Fears of an imminent destructive recession and hopes of any interest rate cuts in 2023 are evaporating in equal measure, with each narrative pulling markets in opposite directions.

We learned last week that the Fed was apparently a lot less united at its recent interest rate-setting June meeting than the announced unanimous decision suggested. According to the minutes of that gathering released on Wednesday, some officials favored another quarter-point increase right then and there, but eventually went along somewhat reluctantly with a decision to pause the hikes.

Nearly all members of the rate-setting committee appeared to agree that additional rate increases would likely be needed this year, as the majority still believe there will be recession, albeit a mild one, at some point in the next year or so. The key takeaway? More interest rate hikes are coming, likely starting with the next meeting in a couple of weeks time. More on this later.

Stock markets are pricing in a continued drop in inflation and are not pricing in a meaningful slowdown in growth. Therefore, it logically follows that “stagflation” (stubbornly high inflation in a contracting economy) is the biggest kryptonite for stock prices since it would undermine all the “glass is half full” reasons for the recent rally.

So going into Friday’s Jobs Report, the greatest fear was that it could be stagflationary in nature. What would such a nightmare report look like? ..

very low job adds (an increase of 100k or below) - implying hiring is slowing,

the lack of a material increase in the unemployment rate (staying in the mid 3% area or lower) - which would keep the Fed hawkish and likely to continue raising rates higher for longer,

an increase in wage growth (5% or above) - which would imply a possible bounce back in inflation.

We got a hint on Thursday morning from the ADP private sector-only jobs report which showed more than double the expected level of job creation in June. We also learned from the Job Openings and Labor Turnover Survey (JOLTS) that job cuts by US employers have now fallen to an eight-month low and the quits rate rose by the most in nine months, indicating workers still feel confident in their ability to secure another job and that reports of the end of the Great Resignation were highly exaggerated.

In a perfect example of the lack of room there is for any kind of disappointment that I mentioned in last week’s report, Thursday’s “pre-game” employment data sent stocks plunging and market interest rates surging on Thursday as the higher-for-longer interest rate storyline was strongly bolstered.

But when the real thing came out in the form of the Jobs Report on Friday morning before the market opened, it was reasonably Goldilocks with:

209k jobs added and a downward review of the previous month’s number,

a slight fall to a 3.6% unemployment rate, and

unchanged 4.4% wage growth.

However, the stock market went on to suffer further losses on Friday, albeit less dramatic than the day before.

It’s now pretty much case-closed for a definite quarter-point interest rate hike on July 26th after the next Fed meeting (93% probability - see FEDWATCH INTEREST RATE PREDICTION TOOL below) and the odds of an immediate follow-up second hike at the following meeting in September are now rising fast (up from nowhere to 24%).

We no longer have the cushion of low expectations provided by the very negative sentiment that we had at the beginning of the year. There now seems to be a broad assumption that stocks will move higher, a very different environment indeed.

Above 4,400 the S&P 500 has fully priced in a lot of good news (it closed on Friday at 4,399) and is also rather stretched from a valuation standpoint.

So, while the major indexes’ market momentum (see EXPLAINER: FINANCIAL TERM OF THE WEEK below) continues to be higher, it’s important to be aware that if economic data and the state of Q2 earnings which start coming out this week (see THIS WEEK’S UPCOMING CALENDAR below) do suddenly turn negative (keep an eye on this weekly report for any signs that this may be the case) then there’s very little support for this market between here and at least 10% lower.

OTHER NEWS ..

Zuckerberg And Musk Face Off .. Mark Zuckerberg’s Meta/Facebook brought forward the launch of Threads, its “Twitter-Killer” micro-blogging social media site which cross-functions within Instagram, with an impressive sign-up rate of 75 million users in the first 48 hours (and that’s with it not even being available in Europe yet) and a lot of advertiser interest. The timing is smart with Twitter users growing more and more dissatisfied with the chaos on the site and open to something new following Elon Musk’s constant meddling with the platform’s features and vetting policies and the huge spike in both technical problems and trashy and toxic content since his takeover.

As The Wall Street Journal put it; “If you’re wondering what it’s like to use the new Threads app, just close your eyes and picture Twitter but with a lot less Elon Musk — and that’s exactly the point.”

