It started out so well. There was green all over the board for a while with earnings mostly looking very perky. But in the end, sentiment was overwhelmed by the noise of higher interest rates, Middle East fears, bedlam in Congress, a government shutdown once again looming on the horizon, fears that consumer spending - and thereby inflation - is refusing to die and some rather nasty projections about the global financial system.

Stocks began the week by jumping higher at the open on Monday and maintained their gains for the rest of the session, boosted both by a continued strong start to Q3 earnings season and by signs that cooler heads may be prevailing as Israel plots its next move and the apparent slight lessening of the risks of escalation into a regional conflict that directly includes Iran and other Arab states (and therefore likely to drag in the U.S. and other allies as well). It is this scenario that concerns the stock market, primarily because of the effects it could have on oil prices and the possibility of a resulting global recession.

Whatever you do, don’t stand between an American and a cash register. On Tuesday, we learned that Retail Sales in September, which was expected to rise by 0.3% month to month, more than doubled that rate of growth - soaring by 0.7% and both July and August’s numbers were revised higher. It continues to worry Wall Street that this orgy of spending could still push the Fed into an extra rate hike or two to dampen it down in the interests of dealing with inflation. Stocks hit the brakes, finishing the day fractionally lower.

Gloom swiftly descended on the markets on Wednesday as market interest rates soared again with 30 year fixed mortgage rates briefly touching 8% before retreating (SEE AVERAGE 30-YEAR FIXED RATE MORTGAGE below) and we finally saw a few earnings report disappointments, particularly from United Airlines (UA) and Morgan Stanley (MS). The body count kept rising in the Middle East and the oil price relentlessly followed suit and, as if we needed it, we got a reminder of how dysfunctional Congress is right now with the embarrassing chaos of the ultimately-doomed speakership bid of Jim Jordan.

Thursday wasn’t much better as remarks from Fed Chair Jerome Powell seemed to rule out an interest rate hike after the next meeting on November 1st (no big deal JP, we all kinda knew that already .. see FEDWATCH INTEREST RATE PREDICTION TOOL below) but failed to do so for anytime after that. He appeared to strengthen the “interest-rates-will-be-higher-for-longer” narrative. Stock markets were unimpressed and prices fell further since Fed rate policy is still the most critical driver of medium- and long-term stock and bond performance and Powell’s failure to confirm that it’s game over for rate hikes is a near-term negative.

The misery only further intensified on Friday when a Fed report warned of serious risks to the global financial system brought about by excessive asset valuations (including real estate), over-borrowing both by companies and individuals in the face of increased interest rates and over-leveraging by many financial institutions. Stocks fell for the fourth day in a row with the S&P 500 down a chunky 2.4% for a week that had started so well. The NASDAQ did even worse, losing 3.2%.

In the geopolitical sphere, "we're at the mercy of day-to-day news," according to Charles Schwab's renowned economist, Liz Ann Sonders. JP Morgan Chase CEO Jamie Dimon seemed to have become infected with a severe case of recency bias calling this "the most dangerous time the world has seen in decades," last weekend but the stock market was having none of it.

The so-called “fear gauge” measure of expected upcoming market risk and volatility, the CBOE Volatility Index known as the VIX (see LAST WEEK BY THE NUMBERS below), actually plunged about 11% on Monday, its largest one day drop in months although it drifted back higher as the week wore on and stock prices shifted back lower. It’s still about 75% below where it was in the early days of the pandemic, however.

For all the political and geopolitical noise that will occur in the coming days and weeks in the media, we need to watch oil prices because that is the primary way to measure the extent of the market’s worries about a regional conflict breaking out. If we start heading back towards and through the $100 a barrel level, that will indicate a higher degree of worry that could begin to directly impact stock prices.

This remains a noisy market and it’s being made even more so with the Middle East conflagration. While this noise is intensifying with the escalating geopolitical risks and sometimes contradictory data on inflation and growth, the bottom line is that the underlying factors that have fueled the rally in stocks since late May (and really all year) mostly remain in place for the time being.

