Exhausting deadlines about tariffs are not going away (Warren Buffet described them as “an act of war” last week) and market volatility is an inevitable result.

Despite the next tariff round looming within 24 hours, markets still seemed convinced on Monday morning that they would not in fact be implemented as promised and stocks initially moved higher at the open.

Trump then came out and said there was “no room left” for Canada, Mexico and China to avoid them, and that they were “all set” and would go ahead as planned the following day. He even went on to increase China’s additional levy from 10% to 20%.

Markets totally freaked out. Stocks went into a hard tailspin, experiencing their worst day of the year so far. The Tech and Energy sectors got particularly annihilated. Interest rates fell as investors abandoned stocks and fled into the perceived safety of bonds, which are now outperforming stocks since Trump was elected. Asian and European stock markets got the memo and nose-dived.

Tariff Tuesday arrived with no last minute reprieve. Canada and China immediately retaliated with powerful levies of their own on American imports. Retailers like Target quickly announced that resulting price increases to shoppers at their stores would take effect within days. Stocks resumed their dramatic slide. BTFDers were eventually triggered by the massacre and stopped the worst of the bleeding, eventually erasing some but far from all of the day’s losses.

After the close, confusion reigned as Commerce Secretary Lutnick implied that the tariffs could possibly be scaled back as soon as the next day. but there was no sign of such backtracking when Trump doubled down in his speech to Congress, identifying April 2nd as a key date for further and wider implementation, which he acknowledged may cause “a little disturbance”.

Stock indexes went into wait-and-see mode on Wednesday until more clarity emerged about rumored tariff carve-outs and they didn’t have to wait long as temporary relief for car-makers was announced by the White House. Wall Street’s reaction was moderately positive and equities finished the day higher. Interest rates reversed course and moved back up again.

That brief burst of optimism swiftly evaporated on Thursday. Stocks dropped like a stone at the open before tariff chaos blew up again with Canada and Mexico suddenly being granted partial reprieves until April 2nd.

But Wall Street is frankly fed up with all this amateurish day-to-day flip-flopping and clearly feels that the only safe thing to do right now is to sell stocks, so there was noticeably no positive bump on the news. We ended up with another heavy down-day on our hands. Highly-valued tech stocks continued to bear the brunt of the pain, with Tesla and Nvidia particularly brutalized.

The S&P 500 closed lower on Thursday than where it was on election day and also below its closely-watched 200-day moving average for the first time since the lows of October 2023. The NASDAQ index moved into official correction territory (down 10%+ from its recent record high achieved just two weeks earlier). And all that with the potential volatility of the Jobs Report and a big speech from Fed chairman Powell on deck for the next day.

The Jobs Report came out pre-market on Friday and markets breathed a small sigh of relief as the numbers proved to be fairly drama-free relative to expectations. The bullet-dodge, however, failed to lift stock prices which sank lower again amidst the continued backdrop of absurd tariff mayhem and uncertainty and a more broadly deteriorating geopolitical environment.

It took the calming tones of Powell to come to the rescue to restore confidence to markets. Finally, here was an adult in the room, acknowledging with his usual understatement that while there is increased uncertainty in the US economic outlook, the economy “continues to be in a good place”.

The indexes recovered to end up in the green for the session but still deeply in the red for what was a difficult week. Both the S&P 500 and the NASDAQ have recorded their largest three-week percentage decline since the dark days of 2022.

Worries about a risk of stagflation (rising inflation and stagnant growth) are rapidly growing on fears that the new administration’s policies will bolster consumer price increases and impede economic expansion. Stagflation is especially concerning because of the very limited range of tools available to deal with it.

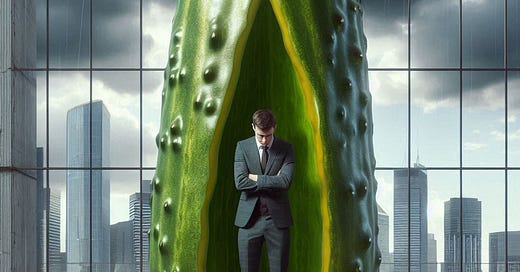

Put simply, the Fed is in a pickle. Tariffs are incontestably inflationary and that is a major roadblock when it comes to Fed interest rate cuts. Yet the longer it waits to cut, the more the central bank risks pushing the economy towards the possibility of a recession that will be exacerbated by those very same tariffs.

If you are not yet a client of Anglia Advisors and would like to explore becoming one, please feel free to reach out for a complimentary no-obligation discovery call.

ARTICLE(S) OF THE WEEK ..

Two great articles with some of the best advice I have seen on how to think about and deal with difficult stock market conditions. Please read them!!

THIS WEEK’S UPCOMING CALENDAR ..

A quiet upcoming week on the economic data front but there are earnings reports due from Adobe, Dick's Sporting Goods, Kohl's, Dollar General, DocuSign and Ulta Beauty.

Oh, and the US government is scheduled to shut down on Friday.

LAST WEEK BY THE NUMBERS:

Last week’s market color courtesy of finviz.com

Last week’s best performing U.S. sector: Healthcare (two biggest holdings: Eli Lilly, UnitedHealth Group) ⬆︎ 0.2% for the week

Last week’s worst performing U.S. sector: Financials (two biggest holdings: Berkshire Hathaway, JPMorgan Chase) ⬇︎ 5.9% for the week

SPY, the S&P 500 Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from a universe of the largest U.S. companies. Its price fell 3.3% last week, is down 1.8% so far this year and ended the week 6.1% below its all-time record closing high (02/19/2025).

IWM, the Russell 2000 Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a universe of 3,000 of the largest U.S. stocks. Its price fell 4.3% last week, is down 6.8% so far this year and ended the week 15.1% below its all-time record closing high (11/08/2021).

INTEREST RATES:

FED FUNDS * ⬌ 4.33% (unchanged)

PRIME RATE ** ⬌ 7.50% (unchanged)

3 MONTH TREASURY ⬆︎ 4.34% (4.32% a week ago)

2 YEAR TREASURY ⬌ 3.99% (3.99% a week ago)

10 YEAR TREASURY *** ⬆︎ 4.32% (4.24% a week ago)

20 YEAR TREASURY ⬆︎ 4.66% (4.55% a week ago)

30 YEAR TREASURY ⬆︎ 4.62% (4.51% a week ago)

Treasury data courtesy of ustreasuryyieldcurve.com as of the market close on Friday.

* Decided upon by the Federal Reserve. Used as a basis for interbank loans and for determining high yield savings rates.

** Used as a basis for determining many consumer loan rates such as credit cards, home equity and auto.

*** Used as a basis for determining mortgage rates.

AVERAGE 30-YEAR FIXED MORTGAGE RATE:

⬇︎ 6.63%

One week ago: 6.76%, one month ago: 6.89%, one year ago: 6.88%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

FEDWATCH INTEREST RATE TOOL:

Where will the Fed Funds interest rate be after the next rate-setting meeting on March 19th?

Unchanged from now .. ⬇︎ 88% probability (96% a week ago)

0.25% lower than now .. ⬆︎ 12% probability (4% a week ago)

What is the most commonly-expected number of 0.25% Fed interest rate cuts in 2025?

⬆︎ 3 (up one from a week ago)

All data based on the Fed Funds interest rate (currently 4.33%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

FEAR & GREED INDEX:

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any financial decisions, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind.

Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No client advice may be rendered by Anglia Advisors unless or until a properly-executed Client Engagement Agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?