Cash Is King In NYC .. More Manhattan property buyers are paying cash than at any other time on record as mortgage rates soar. According to a report on Bloomberg, about two-thirds of all purchases in Q2 2023 were completed without financing, the largest share since the tracking of payment methods began in 2014.

In the luxury tier (the top 10% of the market) the median price for Manhattan deals that closed in the quarter was $6.7 million, up 4% from a year earlier. Across all price ranges, properties traded at a median price of $1.2 million, down 4% from a year ago.

New Yorkers Can’t Catch A Break ... New York City’s air quality dropped once again to unhealthy levels on Wednesday. Instead of Canadian wildfires, however, Fourth of July fireworks and summer pollution were the main culprits this time. Those who managed to escape the city were just as unlucky, as sharks decided to join the rich and famous in hitting the Hamptons for the extended holiday break. Bloomberg reported that five swimmers are suspected to have been bitten.

UNDER THE HOOD ..

The gap between the “Haves” and “Have Nots” is still very distinct in the US stock market. As in most societies, there are far more Have Nots than Haves but the Haves are doing very nicely, thank you very much.

Broad-based Demand, not selective strength, is what drives bull markets, especially at turning points in the cycle. To date, from their respective October lows, the S&P 500 Large Cap Index is up 23% the NYSE Composite Index (which covers all stocks trading on the New York Stock exchange regardless of company size) rose just over 16%, while the S&P 600 Small Cap Index has gained less than 13%.

Another reason for skepticism is that all these gains have also been accomplished on relatively low trading volume, indicating something of a lack of enthusiasm and urgency among buyers.

These cross-currents are very atypical of the dawn of a new bull market, but are very common in unhealthy advances that tend to flame out before becoming sustainable long term turnarounds and caution is still warranted unless or until sustained and powerful broad-based Demand emerges.

The rally from the October 2022 lows embodies technical characteristics inconsistent with a new bull market (as I keep saying over and over). Despite these facts, some may still ask whether it is possible that “this time things could be different?” Exceptions are always possible, but frankly, not probable. And technical analysis (indeed stock market strategy in general) is simply a business of probabilities.

Anglia Advisors clients are welcome to reach out to me to discuss market conditions further.

THIS WEEK’S UPCOMING CALENDAR ..

And they’re off!! .. Q2 earnings season begins this week including several large US banks set to report and then from there, we'll have weeks of corporate data to digest.

Citigroup, JPMorgan Chase, and Wells Fargo will be this week's big banking earnings announcements. Pepsico, UnitedHealth Group, Delta Airlines, Blackrock, State Street, Conagra, Cintas and Fastenal are among the others who will also report this week.

The economic data highlight of the week will be Wednesday’s Consumer Price Index (CPI) measure of retail inflation for June. Consensus estimates call for a fall to a 3.1% year-on-year rate of headline inflation, with the more closely-watched Core CPI rate seen rising at a 5.0% clip year-on-year. Both would be the slowest rates of inflation since 2021.

CPI’s sidekick, the Producer Price Index (PPI) measure of wholesale inflation experienced by manufacturers for June will be released the next day.

Other data out this week include a pair of sentiment indicators; the Small Business Optimism Index and the Consumer Sentiment Index.

LAST WEEK BY THE NUMBERS ..

Last week’s market color courtesy of finviz.com

Last week’s best performing US sector: Real Estate (two biggest holdings: Prologis, American Tower) - up 0.3% for the week.

Last week’s worst performing US sector: Healthcare (two biggest holdings: United Health Group, Johnson & Johnson) - down 2.8% for the week.

The proprietary Lowry's measure for US Market Buying Power is currently at 157 and fell by 8 points last week and that of US Market Selling Pressure is now at 130 and rose by 2 points over the course of the week.

SPY, the S&P 500 Large Cap ETF, is made up of the stocks of the 500 largest US companies. It remains above its 50-day and 90-day moving averages and above its long term trend line with a RSI of 58**. SPY ended the week 8.2% below its all-time high (01/03/2022).

