Stocks closed out a truly spectacular November last week with the S&P 500 index finishing about 9% higher than it was at the beginning of the month. Tech stocks were the best performers by sector, but real estate came a close second - despite the cratering post-pandemic commercial space. Energy was the worst performer, falling 2% in line with very weak oil prices and was the only sector with a negative outcome for the month.

Monday proved to be a rather forgettable session, with prices trapped inside a narrow range, eventually finishing a touch lower. The only thing of interest going on was the trickle of data releases on all the shopping being done the previous week. The biggest takeaway from the early data was that consumer spending could be up handsomely from last year and that (shocker!) we are all doing more of our shopping online rather than braving actual stores.

Some of the good vibes returned on Tuesday. A report showed that consumer confidence increased in November after having fallen for three consecutive months. Fed-speak was generally supportive also. Federal Reserve Governor Christopher Waller said policy is well positioned to return inflation to the Fed’s 2% goal and his colleague Michelle Bowman deftly avoided answering when directly asked if there would be another interest rate hike. Most stocks took another small leg higher.

More encouraging Thanksgiving-related data came out on Wednesday. Over 200 million U.S. consumers participated in weekend shopping, that’s 18 million more than expected and more people travelled through U.S. airports in a single day on Sunday than ever before.

But the big news of the day was that the second of three official estimates indicated that the U.S. economy grew faster in Q3 than even optimistic analysts had thought. Gross Domestic Product (GDP) rose at a mind-bending 5.2% annualized pace, up from the previous estimate of 4.9%, more than double the previous quarter’s growth rate and the fastest since the economy began rapidly accelerating out of the depths of the pandemic two years ago. Consumer spending also grew, but at a less-breakneck rate of 3.6%. After initially jumping higher on the data, stock prices faded in the afternoon to finish largely unchanged.

Before the market opened on Thursday, we learned that the Fed’s darling inflation measure, the Core Personal Consumption Expenditure (PCE) index, came in as expected at a year-on-year 3.2% and the annualized rate over the last six months has now fallen to 2.5%, pretty much putting the final nail in the coffin of any chance of an interest rate hike on December 13th at the Fed’s final rate-setting meeting of the year (see FEDWATCH INTEREST RATE PREDICTION TOOL below). Stocks ticked higher again.

Friday marked the beginning of the final month of 2024 and Decembers have traditionally proved pretty generous to stock investors. And we got off to a solid start this year, following a speech from Fed Chair Jerome Powell, making the rather innocuous, not-very-startling statement that he believed the central bank's recent policies have helped bring down inflation. But in the current giddy glass-is-half-full environment, this was seen to even further bolster the case that policymakers won't raise interest rates any further.

Stocks took their cue from this interpretation and all the indexes finished the day meaningfully higher, with Small Caps in particular outshining the rest.

The end of 2024 guesstimates for the S&P 500 are rolling in .. much of what I’m seeing clusters near a record-busting price target of close to 5000 (the all-time high is 4796, reached on the first trading day of 2022), with some of them as high as 5400 and remarkably few predicting lower prices than where we are now.

The index closed on Friday at around 4595, so a 5,000 level on New Year’s Eve 2024 implies a rally of 8.8% over the next thirteen months. This is not far from the historical average gain per year for the index but, if accomplished, would represent a rather impressive total two-year gain of more than 30% from the end of 2022 to the end of 2024.

Interesting factoid for 2024 crystal ball-gazers; in election years of first-term presidents, whether they get re-elected or not, the stock market has historically moved higher literally 100% of the time.

The bullish argument for stocks can largely be summed up by; Everything that’s already priced in actually happens. Because a lot of it hasn’t yet. Bulls are anticipating; no economic slowdown, immaculate disinflation, resilient corporate earnings continue to beat expectations and a healthy dose of interest rate cuts from the Fed in 2024 and beyond.

The bearish argument for stocks can largely be summed up by; Everything we were worried about for 2023 actually ends up happening in 2024. In other words, the long list of concerns for 2023 weren’t misguided, they were just early. Bears are anticipating (much as they were a year ago); economic growth actually contracts leading to a recession, inflation stops falling and maybe even ticks back higher again, corporate earnings growth disappoints and the Fed does not cut interest rates as soon or by as much as expected.

We should remember that outcomes are rarely binary and elements of both theses will probably come to fruition, but these are the factors to keep an eye on which - along with any kind of unpredictable external shock and I think the inevitable craziness that will accompany the U.S. presidential election - will determine how accurate these year-end 2024 price target guesses end up being.

OTHER NEWS ..

