New features in the report (see below):

- Weekly updates on the latest official average 30 year fixed mortgage rate with comps going back one week, one month and one year

- FedWatch Tool information: What the latest important market expectations are on interest rates with comps going back one week and one month

Federal Reserve Chairman Jerome Powell basically killed risk appetite on Tuesday with a change of tone on inflation in remarks before the Senate Banking Committee. Not for the first time, he contradicted previous statements he has made recently, stating that the central bank may now have to both speed up the pace and increase the size of interest rate hikes in order to get inflation in check. Powell also told the panel the “ultimate level of interest rates is likely to be higher than previously anticipated”.

JP’s comments to Congress sent stock prices crashing and drove the interest rate yield on the two-year Treasury note up above 5% for the first time since Fergie took the rather debatable position that girls don’t cry in 2007 and the ten-year rate pushed right up against 4%. That differential between those two rates shifted to the steepest it has been in over 40 years.

On the other hand, did Powell really say anything so controversial or unexpected? I don’t think so. His tone change was entirely predictable given that recent economic data and earnings reports/guidance is completely inconsistent with inflation heading back to the Fed’s target of 2% anytime soon. He didn’t really say anything that should have come as a total shock to anyone, let alone market professionals; potential peak interest rates of now around 5.6% and now a very meaningful possibility of a half a point rate rise at the next Fed meeting (see below).

He even made a bit of a lukewarm attempt to partly take the edge off Tuesday’s comments by stating on Wednesday, in reference to the possibility of a 0.50% hike later this month instead of 0.25%, that “I stress that no decision has yet been made on this".

Once again, the constantly over-exuberant stock market was caught offside by such remarks. The sharply negative immediate stock and bond market reaction on Tuesday was really a result of the final evaporation of January’s excessive optimism that had been brought about by a now-discredited fantasy about pivots and pauses that the market had spun for itself.

When the Jobs Report finally came out pre-market on Friday morning, it showed the creation of an additional 311k jobs in February, vs the expected number of 215k. There was a downward revision of January’s shock blockbuster number of $517k as expected, but only by 13k, although December’s number was also revised down, from 260k to 239k. However, the unemployment rate unexpectedly bumped up to 3.6% from the half-century lows of 3.4%, as layoffs ticked up and more workers re-entered the workforce. Average hourly earnings only rise slightly and below expectations.

This was initially viewed as a “hot, but not too hot” report and the negative stock market reaction was relatively muted to yet another huge rise in jobs filled (but still about 180k less than the previous month), but a surprise increase in the unemployment rate. Both two and ten year Treasury interest rates actually eased lower from their highs earlier in the week after the report came out.

What pushed the market down hard on Friday afternoon was not really a reaction to the Jobs Report, which was quickly overshadowed by banking sector fears brought about by high profile bank failures, which I go into deeper below in OTHER NEWS .. Crypto and tech banking woes edition.

The market probability of the Fed raising interest rates by a half percent at its next meeting ending on March 22nd instead of the originally highly-expected quarter percent initially exploded right after Powell’s comments on Tuesday from 31% to 72% according to the CME FedWatch tool. It fell back a bit to close the week at 68% but a 0.50% rise in rates next time out is now very much a majority opinion and a huge rise in likelihood from a month ago when its probability reading was just 9%.

By the way, it is becoming increasingly clear that the CME FedWatch tool data (which I now include in this report every week, see below) is just about the most important source of information out there right now when it comes to trying to figure out crucial information about what financial markets are really thinking about interest rates and how traders are positioning themselves.

This year is going to be all about economic growth, and if that rolls over, so will the stock market. Stocks may have proven themselves resilient to more than previously-expected rate hikes, but I remain concerned they will not be immune to the eventual impact of these rate hikes. Put more plainly, stocks may have already discounted somewhat higher interest rates, but they have not fully discounted the effects of a recession that higher-for-longer interest rates might unleash upon the economy.