IWM, the Russell 2000 Small Cap ETF, is made up of the bottom two-thirds in terms of company size of the group of the 3,000 largest US stocks. It remains just above its 50-day and 90-day moving averages and above its long term trend line with a RSI of 60**. IWM ended the week 23.8% below its all-time high (11/05/2021).

** RSI (Relative Strength Index) above 70: technically overbought, RSI below 30: technically oversold

The VIX, the commonly-accepted measure of expected upcoming stock market risk and volatility (often referred to as the “fear index”) implied by S&P 500 index option trading, ended the week 1.2 points higher at 14.8. It remains below its 50-day and 90-day moving averages and below its long term trend line.

AVERAGE 30-YEAR FIXED RATE MORTGAGE ..

6.81%

(one week ago: 6.71%, one month ago: 6.71%, one year ago: 5.30%)

Data courtesy of: FRED Economic Data, St. Louis Fed as of Thursday of last week.

AAII INVESTOR SENTIMENT (outlook for the upcoming 6 months) ..

↑Bullish: 46% (42% a week ago)

↔ Neutral: 29% (31% a week ago)

↓Bearish: 25% (27% a week ago)

Net Bull-Bear spread: ↑Bullish by 21 (Bullish by 15 a week ago)

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

Weekly sentiment survey participants are usually polled on Tuesdays and/or Wednesdays.

Data courtesy of: American Association of Individual Investors (AAII).

FEAR & GREED INDEX ..

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven different indicators that measure some aspect of stock market behavior. They are market momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with a sense of “FOMO” and investors chasing rallies in an excessively risk-on environment, possibly leaving the market vulnerable to a sharp downward correction at some point.

Data courtesy of CNN Business.