Riddle Me This .. On Monday, we got data that showed that the median price of a new home had plunged 18% year over year. Then the next day, we were told that existing home prices rose for an eighth straight month, surging to a new record high.

Put that all together and housing prices are .. rising? Falling? It depends? Everyone expected home prices to fall when mortgage rates shot up to 8%. But it turns out that most American homeowners had already locked in a mortgage interest rate far below today’s and have no intention of giving that up, meaning hardly anyone is selling. This lack of inventory has led to bidding wars and higher prices for existing homes.

Builders, meanwhile, have now started trying to fill that gap with accelerating new construction and the market for new home sales has had a different dynamic altogether.

The housing/shelter component is about a 40% weighting in the Core Consumer Price Index (CPI) reading. Without lower price inflation in that category, it is going to be hard for the Fed to reach its target of bringing inflation back down to to 2%.

New Blood .. Joining the S&P 500 index on December 18th in one of its occasional reconstitutions will be Uber, Jabil and Builders FirstSource. Booted out to make way for these three new members will be Sealed Air, Alaska Air and SolarEdge Technologies.

Apple Pulls The Plug On Goldman Sachs .. The tech company recently sent a proposal to the Wall Street investment bank announcing its intention to exit their credit card and savings account partnership contract in the next 12 to 15 months, according to a Bloomberg report. This contract had previously been extended through 2029 just a matter of months ago.

The end of the much-heralded cooperation initiative which began with the Apple credit card in 2019 and then the high yield savings account earlier this year is the final nail in the coffin of Goldman's doomed bid to expand into consumer lending which was launched back in 2016 with the introduction of the Marcus savings account.

UNDER THE HOOD ..

It is important to remember that the market deals in probabilities, not certainties. That’s where certain forms of technical analysis can be useful, but frequently it exposes two sides of a coin. This is one of those times.

The continuation higher in the last two or three weeks of the percentage of stocks trading above their Long Term Moving Averages (see below) is consistent with a further improvement in market breadth and supports the case that the November rally may possibly more sustainable than initially thought.

However, the percent of stocks 20% or more below their one year highs also remains stubbornly elevated and is well above its late July levels despite the S&P 500 now being very close to the highs of that time.

Also, the major price indexes are in the process of challenging a potential Supply zone in the form of their late July highs while at the same time short-term overbought conditions are present. This combination always increases market risks.

There are two things to keep an eye on .. 1) any weakening in Large Cap internals, which would likely happen if the major index advance were nearing its end, and 2) signs that Small Cap stocks are starting to strengthen, because even if larger stocks stall, new buying in smaller stocks - which some would call a healthy rotation - has the capacity to keep the advance going.

Anglia Advisors clients are welcome to reach out to me to discuss market conditions further.

THIS WEEK’S UPCOMING CALENDAR ..

It’s jobs week. The latest Jobs Report comes out on Friday. Consensus calls for 175k new payrolls in November, after a gain of 150,000 in October. The unemployment rate is forecast to hold steady at 3.9%.

Before that we get the latest Job Openings and Labor Turnover Survey (JOLTS), which is expected to show 9.4 million jobs available, down slightly from September.

Together, these two data points will probably suggest a still-tight labor market in the U.S., but less dramatically so than earlier this year.

Not a lot going on on the earnings front, although we will hear from AutoZone, Broadcom, Dollar General, Campbell’s Soup and J.M. Smucker.

ARTICLE OF THE WEEK ..

It may not always feel like it, but there really has never been a better time to be a stock market investor.

LAST WEEK BY THE NUMBERS ..

Last week’s market color courtesy of finviz.com

Last week’s best performing US sector: Real Estate (two biggest holdings: Prologis, American Tower) - up 4.3% for the week.

Last week’s worst performing US sector: Communication Services (two biggest holdings: Alphabet/Google, Meta/Facebook) - down 0.9% for the week.

The proprietary Lowry's measure for US stock market Buying Power rose by 15 points last week to 154 and that of US stock market Selling Pressure fell by 13 points to 124 over the course of the week.

SPY, the S&P 500 Large Cap ETF, is made up of the stocks of the 500 largest US companies. It ended the week up 21.4% year-to-date (total return) and 3.9% below its all-time high (01/03/2022). SPY is above its 50-day and 90-day moving averages and is also above its long term trend line, with a RSI of 74***

IWM, the Russell 2000 Small Cap ETF, is made up of the bottom two-thirds in terms of company size of the group of the 3,000 largest US stocks. It ended the week up 7.2% year-to-date (total return) and 23.8% below its all-time high (11/05/2021). IWM is now above its 50-day and 90-day moving averages and is also above its long term trend line, with a RSI of 68***

*** RSI (Relative Strength Index) above 70: strong but technically overbought, RSI below 30: weak but technically oversold

The VIX, the commonly-accepted measure of expected upcoming stock market risk and volatility (often referred to as the “fear index”) implied by S&P 500 index option trading, ended the week 0.1 points (1%) higher at 12.6. It is below its 50-day and 90-day moving averages and is also below its long term trend line.