But if market interest rates remain high then, while it probably guarantees no more hikes from the Fed, it absolutely does not prompt any rate cuts. And if market rates fall, then that all but guarantees no imminent Fed rate cuts.

Either way, things don’t look good for any interest rate cuts from the Fed any time soon and the problem is that markets have pretty much baked these cuts in to the current level of stock prices.

That is why stocks have been falling so effortlessly of late when it periodically hits home that interest rate cuts are not as imminent as assumed. This will likely to keep a lid on stock prices for a while until Powell decides to become more emphatic about a timeline for lowering rates and we may be waiting quite a while for that.

OTHER NEWS ..

It’s Back To Work We Go .. Work-from-home rates in the US have plunged to the lowest levels since the pandemic. Fewer than 26% of households still have someone working remotely at least one day a week, a sharp decline from the 37% peak. Only seven states, plus DC, now have a remote-work rate above 33%.

Rite Aid Band Aid .. Rite Aid has filed for bankruptcy. The nation’s third-largest pharmacy chain had been in trouble for a while, with rising debt plus legal fees and large settlements tied to the opioid epidemic. Rite Aid is doing the Chapter 11 version of bankruptcy, which means it will keep operating while it does some restructuring and will be closing some “underperforming” stores.

While Rite Aid does have some problems unique to its business, it’s been a rough year for retail pharmacies in general. which has included staff walkouts and a sharp rise in theft and even violence at CVS and Walgreens stores, with more and more products annoyingly but necessarily locked up behind plastic barriers in stores with shorter hours.

Good Show From Netflix .. Netflix is raising prices for some customers in the US, UK and France after posting its best quarter for subscriber growth in years, a sign of management’s confidence in the future even as rival streaming services lose money. The world’s top paid-streaming service said it added 8.76 million customers in Q3, far exceeding analysts’ forecasts and boosting its overall subscriber base to over 247 million. The company credited a strong programming slate and its crackdown on password sharing.

The company has returned to growth as many of its peers struggled to figure out their streaming operations. For example, Walt Disney Co., Warner Bros Discovery Inc. and Paramount Global have all cut costs and fired staff to improve their financial performance. Streaming companies have spent billions of dollars to fund new streaming services that can replace their declining linear TV networks. But most of them lose money.

Netflix had what was bizarrely (to me at least) the most-watched program on any streaming platform over the summer .. Suits, a series that first aired on USA Network and where we got our first glimpse of Meghan Markle years before she would reappear on Netflix in a rather different (!) role years later.

UNDER THE HOOD ..

The S&P 500 fell below its important 200-day moving average on Friday for the first time since March and almost exactly a year after its recent lows of 2022 (which was some 15% below where we are now). The NASDAQ ended the week at its lowest point since May.

Positive technical factors (and there are some!) are being overshadowed by the dominant condition of uncertainty in the market. Of course, with the benchmark 10-year Treasury yield approaching 5.0%, war-induced upside pressure on oil prices and another potential government shutdown on the cards, that is not a surprise.

Total trading volume remains sickly, as neither bulls nor bears feel confident enough to press their positions. And still the most problematic sign is that more than half of Small Cap stocks have not been able to lift themselves up off the floor, remaining in bear markets, 20% or more below their one year highs.

Anglia Advisors clients are welcome to reach out to me to discuss market conditions further.

THIS WEEK’S UPCOMING CALENDAR ..

This will be the busiest week of the Q3 earnings season, with nearly a third of S&P 500 companies scheduled to report, including Microsoft, Amazon, Alphabet/Google, Meta/Facebook, Coca-Cola, Exxon-Mobil, GE, General Motors, Chevron, Boeing, IBM, UPS, Ford, Visa, Verizon, Intel, Merck, T-Mobile, Spotify, NextEra Energy, Comcast and Chipotle.

This week we will also see the first of three advance estimates of Q3 Gross Domestic Product (GDP). On average, estimates call for a 3.6% increase in growth, versus 2.1% in Q2.

