U.S. markets shook off the weekend’s news of Israel’s bombing of Iran and looming political gridlock in Japan and embarked on an incredibly busy earnings and economic data-packed last full week before both the election and the next Fed interest rate decision on a positive note at the open on Monday. Oil prices suffered their biggest one-day fall in over two years on the back of an apparent lack of damage to Iranian oil facilities during Israel’s attack.

This hit the energy sector but most stocks generally got a boost from the retreat in recently-extended oil prices and at least a temporary dip in the geopolitical temperature and the indexes finished the session higher, although off the highs of the day.

Old school names Ford, McDonalds, Xerox, Black & Decker and Jet Blue all issued rather troubling earnings reports which weighed on markets on Tuesday morning. While the Job Openings and Labor Turnover Survey (JOLTS) showed a lower number of open job positions than expected, the Consumer Confidence Index showed a long overdue major leap in how confident consumers feel about what is clearly a really strong U.S. economy.

Stocks liked that and the indexes, led by the NASDAQ, recovered from their early losses to move into the green zone, but in the end the gains were relatively small as traders kept their powder dry ahead of the real business end of the week with the slew of big dog earnings and economic data starting after Tuesday’s closing bell.

Alphabet/Google kicked things off by solidly beating analysts' estimates for earnings and revenue but showed an alarming increase in capital expenditure, much of it AI-related. AMD’s results disappointed and Eli Lilly’s forward guidance was unimpressive. The bigger picture, however, remains vigorous, with Q3 Gross Domestic Product (GDP) coming in at +2.8%, pointing to an economy that’s humming along nicely, with strong consumer spending supported by a robust labor market, and business investment that remains solid.

The net effect on stocks on Wednesday ended up being minimal with the indexes floating around either side of unchanged most of the day, eventually ending the session with light losses.

After hours, we learned that Microsoft’s cloud-computing business and Office software fueled stronger-than-projected revenue growth in Q3 but the company is struggling to bring data centers online fast enough to keep up with demand for AI services. Meta/Facebook failed to beat estimates on revenue despite a decent earnings number and its wearables division (headsets and glasses) continues to rip through ridiculous amounts of cash with apparently very little sign of any light at the end of the tunnel.

The Bank of Japan held interest rates unchanged but the Microsoft and Meta reports gave the broad market no chance and dragged stock prices significantly lower on Thursday and things only got worse when the Fed’s favorite inflation measure, the Core Personal Consumption Expenditures (PCE) price index showed some unexpected stickiness in the rate of inflation.

This further hurt the narrative of imminent outsized Fed interest rate cuts. Stocks in general had a bad day (all of the S&P 500’s gains for the month of October were wiped out in the final session of the month) but tech and AI names did even worse, suffering something of a Halloween massacre.

After Thursday’s close Amazon reported better-than-expected earnings and revenue, with Amazon Web Services the standout performer. These days, Wall Street has become accustomed to the Magnificent Seven and other tech and AI-related names not just beating forecasts but absolutely smashing them. This proved to be Apple’s downfall as it reported slightly higher-than-expected earnings and revenues, but the word “slightly” proved to be a problem for the market which sent the stock tumbling in after-hours trading.

On Friday morning before the opening bell, the jewel in the crown of what was a very crowded week of data, the Jobs Report, was released. It showed a heavily-reduced payroll number of just +12k jobs added in October but with the huge caveat that the studied period was very distorted, including two massive hurricanes and significant labor strikes. Big revisions and corrections can be expected in next month’s report. September’s number was revised downwards but the unemployment rate remained unchanged at 4.1%.

Wall Street saw nothing here likely to derail a quarter point rate cut this week and interest rates fell back and stocks moved higher at the open and held onto those gains all day, but still ended up lower on the week. For the NASDAQ it was the first weekly loss in the last two months.

This week will be absolutely pivotal for markets. The world could be a very different place by the next time you read one of my reports. Or not. The U.S election is on a knife edge and, despite a bit of vocal pro-Trump bravado, Wall Street has absolutely no idea what the result will be. There is a scenario by which the outcome will be vociferously challenged both in the courts and in the streets and Wall Street’s most implacable enemies, uncertainty and disorder, could reign for weeks or possibly even months.

Meantime, the Fed this week needs to read the messy tealeaves of economic data recently tainted by hurricanes and strikes as well as trying to stay out of political trouble with its interest rate decision-making. I don’t envy Powell his job this week.

OTHER NEWS ..

