The market’s positive momentum from the end of the previous week followed through into Monday after a generally quiet weekend on the newswires and with the stock market open but bond markets closed for Columbus Day, trading volume was weak. Prices across the board were bolstered by Fed-speak from a number of committee members and senior officials that was generally pro-steady interest rate cuts. We hit a landmark at the close, there have now been as many new all-time record closing highs this year for the S&P 500 as there have been presidencies in the history of the United States (46).

On Tuesday, Dutch chipmaker ASML Holding’s shares plunged the most in 26 years after it booked only about half the orders that analysts had expected, a startling slowdown for the Dutch company. What made it stranger was that we weren’t supposed to learn that until Wednesday but the high tech firm seemed unable to auto-schedule a press release properly and the information was published a day early (which drew the concerned attention of the regulators). The contagion spread to other names in the sector and, combined with another grim session for energy stocks resulting from the continued swoon in oil prices and some underwhelming earnings reports from UnitedHealth Group (UNH), CVS and Humana, it was a pretty dismal day overall for the indexes.

The financial sector resumed its role as the really bright spot in earnings on Wednesday with Morgan Stanley reporting solid numbers, but United Airlines got in on the act as well with a very positive report. With a reminder that it is actually possible to generate good earnings somewhere other than just in AI, the pendulum swung back in favor of the bulls and stocks ended the day nicely higher.

There was a lot to digest before the opening bell in New York on Thursday morning. The European Central Bank (EBC) duly cut interest rates for the third time this year by 0.25% as expected in an attempt to counter sluggish growth in the region. U.S. Retail Sales rose by more than expected and Weekly Jobless Claims came in way below the expected number.

These data points reinforced the extraordinary strength of the economy right now, so much so that some are now even beginning to question whether any kind of interest rate cut at all is needed at the next Fed meeting in November. We’ve come a long way from the assumption of a second consecutive half point cut from a few weeks ago.

Stocks generally liked what they saw and initially shifted higher but enthusiasm was dampened a little by data showing that Industrial Production fell by more than expected. The indexes spent the day slowly drifting back lower again, finishing the session pretty much unchanged from where they opened.

A Netflix earnings beat and very positive forward guidance from the previous evening cheered the market on Friday morning with the stock surging 10% at the open. Apple pitched in with its iPhone 16 launch apparently going down very well in China. Not such good news at CVS who followed up their miserable earnings report by a C-Suite shakeup and the stock spiraled markedly lower. On a big picture level, however, the major indexes moved upwards - led by the NASDAQ - to achieve a sixth straight week of gains, the longest such streak of the year and closing, once again, at new all-time record highs for the S&P 500 and the Dow Jones Industrial Average.

The S&P 500 is closing in on 5,900 and it’s obvious to anyone taking any notice that at that level the market is making no allowance whatsoever for any kind of growth slowdown. And to be fair, the economic data recently has been far better than expected and has strongly supported this uber-optimism.

A soft landing remains, by far, the most likely outcome for the economy as important economic data has strengthened across multiple fronts over the past month. It’s not an exaggeration to say this is as positive as the economy has looked all year.

What is of concern to some people is not so much that there is an increasing likelihood of any upcoming growth disappointments (there isn’t), but the extent of the damage that could be done to stock prices if such disappointments were to end up happening at some point, since the market is strongly assuming that they simply won’t come to pass and is very much priced accordingly. There is no buffer at all against evidence of any kind of growth setback. That’s why each piece of major economic data needs to be closely watched.

OTHER NEWS ..

Pension Rankings .. The Netherlands retained its title as the world’s top pension system in an annual international index, which warned that too many people globally are retiring without enough guidance on how to make their savings last. Iceland and Denmark came in second and third respectively.

The report, which rates retirement systems based on their adequacy, sustainability and integrity, said while those at the top are performing well, there are demographic challenges for pensions worldwide. “We’re just not having babies and we’re living longer,” David Knox, the report’s lead author, said.

The U.S., as usual, did terribly and ranked 29th out of 48, behind most of Western Europe, parts of Asia and Canada and Mexico.

Expensive Magic .. Walt Disney Co. is increasing ticket prices for its two Southern California theme parks by about 6% on most days. The most expensive tickets (typically weekends and holidays) are climbing over 6% to $206 per day. The lowest-priced admission, available for at least 15 days in January and February, will stay at $104, unchanged since 2019.

However, for a cool $400 per person, guests at Disney theme parks can skip the long lines at popular attractions such as the Indiana Jones and Star Wars: Rise of the Resistance rides. Resorts in Southern California and Florida will begin testing the Lightning Lane Premier Pass later this month.

ARTICLE OF THE WEEK ..

THIS WEEK’S UPCOMING CALENDAR ..

The week will be packed with corporate news, as about one-in-five S&P 500 companies publish their Q3 results, including Tesla, T-Mobile, Coca-Cola, Verizon, Colgate-Palmolive, AT&T, UPS, Southwest Airlines, Honeywell, General Motors, Lockheed martin, 3M, Newmont and NextEra Energy.

Economic-data highlights of the week include the latest Existing Home Sales data for September and the Durable Goods report.

LAST WEEK BY THE NUMBERS ..

Last week’s market color courtesy of finviz.com

Last week’s best performing U.S. sector: Utilities (two biggest holdings: NextEra Energy, Southern Co.) - up 3.5% for the week.