AVERAGE 30-YEAR FIXED MORTGAGE RATE ..

7.22%

One week ago: 7.29%, one month ago: 7.79%, one year ago: 6.49%

Data courtesy of: FRED Economic Data, St. Louis Fed as of Thursday of last week.

FEAR & GREED INDEX ..

“Be fearful when others are greedy and be greedy when others are fearful.” Warren Buffet.

The Fear & Greed Index from CNN Business can be used as an attempt to gauge whether or not stocks are fairly priced and to determine the mood of the market. It is a compilation of seven different indicators that measure some aspect of stock market behavior. They are: market momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility and safe haven demand.

Extreme Fear readings can lead to potential opportunities as investors may have driven prices “too low” from a possibly excessive risk-off negative sentiment.

Extreme Greed readings can be associated with a sense of “FOMO” and investors chasing rallies in an excessively risk-on environment, possibly leaving the market vulnerable to a sharp downward correction at some point.

Data courtesy of CNN Business.

PERCENT OF S&P 500 STOCKS TRADING ABOVE THEIR LONG TERM MOVING AVERAGE (LTMA) ..

63% (314 of the 500 largest stocks in the U.S. ended last week above their LTMA and 186 were below)

One week ago: 55%, one month ago: 38%, one year ago: 63%

A closely-watched measure of market breadth and participation, providing a real-time look at how many of the largest 500 publicly-traded stocks in the U.S. are trending higher or lower, as defined by whether the stock price is above or below the 200-day moving average which is among the most widely-followed of all stock market technical indicators.

The higher the reading, the better the deemed health of the overall market, with 50% considered to be a key pivot point.

WEEKLY US INVESTOR SENTIMENT (outlook for the upcoming 6 months) ..

↑Bullish: 49% (45% a week ago)

⬌ Neutral: 32% (31% a week ago)

↓Bearish: 19% (24% a week ago)

Net Bull-Bear spread: ↑Bullish by 30 (Bullish by 21 a week ago)

For context: Long term averages: Bullish: 38% — Neutral: 32% — Bearish: 30% — Net Bull-Bear spread: Bullish by 8

Survey participants are typically polled during the first half of the week.

Data courtesy of: American Association of Individual Investors (AAII).

FEDWATCH INTEREST RATE PREDICTION TOOL ..

Where will interest rates be at the end of 2023 (one more Fed decision day, on December 13th)?

⬌ Unchanged from now .. 99% probability

One week ago: 96%, one month ago: 80%

↑ Higher than now .. 1% probability

One week ago: 4%, one month ago: 20%

Data courtesy of CME FedWatch Tool. Based on the Fed Funds rate (currently 5.375%). Calculated from Federal Funds futures prices as of Friday.