Then on Friday, the Personal Consumption Expenditures (PCE) price index for September will be released. The Core version of this number is the inflation rate that the Fed uses to make its inflation-dependent decisions and is forecast to be 3.7% higher than a year earlier, down from August's 3.9%.

ARTICLE OF THE WEEK ..

The IRS has announced its annual changes to limits and thresholds for next year when it comes to workplace benefits, 401ks, IRAs etc.

I have laid them all out for you here.

LAST WEEK BY THE NUMBERS ..

Last week’s market color courtesy of finviz.com

Last week’s best performing US sector: Energy (two biggest holdings: Exxon-Mobil, Chevron) - up 0.1% for the week.

Last week’s worst performing US sector: Consumer Cyclical (two biggest holdings: Amazon, Tesla) for the third week in a row - down 6.1% for the week.

The proprietary Lowry's measure for US stock market Buying Power fell by 7 points last week to 109 and that of US stock market Selling Pressure rose by 5 points to 163 over the course of the week.

SPY, the S&P 500 Large Cap ETF, is made up of the stocks of the 500 largest US companies. It is below its 50-day and 90-day moving averages and fell below its long term trend line, with a RSI of 35***. SPY ended the week 11.8% below its all-time high (01/03/2022).

IWM, the Russell 2000 Small Cap ETF, is made up of the bottom two-thirds in terms of company size of the group of the 3,000 largest US stocks. It is below its 50-day and 90-day moving averages and is also below its long term trend line, with a RSI of 32***. IWM ended the week 31.4% below its all-time high (11/05/2021).

*** RSI (Relative Strength Index) above 70: technically overbought, RSI below 30: technically oversold

The VIX, the commonly-accepted measure of expected upcoming stock market risk and volatility (often referred to as the “fear index”) implied by S&P 500 index option trading, ended the week 2.4 points higher at 21.7. It is above its 50-day and 90-day moving averages and is also above its long term trend line.

AVERAGE 30-YEAR FIXED RATE MORTGAGE ..

7.63%

One week ago: 7.57%, one month ago: 7.19%, one year ago: 6.94%

Data courtesy of: FRED Economic Data, St. Louis Fed as of Thursday of last week.

FEAR & GREED INDEX ..

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven different indicators that measure some aspect of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with a sense of “FOMO” and investors chasing rallies in an excessively risk-on environment, possibly leaving the market vulnerable to a sharp downward correction at some point.

Data courtesy of CNN Business.

US INVESTOR SENTIMENT (outlook for the upcoming 6 months) ..

↑Bullish: 34% (40% a week ago)

⬌ Neutral: 31% (23% a week ago)

↓Bearish: 35% (37% a week ago)

Net Bull-Bear spread: ↓Bearish by 1 (Bullish by 3 a week ago)

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

Weekly sentiment survey participants are typically polled on Tuesdays and/or Wednesdays.

Data courtesy of: American Association of Individual Investors (AAII).

FEDWATCH INTEREST RATE PREDICTION TOOL ..

What will the Fed announce re: any interest rate change on November 1st after its next meeting?

⬌ No change .. 100% probability

One week ago: 94%, one month ago: 70%

↑ 0.25% increase .. 0% probability

One week ago: 6%, one month ago: 29%

Where will interest rates be at the end of 2023?

⬌ Unchanged from now .. 80% probability

One week ago: 70%, one month ago: 56%

↑ Higher than now .. 20% probability

One week ago: 30%, one month ago: 43%

Data courtesy of CME FedWatch Tool. Based on the Fed Funds rate (currently 5.375%). Calculated from Federal Funds futures prices as of Friday.