All Change .. Nvidia will finally make an appearance in the Dow Jones Industrial Average, replacing Intel in the index this week. The swap reflects the reversal of fortunes of the two firms within the tech industry. Sherwin-Williams will replace Dow Inc. as well.

S&P Dow Jones Indices, which manages the 30-stock benchmark, said the changes were made to ensure a more representative exposure to the semiconductors industry and the materials sector. They take effect on November 8th.

Democracy Burning? .. Fires deliberately set at ballot boxes in Washington and Oregon destroyed hundreds of ballots in counties with very close races and are being investigated by the FBI and U.S. Attorney’s Office. Law enforcement has identified a vehicle suspected of being used by the firestarter. Meanwhile, conspiracy theorists who still believe Trump won the 2020 election are using Telegram to monitor and film polling places in swing states in an effort that officials say risks intimidating voters and suppressing voter turnout.

Crash! .. Super Micro Computer (SMC) admitted on Wednesday that Ernst & Young (E&Y) had resigned as its auditor. E&Y said in a statement; "We are resigning due to information that has recently come to our attention which has led us to no longer be able to rely on management's and the Audit Committee's representations and to be unwilling to be associated with the financial statements prepared by management".

This information was likely that provided by analyst firm Hindenburg Research which recently disclosed a major short position resulting from claims of rampant "accounting manipulation", which were strongly denied by SMC at the time. The company’s stock (SMCI), already beaten and battered by the Hindenburg report, promptly lost close to half of its remaining value and is now down over 78% from its high recorded just last March.

ARTICLE OF THE WEEK ..

Sorry, Your Insurance Bill Probably Isn’t Coming Down Much. Here’s Why ..

THIS WEEK’S UPCOMING CALENDAR ..

This week's presidential election will be followed two days later by a Federal Reserve interest-rate-setting decision. There could very well still be some doubt about the outcome (at least in the minds of some people) of the election by the time Fed chairman Jerome Powell steps up to the podium to give his press conference on Thursday. Markets are overwhelmingly pricing in a quarter-point reduction in the federal-funds rate.

Around 100 S&P 500 companies will release quarterly results during the week including CVS, Moderna, BioNTech, Monster Energy, DuPont, Novo Nordisk, Airbnb, Marriott International, Wynn Resorts, Qualcomm, Toyota, Paramount, Warner Bros, Marathon Petroleum and troubled Super Micro Computer.

LAST WEEK BY THE NUMBERS ..

Last week’s market color courtesy of finviz.com

Last week’s best performing U.S. sector: Communications Services (two biggest holdings: Alphabet/Google, Meta/Facebook) - up 0.7% for the week.

Last week’s worst performing U.S. sector: Utilities (two biggest holdings: NextEra Energy, Southern Co.) - down 3.3% for the week.

SPY, the S&P 500 Large Cap ETF, tracks the S&P 500 index, made up of 500 stocks from among the largest U.S. companies. Its price fell 1.4% last week, is up 20.1% so far this year and ended the week 2.3% below its all-time record closing high (10/18/2024)

IWM, the Russell 2000 Small Cap ETF, tracks the Russell 2000 index, made up of the bottom two-thirds in terms of company size of a group made up from among 3,000 largest U.S. stocks. Its price rose 0.1% last week, is up 9.1% so far this year and ended the week 9.7% below its all-time record closing high (11/08/2021).

AVERAGE 30-YEAR FIXED MORTGAGE RATE ..

6.72%

One week ago: 6.54%, one month ago: 6.12%, one year ago: 7.76%

Data courtesy of: FRED Economic Data, St. Louis Fed as of last Thursday.