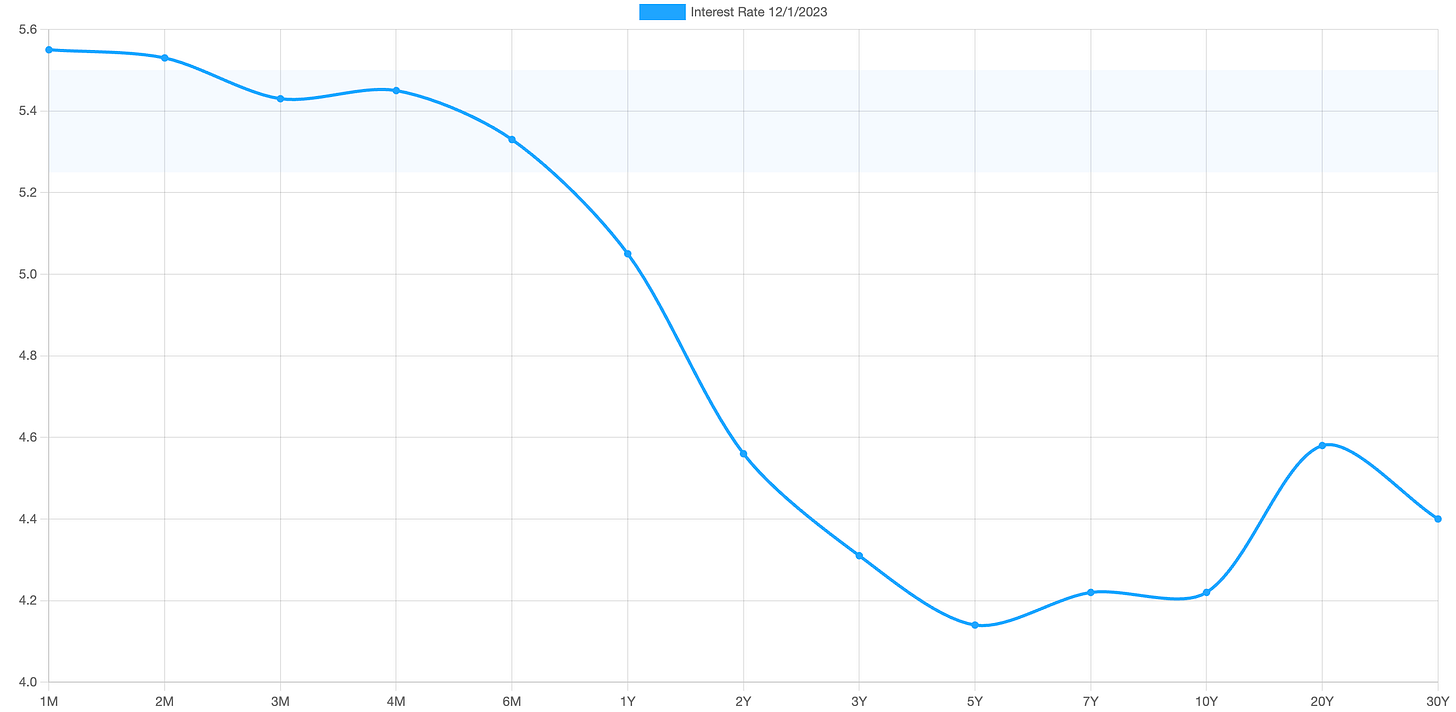

US TREASURY INTEREST RATE YIELD CURVE ..

The interest rate yield curve remains unusually “inverted” (i.e. shorter term interest rates are generally higher than longer term ones) with the highest rate (5.55%) being paid currently for the 1-month duration and the lowest rate (4.14%) for the 5-year.

The most closely-watched and commonly-used comparative measure of the spread between the 2-year and the 10-year fell from 0.45% to 0.34%, indicating a flattening in the inversion of the curve during the last week.

Historically, an inverted yield curve is not the norm and has been regarded as a leading indicator of an impending recession, with shorter term risk deemed to be unusually higher than longer term. The steeper the inversion, the greater the deemed risk of recession.

The curve has been inverted since July 2022 based on the 2-year vs. 10-year spread.

Data courtesy of ustreasuryyieldcurve.com as of Friday. Lightly shaded area shows the current Federal Funds rate range.

WWW.ANGLIAADVISORS.COM | SIMON@ANGLIAADVISORS.COM | CALL OR TEXT: (929) 677 6774 | FOLLOW ANGLIA ADVISORS ON INSTAGRAM

This material represents a highly opinionated assessment of the financial market environment based on assumptions and prevailing data at a specific point in time and is always subject to change at any time. No warranty of its accuracy or completeness is given. It is never to be interpreted as an attempt to forecast any future events, nor does it offer any kind of guarantee of any future results, circumstances or outcomes.

The material contained herein is not necessarily complete and is wholly insufficient to be exclusively relied upon as research or investment advice or as a sole basis for any investment or other financial decisions. The user assumes the entire risk of any decisions made or actions taken based in whole or in part on any of the information provided in this or any Anglia Advisors communication of any kind. Under no circumstances is any of Anglia Advisors’ content ever intended to constitute tax, legal or medical advice and should never be taken as such. Neither the information contained or any opinion expressed herein constitutes a solicitation for the purchase of any security or asset class.

Posts may contain links or references to third party websites or may post data or graphics from them for the convenience and interest of readers. While Anglia Advisors may have reason to believe in the quality of the content provided on these sites, the firm has no control over, and is not in any way responsible for, the accuracy of such content nor for the security or privacy protocols that external sites may or may not employ. By making use of such links, the user assumes, in its entirety, any kind of risk associated with accessing them or making use of any information provided therein.

Those associated with Anglia Advisors, including clients with managed or advised investments, may maintain positions in securities and/or asset classes mentioned in this post.

If you enjoyed this post, why not share it with someone or encourage them to subscribe themselves?