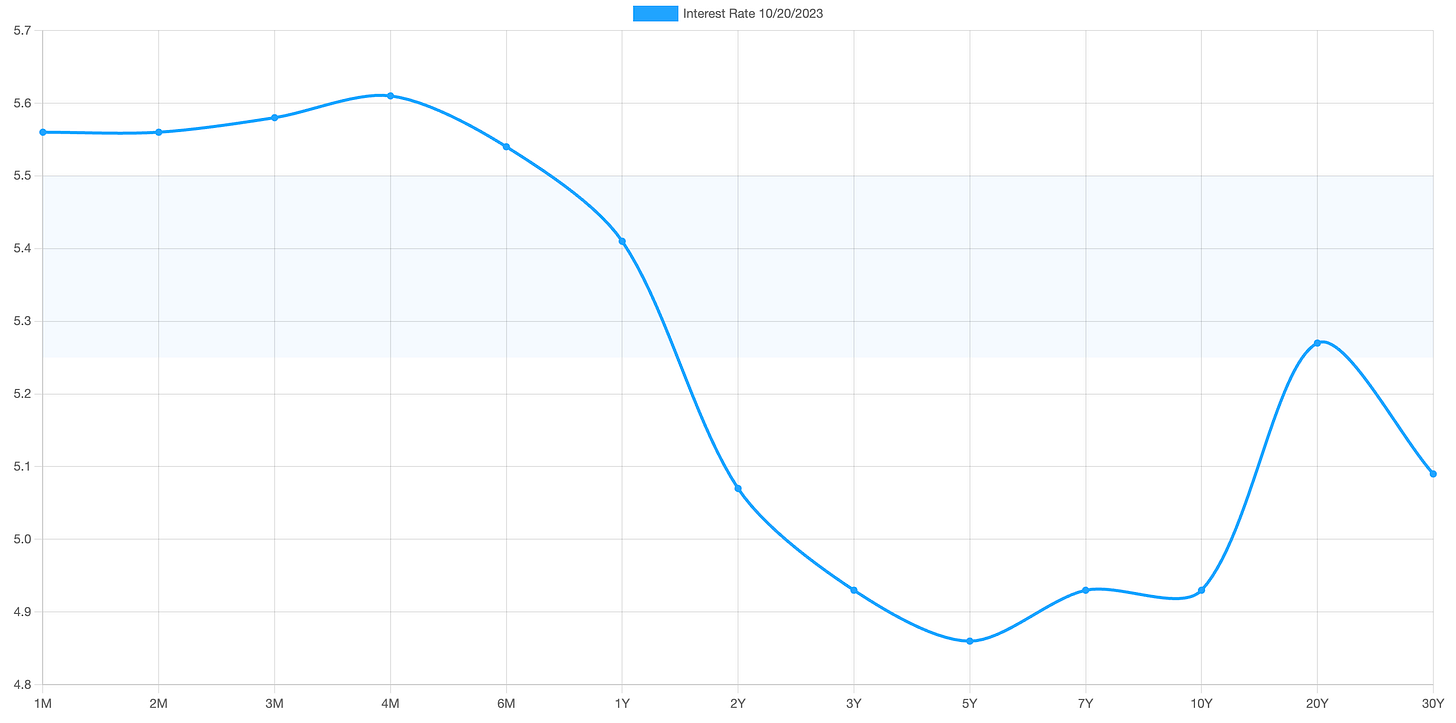

US TREASURY INTEREST RATE YIELD CURVE ..

The interest rate yield curve remains “inverted” (i.e. shorter term interest rates are generally higher than longer term ones) with the highest rate (5.61%) being paid currently for the 4-month duration and the lowest rate (4.86%) for the 5-year.

The closely-watched and most commonly-used comparative measure of the spread between the 2-year and the 10-year fell from 0.41% to 0.14%, indicating a severe flattening in the inversion of the curve during the last week.

Historically, an inverted yield curve has been regarded as a leading indicator of an impending recession, with shorter term risk deemed to be unusually higher than longer term. The steeper the inversion, the greater the deemed risk of recession.

The curve has been inverted since July 2022 based on the 2 year vs. 10 year spread.

Data courtesy of ustreasuryyieldcurve.com as of Friday. Light shaded area shows the current Federal Funds rate range.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (929) 677 6774 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing data at a specific point in time and is always subject to change at any time. No warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any investment or other financial decisions. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind. Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors may have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?