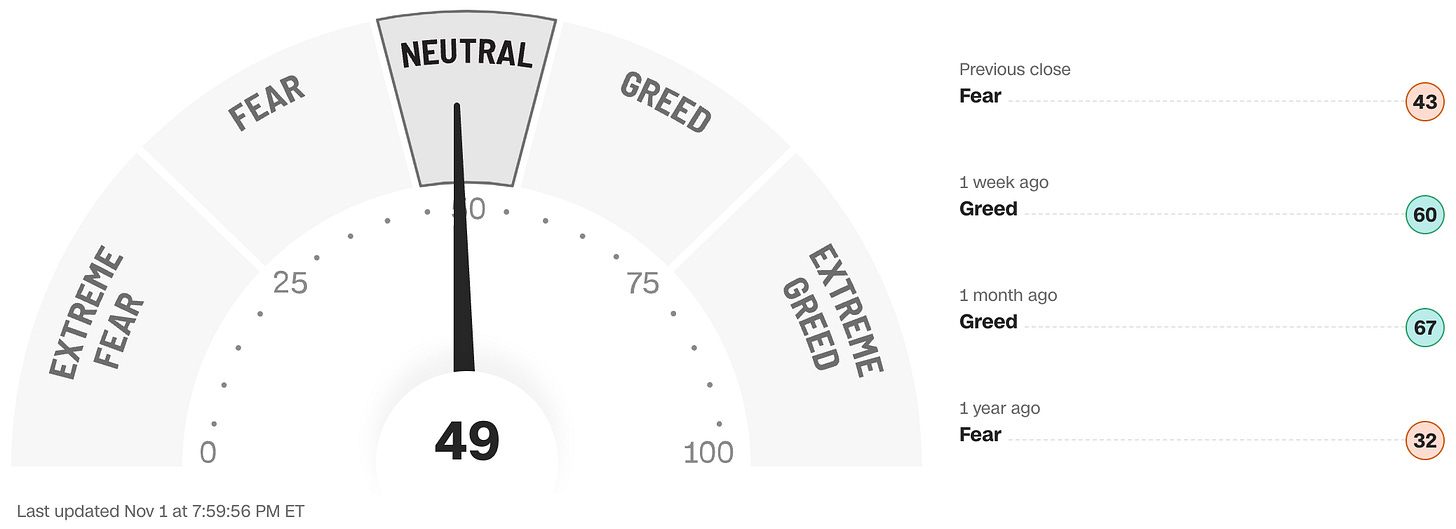

FEAR & GREED INDEX ..

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven of the most important indicators that measure different aspects of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call option ratio, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with possibly too-frothy prices and a sense of “FOMO” with investors chasing rallies in an excessively risk-on environment . This overcrowded positioning leaves the market potentially vulnerable to a sharp downward reversal at some point.

A “sweet spot” is considered to be in the lower-to-mid “Greed” zone.

Data courtesy of CNN Business as of Friday’s market close.

FEDWATCH INTEREST RATE TOOL ..

Where will interest rates be after the Fed’s next meeting on November 7th?

Higher than now .. 0% probability (0% a week ago)

Unchanged from now .. 4% probability (5% a week ago)

0.25% lower than now .. 96% probability (95% a week ago)

0.50% lower than now .. 0% probability (0% a week ago)

All data based on the Fed Funds interest rate (currently 4.875%). Calculated from Federal Funds futures prices as of the market close on Friday. Data courtesy of CME FedWatch Tool.

% OF S&P 500 STOCKS TRADING ABOVE THEIR 50-DAY MOVING AVERAGE:

48% (240 of the S&P 500 stocks ended last week above their 50D MA and 260 were below)

One week ago: 55%, one month ago: 76%, one year ago: 25%

% OF S&P 500 STOCKS TRADING ABOVE THEIR 200-DAY MOVING AVERAGE:

69% (343 of the S&P 500 stocks ended last week above their 200D MA and 157 were below)

One week ago: 72%, one month ago: 77%, one year ago: 33%

Closely-watched measures of market breadth and participation, providing a real-time look at how many of the S&P 500 index stocks are trending higher or lower, as defined by whether the stock price is above or below their more sensitive 50-day (short term) and less sensitive 200-day (long term) moving averages which are among the most widely-followed of all stock market technical indicators.

The higher the reading, the better the deemed health of the overall market trend, with 50% considered to be a key pivot point. Readings above 90% or below 15% are extremely rare.

WEEKLY US INVESTOR SENTIMENT (outlook for the upcoming 6 months) ..

↑Bullish: 39% (38% a week ago)

⬌ Neutral: 30% (32% a week ago)

↓Bearish: 31% (30% a week ago)

Net Bull-Bear spread: ↑Bullish by 8 (Bullish by 8 a week ago)

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

Survey participants are typically polled during the first half of the week.

Data courtesy of: American Association of Individual Investors (AAII).

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (646) 286 0290 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing information and data at a specific point in time and is always subject to change at any time. Although the content is believed to be correct at the time of publication, no warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is also wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any financial decisions, including investment decisions or making any kind of consumer choices, without further consultation with Anglia Advisors or other qualified Registered Investment Advisor. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind.

Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class. No advice may be rendered by Anglia Advisors unless or until a properly-executed Client Engagement Agreement is in place.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors might have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?