Beyond growth, the other massive red flag will be if the Fed indicates that it will raise rates substantially above the latest 5.6-ish% market estimate for peak (terminal) interest rates. For practical purposes, I now believe that means 6.0% or higher. If the Fed signals that’s where the Fed Funds rate is going, that will hit stocks, very possibly hard enough to test the October 2022 lows.

The market does not yet believe that we are even close to a world with a 6.0% Fed Funds rate in it (see FedWatch tool, below), but sentiment can change very fast as we have seen lately. Keep a close eye on that FedWatch tool.

OTHER NEWS .. Crypto and tech banking woes edition

The worlds of crypto, Silicon Valley tech and venture capital were all rocked last week when two of the biggest supporting pillars of their universes crumbled to dust.

First, as anticipated in last week’s Angles report, Silvergate Capital (SI), the San Diego-based crypto bank under investigation by regulators, shut itself down, sending even more tremors through an industry that’s been on edge since the collapse of FTX in November last year.

In an eye-rolling example of annoying corporate-speak, the biggest provider of banking, money transfer and exchange services to the entire crypto ecosystem, said in a statement; “In light of recent industry and regulatory developments, Silvergate believes that an orderly wind down of bank operations and a voluntary liquidation of the bank is the best path forward”.

Silvergate’s ties to disgraced Sam Bankman-Fried and his collapsed crypto exchange FTX and hedge fund Alameda Research may be one of the motivations behind the investigations. The firm also announced on its website that it would immediately discontinue its operation of the Silvergate Exchange Network.

Then on Thursday, SVB Financial Group (SIVB), the parent of Silicon Valley Bank, reported that colossal client outflows from the bank had resulted in forced asset sales at huge losses and the stock duly plunged over 60% in a matter of hours.

The so-called “backbone” of tech start-ups and venture capital firms everywhere, but particularly in the Bay Area of San Francisco, made its final journey to the scrap heap on Friday morning when the NASDAQ exchange confirmed the halting of trading in the stock and hours later California state regulators seized control of the wreckage, triggering FDIC insurance payouts to depositors (but limited to $250k each). This is the biggest bank failure since Washington Mutual back in 2008.

With Silvergate and Silicon Valley Bank the latest to fall into the black hole that has already sucked in so many crypto and crypto-adjacent players, fears about contagion within the banking sector rocketed - with early concerns focused on First Republic Bank (FRC), Signature Bank (SBNY), Fifth Third Bancorp (FITB), Truist Financial Corp (TFC) and KeyCorp (KEY), mostly bankers to the high net worth community (see EXPLAINER: FINANCIAL TERM OF THE WEEK below) and with a track record of embracing the crypto eco-system.

The specter of aggressive short sellers sharpening their claws in relation to the stocks of some of these firms probably sent shivers down spines in their boardrooms.

Rather ominously, almost all banking stocks tumbled in “sell now, ask questions later” sympathy with the SIVB news on Thursday and then again in many cases on Friday as well. Many smaller regional banks got hammered even harder than their bigger cousins.

Charles Schwab (SCHW) lost almost a quarter of its value last week, although this appeared to more related to major insider selling of the stock rather than any direct SIVB fallout.

Obviously mutual funds and exchange traded funds (ETFs) that focus heavily or exclusively on the financial sector and have the likes of SI, SIVB, FRC, SBNY, FITB, TFC, KEY, SCHW etc. as major holdings have got badly hurt.

There are now growing fears about the ability of major “stablecoins” Dai and USDC, operated by Circle Internet Financial, to maintain their essential 1-1 pegs to the dollar given their likely exposure to Silicon Valley Bank.

Unsurprisingly, cryptocurrency prices collapsed in response to all this.

UNDER THE HOOD ..

It’s always somewhat significant when Lowry’s Buying Power and Selling Pressure cross over as they did last week when Selling Pressure moved back into a dominant position over Buying Power for the first time since the end of 2022.

Another significant technical milestone reached last week was the S&P 500 moving back down below all of its important moving averages, the 50 day, the 90 day and its long term trend line, which now all change from being support levels in a falling market to resistance levels in the case of any rebound.

One possible silver lining may be that much of last week’s price deterioration was news-driven (Silvergate, Silicon Valley Bank etc.) and news-driven moves tend to be much less sticky than those driven by fundamental shifts in market conditions.

A decent number (but not all) of the technical indicators that have been supportive of a resurgence in stock prices are beginning to break down under pressure from recent meaningful price declines. In other words, a number of the reasons why the market appeared to be healing in January are in the process of being erased.

Volatility, it seems, is back.

Anglia Advisors clients are welcome to reach out to me to discuss market conditions further.

THIS WEEK’S UPCOMING CALENDAR ..

While the fallout from last week’s banking shocks are sure to remain in focus this week (including more clarity on exactly which companies had Silicon Valley Bank deposits that far exceeded FDIC insurance), attention will turn back to inflation on Tuesday before the market opens, when the huge matter of the latest Consumer Price Index (CPI) measure of retail inflation is released.

The expectation is that February CPI will show an increase of 6.0% year-on-year, compared with 6.4% in January. The Core CPI, which excludes volatile food and energy prices, is expected to rise 5.5% year-on-year, fractionally less than last time.

A few stragglers such as Adobe, Fedex, Lennar and Dollar General will report Q4 2022 results as the latest earnings season draws to a close.

On Friday, the University of Michigan releases its latest Consumer Sentiment Index. Forecasts call for a 67.4 reading which would be the highest in more than a year.

AVERAGE 30-YEAR FIXED RATE MORTGAGE ..

6.73%

(one week ago: 6.65%, one month ago: 6.12%, one year ago: 3.85%)

Weekly data courtesy of FRED Economic Data, St. Louis Fed as of Thursday of last week.

US INVESTOR SENTIMENT LAST WEEK (outlook for the upcoming 6 months) ..

↑Bullish: 25% (23% a week ago)

→Neutral: 33% (32% a week ago)

↓Bearish: 42% (45% a week ago)

Net Bull-Bear spread .. ↓Bearish by 17 (Bearish by 22 a week ago)

Source: American Association of Individual Investors (AAII).

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

The highest recorded percentage of AAII bearish sentiment was 70% and occurred on March 5th 2009, right near the end of the Great Financial Crisis. The lowest percentage of AAII bears was recorded at 6% on August 21st 1987, not long before the stock market crash of October 1987.

Weekly sentiment survey participants are usually polled on Tuesdays and/or Wednesdays.

FEDWATCH TOOL ..

How does the market view the probability that interest rates (Fed Funds rate, currently 4.625%) will be at/above the following rates at year-end?

4.75%: At/above 95%-5% Below

(one week ago: 99%-1%, one month ago: 81%-19%)

5.00%: At/above 76%-24% Below

(one week ago: 93%-7%, one month ago: 47%-53%)

5.25%: At/above 40%-60% Below

(one week ago: 69%-31%, one month ago: 15%-85%)

5.50%: At/above 11%-89% Below

(one week ago: 31%-69%, one month ago: 2%-98%)

5.75%: At/above 1%-99% Below

(one week ago: 7%-93%, one month ago: 0%-100%)

What are the latest market expectations for what the Fed will announce re: interest rate changes (Fed Funds rate) on March 22nd after its next meeting?

32% probability of a 0.25% increase

(one week ago: 69%, one month ago: 91%)

68% probability of a 0.50% increase

(one week ago: 31%, one month ago: 9%)

Data courtesy of CME FedWatch Tool. Calculated from Federal Funds futures prices as of market close on Friday.

LAST WEEK BY THE NUMBERS ..

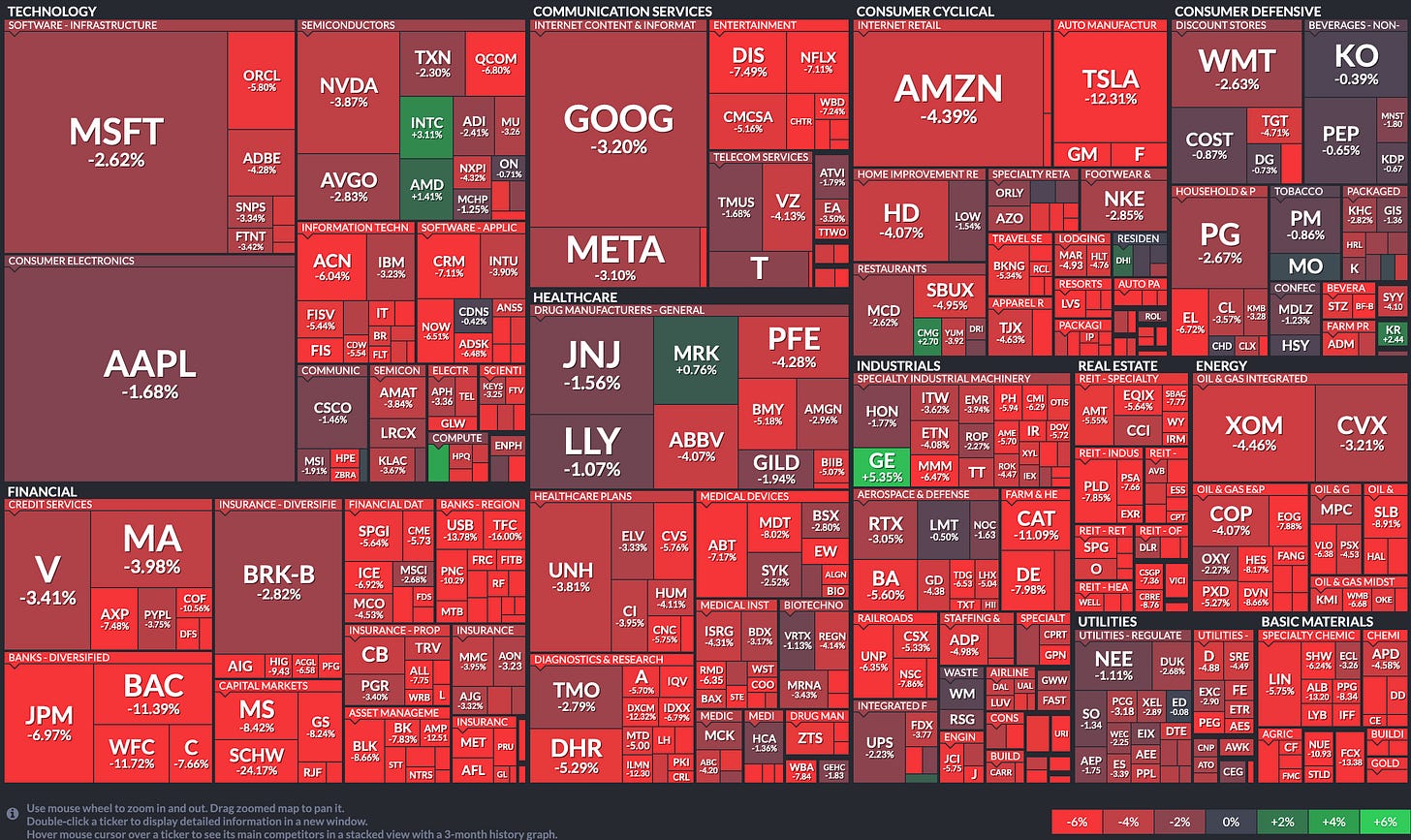

Last week’s market color courtesy of finviz.com:

- Last week’s best performing US sector: Consumer Defensive (two biggest holdings: Proctor and Gamble, Pepsico) - down 2.0% for the week

- Last week’s worst performing US sector: Financials (two biggest holdings: Berkshire Hathaway, JP Morgan Chase) - down 8.3% for the week

- The proprietary Lowry's measure for US Market Buying Power is currently at 141 and fell by 21 points last week and that of US Market Selling Pressure is now at 157 and rose by 21 points over the course of the week. Selling Pressure last week moved back into a dominant position over Buying Power.

- SPY, the S&P 500 ETF, fell back below its 50-day and 90-day moving averages and also fell below its long term trend line. SPY ended the week 16.4% below its all-time high (01/03/2022).

- QQQ, the NASDAQ-100 ETF, fell back below its 50-day moving average but remains just above its 90-day. It also fell back below its long term trend line. QQQ ended the week 22.2% below its all-time high (11/19/2021).

- VIX, the commonly-accepted measure of anticipated stock market risk and volatility (often referred to as the “fear index”), implied by S&P 500 index option trading, ended the week 3.1 higher at 24.8. It is now above both its 50-day and 90-day moving averages and last week moved above its long term trend line for the first time since October of last year.

ARTICLE OF THE WEEK ..

If you’re looking to build wealth and financial stability, diversifying your streams of income can be a powerful strategy. By generating multiple sources of revenue, you can reduce your reliance on any single income stream and increase your earning potential over time. This article by Nick Magiulli explores seven different streams of income that can help achieve financial independence and build long-term wealth.

EXPLAINER: FINANCIAL TERM OF THE WEEK ..

A weekly feature using information found on Investopedia to try to help explain Wall Street gobbledygook (may be edited at times for clarity).

The term “high-net-worth individual” (HWNI) refers to a financial industry classification denoting an individual with liquid assets above a certain figure. People who fall into this category generally have at least $1 million in liquid financial assets.

The assets held by high-net-worth individuals are usually easily liquidated and would include things like their primary residence or fine art. HNWIs often seek the assistance of financial professionals in order to manage their money. Their high net worth often qualifies these individuals for additional benefits and opportunities.

Individuals are measured by their net worth in the financial industry. Although there is no precise definition of how wealthy someone must be to fit into this category, high net worth is generally quoted in terms of having liquid assets of a particular number.

The exact amount differs by financial institution and region but usually refers to people with a net wealth of seven figures or more. As noted above, people who fall into this category have more than $1 million in liquid assets, including cash and cash equivalents. These assets do not include things like personal assets and property such as primary residences, collectibles, and consumer durables.

HNWIs are in high demand by private wealth managers. The more money a person has, the more work it takes to maintain and preserve those assets. These individuals generally demand (and can justify) personalized services in investment management, estate planning, tax planning, and so on.

As such, a high-net-worth individual classification generally qualifies people for separately managed investment accounts instead of regular mutual funds. This is where the fact that different financial institutions maintain varying standards for HNWI classification comes into play. Most banks require that a customer have a certain amount in liquid assets and/or a certain amount in depository accounts with the bank to qualify for special HNWI treatment.

HNWIs are also given more benefits than those whose net worth falls under $1 million. They may qualify for:

Services with reduced fees

Discounts and special rates

Access to special events

As a high-net-worth individual (HNWI), you may qualify for banking, investment, and other financial services with reduced fees, discounts, and special rates, along with access to special events or perks. Some financial institutions may offer you personalized services in investment management, estate planning, and tax planning, among other things. Your wealth may also allow you to take part in initial public offerings (IPOs) and invest in startups that demonstrate financial potential.

HNWIs may, too, be able to invest in hedge funds, which are generally only open to accredited investors who meet certain criteria, including a minimum net worth requirement. HNWIs may also have access to private equity (PE) and venture capital (VC) funds, which are typically not available to the general public. Additionally, HNWIs may be able to invest in real estate and other alternative assets that are not as easily accessible to the general public.

These benefits and opportunities may vary depending on the financial institution and region.

Almost 63% of the world's HNWI population lives in the United States, Japan, Germany, and China, according to the Cap Gemini World Wealth Report. The US had about 7.5 million HNWIs in 2021.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (929) 677 6774 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing data at a specific point in time and is always subject to change at any time. No warranty of its accuracy is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any kind of investment decision. The user assumes the entire risk of any actions taken based on the information provided in this or any Anglia Advisors communication of any kind. Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such.

Posts may contain links or references to third party websites for the convenience and interest of readers. While Anglia Advisors may have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols the sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them and making any use of any information provided therein.

Clients and those associated with Anglia Advisors may maintain positions in securities and asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?