Last week’s worst performing U.S. sector: Energy (two biggest holdings: Exxon-Mobil, Chevron) - down 2.6% for the week.

SPY, the S&P 500 Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from among the largest U.S. companies. Its price rose 0.9% last week, is up 23.0% so far this year and ended the week at a new all-time record closing high.

IWM, the Russell 2000 Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a group made up from among 3,000 largest U.S. stocks. Its price rose 2.0% last week, is up 12.4% so far this year and ended the week 7.0% below its all-time record closing high (11/08/2021).

AVERAGE 30-YEAR FIXED MORTGAGE RATE ..

6.44%

One week ago: 6.32%, one month ago: 6.09%, one year ago: 7.63%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

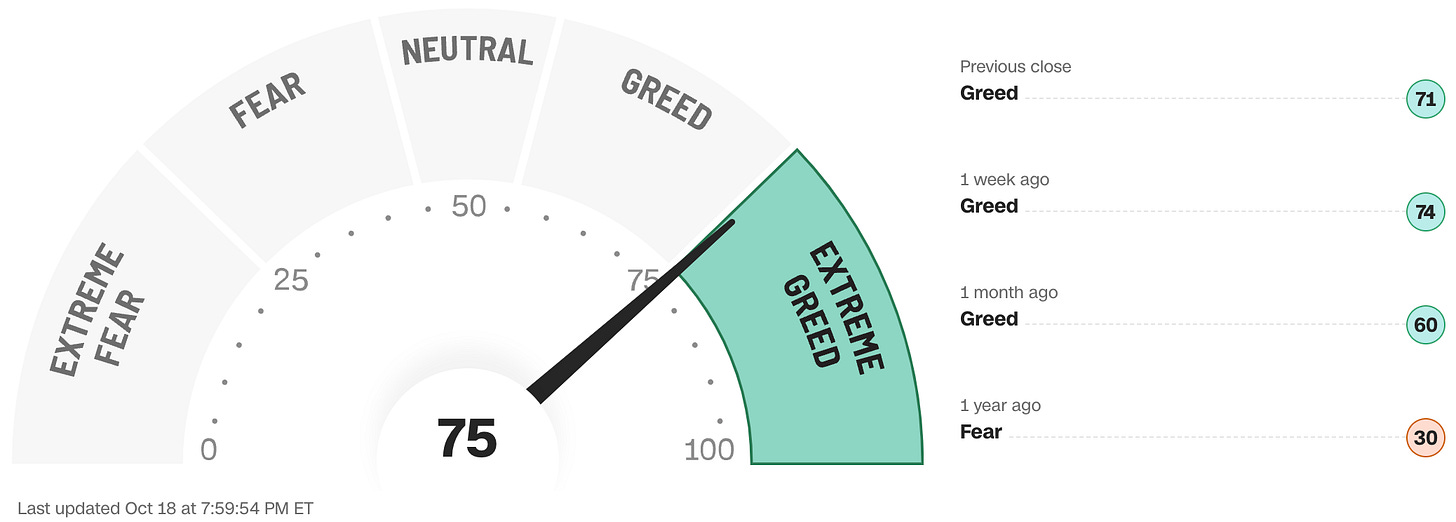

FEAR & GREED INDEX ..

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

FEDWATCH INTEREST RATE TOOL ..

Where will interest rates be after the Fed’s next meeting on November 7th?

Higher than now .. 0% probability (0% a week ago)

Unchanged from now .. 10% probability (11% a week ago)

0.25% lower than now .. 90% probability (89% a week ago)

0.50% lower than now .. 0% probability (0% a week ago)

All data based on the Fed Funds interest rate (currently 4.875%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

% OF S&P 500 STOCKS TRADING ABOVE THEIR 50-DAY MOVING AVERAGE:

76% (381 of the S&P 500 stocks ended last week above their 50D MA and 119 were below)

One week ago: 75%, one month ago: 73%, one year ago: 21%

% OF S&P 500 STOCKS TRADING ABOVE THEIR 200-DAY MOVING AVERAGE:

78% (394 of the S&P 500 stocks ended last week above their 200D MA and 106 were below)

One week ago: 77%, one month ago: 75%, one year ago: 38%

Closely-watched measures of market breadth and participation, providing a real-time look at how many of the S&P 500 index stocks are trending higher or lower, as defined by whether the stock price is above or below their more sensitive 50-day (short term) and less sensitive 200-day (long term) moving averages which are among the most widely-followed of all stock market technical indicators.

The higher the reading, the better the deemed health of the overall market trend, with 50% considered to be a key pivot point. Readings above 90% or below 15% are extremely rare.

WEEKLY US INVESTOR SENTIMENT (outlook for the upcoming 6 months) ..

↑Bullish: 46% (49% a week ago)

⬌ Neutral: 29% (30% a week ago)

↓Bearish: 25% (21% a week ago)

Net Bull-Bear spread: ↑Bullish by 21 (Bullish by 28 a week ago)

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

Survey participants are typically polled during the first half of the week.

Data courtesy of: American Association of Individual Investors (AAII).

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any financial decisions, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind.

Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No advice may be rendered by Anglia Advisors unless or until an executed Client Engagement Agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?