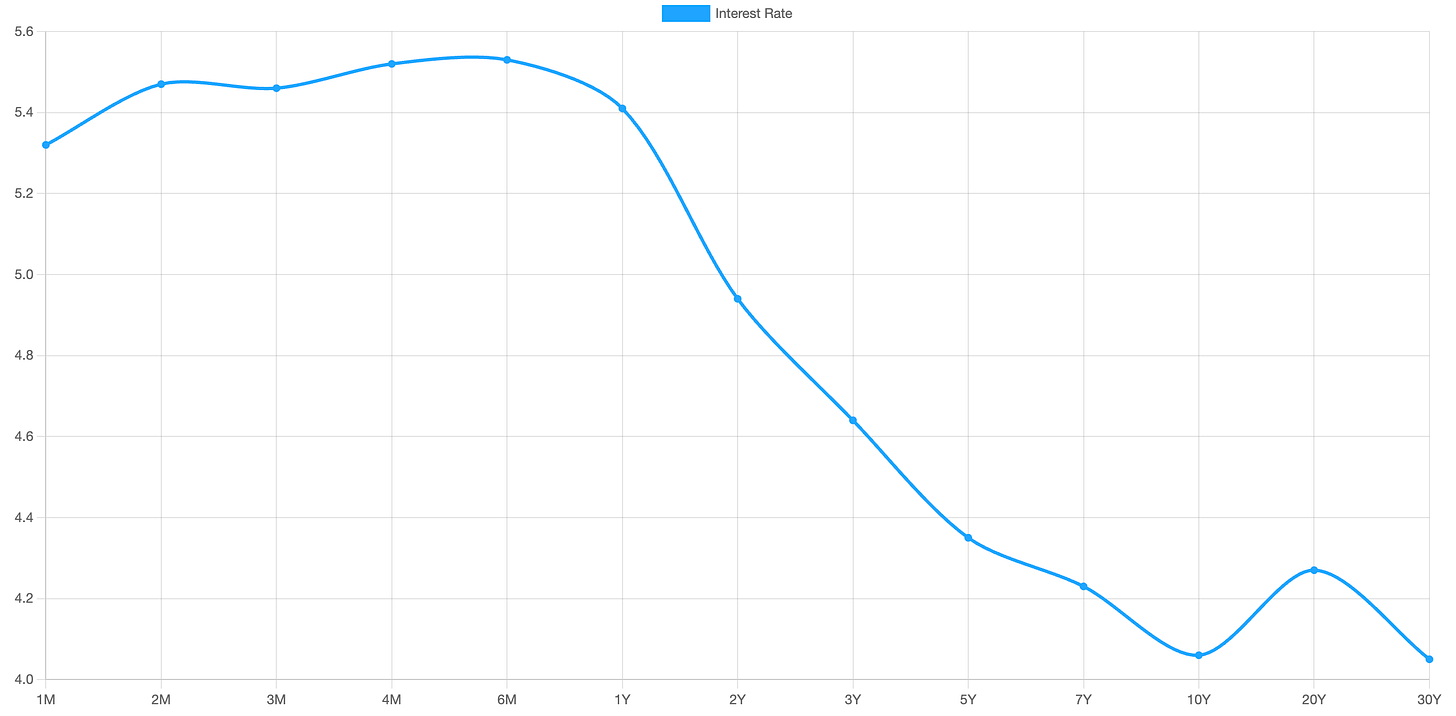

US TREASURY INTEREST RATE YIELD CURVE ..

The interest rate yield curve remains “inverted” (i.e. shorter term interest rates are generally higher than longer term ones) with the highest rate (5.53%) being paid currently for the 6-month duration and the lowest rate (4.06%) for the 10-year.

The closely-watched and most commonly-used comparative measure of the spread between the 2-year and the 10-year last week fell from 0.96% to 0.88%, indicating a flattening of the inversion of the curve during the last week.

Historically, an inverted yield curve has been regarded as a leading indicator of an impending recession, with shorter term risk deemed to be unusually higher than longer term. The deeper the inversion, the greater the deemed risk of recession.

The curve has been inverted since July 2022 based on the 2 year vs. 10 year spread.

Data courtesy of ustreasuryyieldcurve.com as of Friday.

FEDWATCH INTEREST RATE PREDICTION TOOL ..

What are the latest market expectations for what the Fed will announce re: interest rate changes (Fed Funds rate, currently 5.125%) on July 26th after its next meeting?

↔ No change .. 7% probability

(one week ago: 16%, one month ago: 35%)

↑ 0.25% increase .. 93% probability

(one week ago: 84%, one month ago: 65%)

Where will interest rates (Fed Funds rate, currently 5.125%) be at the end of 2023?

↓ Lower than now .. 1% probability

(one week ago: 1%, one month ago: 37%)

↔ Unchanged from now .. 11% probability

(one week ago: 14%, one month ago: 38%)

↑ Higher than now .. 88% probability

(one week ago: 85%, one month ago: 25%)

Data courtesy of CME FedWatch Tool. Calculated from Federal Funds futures prices as of Friday.

ARTICLE OF THE WEEK ..

EXPLAINER: FINANCIAL TERM OF THE WEEK ..

A weekly feature using information found on Investopedia to try to help explain Wall Street gobbledygook (may be edited at times for clarity).

Momentum is the rate of acceleration of a security's price—that is, the speed at which the price is changing. Market momentum refers to the aggregate rate of acceleration for the broader market as a whole.

Market momentum can be used as a measure of overall market sentiment that can support buying and selling with and against market trends. It is one of several indicators that can help an investor to follow price trends.

Generally, market momentum can be defined from the following equation:

M =V−Vx

where V = the latest price and Vx = the closing price x number of days ago

This equation can lead to the drawing of a trend line with varying periods used in the calculation.

Positive momentum can indicate a potential bullish trend while negative momentum can indicate a bearish trend. Broadly, momentum can be measured across both asset classes and individual securities, with market momentum, in particular, referring to the overall market.

Momentum trading is a strategy that seeks to capitalize on the momentum to enter a trend as it is picking up steam. In equities, broad market increases in corporate profits can help to create positive price momentum. In fixed income, falling interest rates can be a catalyst for price momentum.

In individual securities, market momentum for a particular stock can be driven by several factors. Positive momentum can be the result of increasing revenue, earnings, or sales. Positive momentum can also be influenced by a reduction in a company’s debt obligations and an increase in its projected cash flow.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (929) 677 6774 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing data at a specific point in time and is always subject to change at any time. No warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any kind of investment decision or action. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind. Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors may have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Clients of, and those associated with, Anglia Advisors may maintain positions in securities and asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?