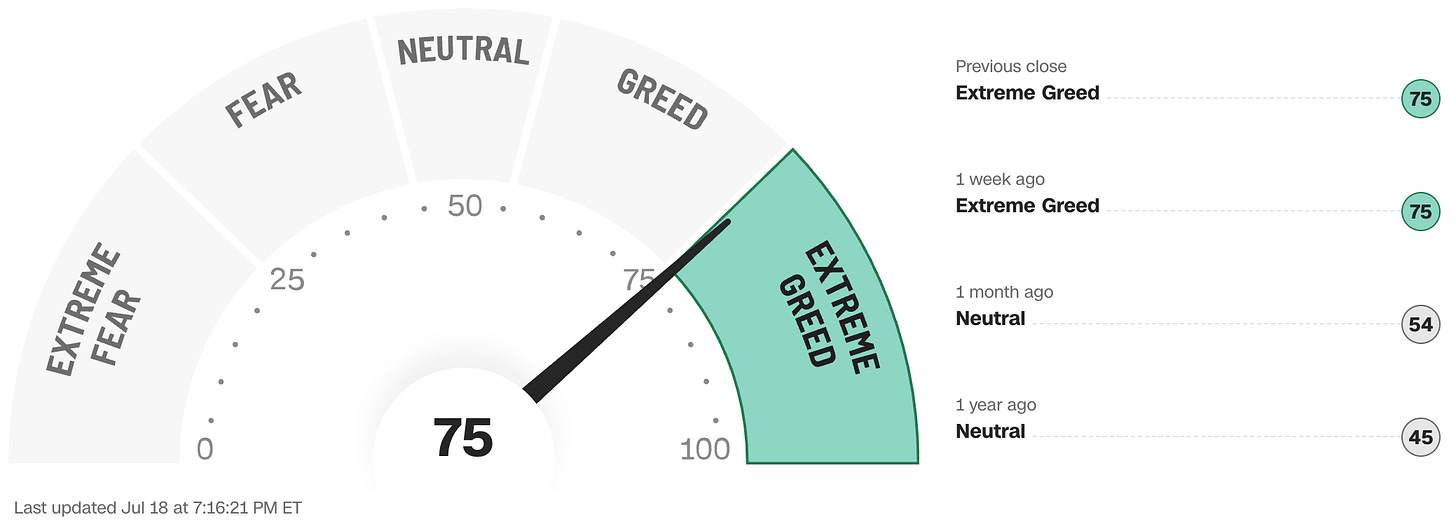

FEAR & GREED INDEX:

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

Note: Anglia Advisors has updated its Privacy Policy. You can view the new version here.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any financial decisions, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any other Anglia Advisors published content.

Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No client advice may be rendered by Anglia Advisors unless and until a properly-executed Client Engagement Agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone?