Stocks began the week nervously on Monday with tit-for-tat attacks further raising the geopolitical temperature in the Middle East and the resulting continued move higher in oil prices to above $80. Things just grew more dismal as the session wore on with analysts issuing rare downgraded outlooks for both Apple and Amazon. Yet another massive destructive storm began to take aim at Florida, which crushed the prices of insurance company stocks, particularly those with large exposure to the region. The indexes all finished the day significantly lower.

Chinese markets spectacularly crashed off from their recent sugar high after coming back from a week’s holiday on the back of a letdown regarding the next stage of stimulus, dragging European stocks lower. But Wall Street shrugged it off when the bell rang on Tuesday morning and set about trying to repair the previous day’s damage, doing a good job and erasing Monday’s losses with tech leading the charge higher. The energy sector, however, slumped as oil prices reversed sharply lower.

Stocks opened slightly softer on Wednesday following a report that the U.S. Justice Department is considering a breakup of Alphabet/Google, signaling a possible broad antitrust crackdown on Big Tech and more labor trouble at crisis-hit Boeing. The mood improved as the session went on with eyes on the CPI inflation numbers the next day and PPI the day after.

The minutes from the previous Fed rate-setting meeting were released in the afternoon and we learned that there had been pretty robust debate at the meeting between the Half-Point Cutters and the Quarter-Pointers and that the decision to go with the half point reduction was a lot tighter than it initially appeared. Stocks were too busy rallying hard to take much notice though and the S&P 500 closed at its 44th all-time record high of the year.

The Consumer Price Index (CPI) measure of retail inflation for September was released pre-market on Thursday. It came in a touch hotter than expected at an annualized rate of +2.4%. Weekly jobless claims spiked much higher to +258k, but temporary distortions due to Hurricane Helene were likely a major factor and that could also be repeated with this week’s data because of Milton as well as the labor dispute at Boeing. Stocks initially drifted a little lower in response and stayed depressed during what was a bland session overall.

Friday began with the release of the Producer Price Index (PPI) measure of wholesale inflation experienced by manufacturers which contrasted with CPI by coming in a touch cooler than expected; prices were unchanged over the month of September and +1.8% annualized rate.

Q3 earnings season kicked off with sparkling reports from JP Morgan, Wells Fargo, Blackrock and Bank of New York Mellon but after Elon Musk gave a typically awkward, evasive and detail-light report on Tesla’s “Cyber-Cab” plans (remember, he once promised that a million of them would be on the road by 2020) which totally underwhelmed Wall Street and the stock was severely punished.

The solid earnings news from the financial names plus the PPI number mostly neutralizing the slight concerns raised by CPI the day before sent all the indexes floating higher (led by Small Caps) and the S&P 500 closed the week at all-time record high #45 of the year.

There is a lot of noise out there right now and it’s going to stay that way with the election less than a month away. The best way to cut through that noise and not get distracted by scary and unsettling headlines is to stay focused exclusively on the three key drivers of this market: 1) economic soft landing, 2) Fed interest rate cuts and 3) stable earnings. As long as news regarding those items stays positive, stocks could well remain resilient.

Stable economic growth remains, by far, the most important influence on this market and as long as growth is solid, that’s a major support for stocks even at these high valuations.

On the Fed, market expectations are volatile as investors consistently talk themselves into more aggressively-interest-rate-cutting Fed policy, but it’s a trap to get caught up in that. The best-case scenario for investors is consistent but measured set of rate cuts that support stable growth.

Earnings reports remain somewhat mixed but they simply aren’t bad enough to offset solid growth or Fed rate cuts. Looking forward, earnings will be a much bigger focus of markets over the next three weeks and the key here is not so much the backward-looking sales and revenue data, but forward-looking guidance. Unless this guidance is much worse than expected and is so bad that it offsets the positives of solid growth and steady interest rate cuts, earnings reports of themselves are unlikely to be the main cause of any pullback.

OTHER NEWS ..

Hindenburg is back .. The latest target of Hindenburg, the research firm whose reports have recently rocked shares of firms owned by billionaire-investor Carl Icahn, India's Gautam Adani, as well as AI-server maker Super Micro Computer for exposed financial shenanigans is Roblox, the gaming platform popular among young children.

Hindenburg found that Roblox lied to investors, regulators, and advertisers about the number of people on its platform, inflating the key metric by 25-42% by deliberately conflating daily active users with the number of people simply visiting its site and also counting bots as legit users. The firm was also accused of failing to protect child gamers from an apparently large presence of in-game pedophile predators. After the report was published on Tuesday, Roblox stock plunged 10% in a matter of minutes.

Crypto Fraud Has Not Gone Away .. Three cryptocurrency companies and about a dozen individuals were charged with market manipulation and fraud as part of a wide-ranging investigation by U.S. authorities that included setting up a fake crypto firm and over 60 effectively non-existent cryptocurrencies. ZM Quant, CLS Global and MyTrade all conspired to make fake trades to boost the price and appearance of activity of the made-up tokens, according to federal prosecutors in Boston.

Distortions Coming .. Two massive hurricanes and (albeit brief) East Coast port closures during the studied period will likely impact upcoming economic data. While this will need to be taken into account when looking at imminent economic numbers, distortions can continue long into the future since such events can trigger later rebuilding activity, increased insurance costs to consumers and localized inflation.

ARTICLE OF THE WEEK ..

Josh Brown and I share the same investment principles and the same things annoy us both. But Josh is also a much better writer than me and he explains it all really well here.

THIS WEEK’S UPCOMING CALENDAR ..

Q3 earnings season ramps up this week, with nearly one in ten S&P 500 companies scheduled to report including Netflix, Taiwan SemiConductor, American Express, Bank of America, Citigroup, Goldman Sachs Group, Morgan Stanley, Proctor & Gamble, Johnson & Johnson, United Airlines Holdings, UnitedHealth Group, ASML Holding, Walgreens Boots Alliance and Prologis.

On Thursday, the European Central Bank (ECB) is expected to deliver its third 0.25% interest rate cut since June, taking its benchmark rate target to 3.25%.

Most of the economic data to watch this week is housing-related but we will also see the latest Retail Sales report on Thursday.

LAST WEEK BY THE NUMBERS ..

Last week’s market color courtesy of finviz.com

Last week’s best performing U.S. sector: Technology (two biggest holdings: Apple, Nvidia) - up 2.2% for the week.

Last week’s worst performing U.S. sector: Utilities (two biggest holdings: NextEra Energy, Southern Co.) - down 2.8% for the week.

SPY, the S&P 500 Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from among the largest U.S. companies. Its price rose 1.0% last week, is up 21.9% so far this year and ended the week at a new all-time record closing high.

IWM, the Russell 2000 Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a group made up from among 3,000 largest U.S. stocks. Its price rose 0.9% last week, is up 10.2% so far this year and ended the week 8.8% below its all-time record closing high (11/08/2021).

AVERAGE 30-YEAR FIXED MORTGAGE RATE ..

6.32%

One week ago: 6.12%, one month ago: 6.20%, one year ago: 7.57%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

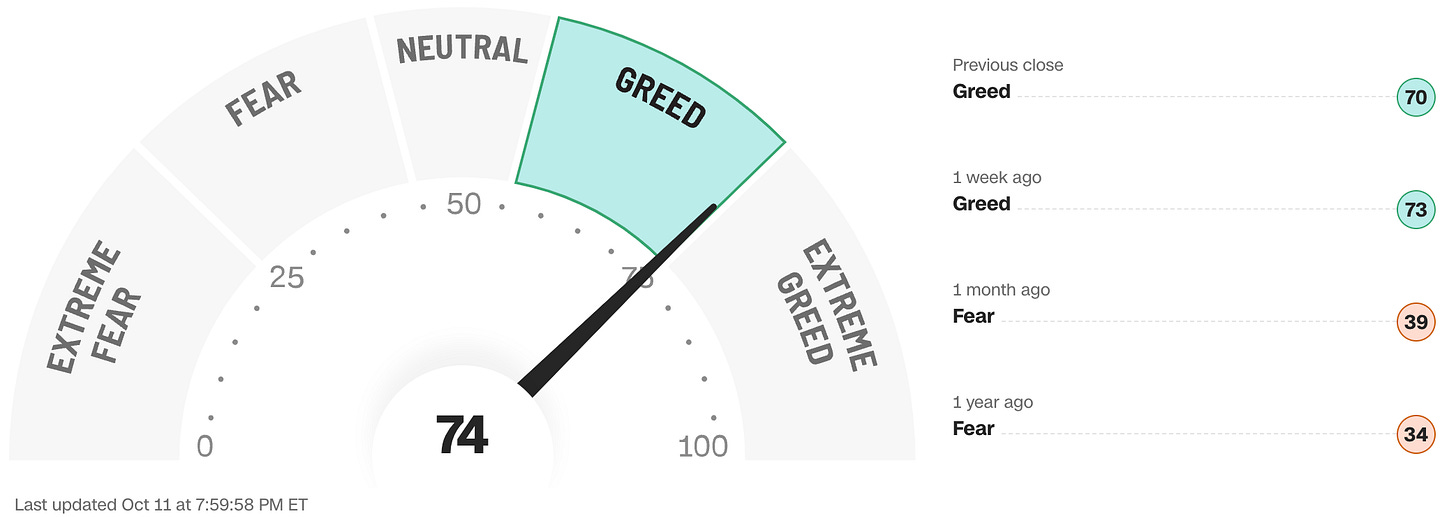

FEAR & GREED INDEX ..

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

FEDWATCH INTEREST RATE TOOL ..

Where will interest rates be after the Fed’s next meeting on November 7th?

Higher than now .. 0% probability (0% a week ago)

Unchanged from now .. 11% probability (7% a week ago)

0.25% lower than now .. 89% probability (93% a week ago)

0.50% lower than now .. 0% probability (0% a week ago)

All data based on the Fed Funds interest rate (currently 4.875%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

% OF S&P 500 STOCKS TRADING ABOVE THEIR 50-DAY MOVING AVERAGE:

75% (374 of the S&P 500 stocks ended last week above their 50D MA and 126 were below)

One week ago: 74%, one month ago: 65%, one year ago: 32%

% OF S&P 500 STOCKS TRADING ABOVE THEIR 200-DAY MOVING AVERAGE:

77% (383 of the S&P 500 stocks ended last week above their 200D MA and 117 were below)

One week ago: 76%, one month ago: 69%, one year ago: 43%

Closely-watched measures of market breadth and participation, providing a real-time look at how many of the S&P 500 index stocks are trending higher or lower, as defined by whether the stock price is above or below their more sensitive 50-day (short term) and less sensitive 200-day (long term) moving averages which are among the most widely-followed of all stock market technical indicators.

The higher the reading, the better the deemed health of the overall market trend, with 50% considered to be a key pivot point. Readings above 90% or below 15% are extremely rare.

WEEKLY US INVESTOR SENTIMENT (outlook for the upcoming 6 months) ..

↑Bullish: 49% (46% a week ago)

⬌ Neutral: 30% (27% a week ago)

↓Bearish: 21% (27% a week ago)

Net Bull-Bear spread: ↑Bullish by 28 (Bullish by 19 a week ago)

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

Survey participants are typically polled during the first half of the week.

Data courtesy of: American Association of Individual Investors (AAII).

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any financial decisions, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind.

Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No advice may be rendered by Anglia Advisors unless or until an executed Client Engagement Agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?